RBA: What will happen with interest rates next?

While the August meeting occurs this week, there are several key announcements and economic movements that give us some idea of what may lie ahead.

Borrowers will be watching the next move when the RBA makes its announcement on interest rates.

While the August meeting occurs this week, there are several key announcements and economic movements that give us some idea of what may lie ahead.

The Australian Bureau of Statistics (ABS) released its quarterly and monthly Consumer Price Index (CPI) data for July, which is usually a strong signal as to what they will do at their next cash rate meeting.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The data showed that inflation had steadied at 3.8 per cent but was still above the 2 to 3 per cent target that the RBA is aiming to achieve.

At the last RBA meeting, the Governor, Michelle Bullock, strongly indicated that a rate rise was imminent if inflation wasn’t curbed.

Whilst inflation didn’t reduce, it is considered more manageable than previously expected and has economists leading towards a hold on interest rates for now.

Stephen Smith, Deloitte Access Economics partner, stated that the latest CPI data “should put to rest the tired notion that the RBA should lift rates, an act that would do nothing but tempt a recession”.

The Federal Treasurer, Jim Chalmers MP, also recently spruiked that the RBA was on the right track with curbing inflation and easing pressure on prices.

Inflation is up, why aren’t interest rates going up as well?

Firstly, there is still a possibility we will see an increase in the cash rate when the RBA meets on Tuesday, which will give banks the push to increase interest rates.

Secondly, whilst inflation is arguably the key driver for any rise or fall in interest rates, it is not the only factor that informs the RBA’s decision.

Full employment and economic prosperity and welfare are the other two tenets that fuel the RBA’s decision-making regarding the cash rate.

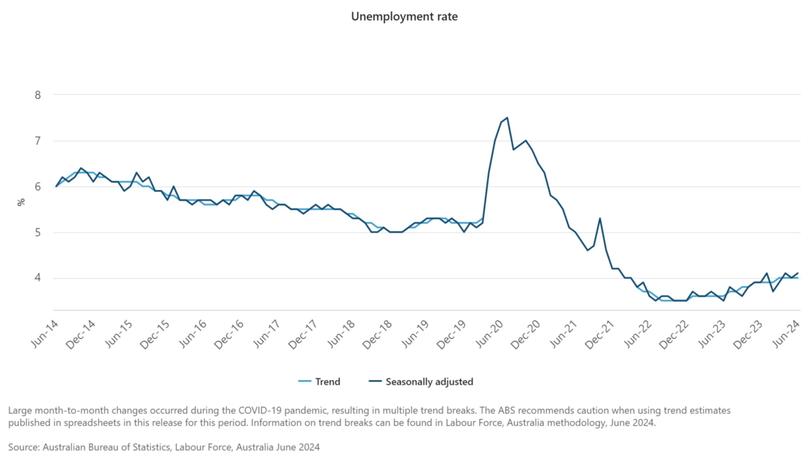

The most recent employment data, which was released in mid-July, saw unemployment remain steady at 4 per cent.

Economic prosperity and welfare is a bit harder to track and visualise, however, it is more of an understanding as to how the economy is travelling and what impact an interest rate rise or cut would have.

At the moment, the Australian economy is seen as having slowed during the post-pandemic years, as interest rate rises have caused uncertainty and trepidation amongst businesses.

As Mr Smith noted, an interest rate rise might lead to a recession in the economy, which would cause further repercussions such as increased costs for debt funding and reduced power in trade negotiations.

What are experts saying about interest rates?

One of the more interesting takes has come from the CPI numbers came from Commonwealth Bank Head of Australian Economics Gareth Aird.

Mr Aird not only believes the RBA will hold firm on the current cash rate, he predicts a cut of 0.25 per cent in November 2024.

“The wriggle room on the data configuration that would see the cash rate cut in November is still tight...the risk clearly sits with interest rate relief not arriving until H1 25,” he said.

We believe the data continues to evolve in a way that sees the RBA cut the cash rate in November.

Westpac Chief Economist Luci Ellis has been slightly less bullish but had a similar stance, stating that she believes rates will remain firm until November 2024 and then we will start to see cuts in the cash rate.

She has gone on to predict that the cash rate will eventually reach 3.1 per cent by the end of 2025, and that is likely as low as they’ll go.

Chief Economist for Challenger, Dr Jonathan Kearns, believes we have hit a ceiling for interest rates, but thinks rate cuts are more likely to come next year.

Meanwhile, economist Saul Eslake, has pointed out that whilst the inflation numbers are still high enough to potentially cause a rise in interest rates, it is unlikely that the RBA board will do so.

He also expected that the RBA would mention that services inflation is the current cause for concern and strongly desire a reduction in that number over the next quarter.

What does this mean for homeowners?

It appears as though it will be business as usual, with rates staying at their current level for the next month.

This is good news for existing homeowners, as it will be some relief that in this time of rising costs, at least their mortgage repayments are not increasing for now.

Prospective buyers will be boosted by the knowledge that they won’t see an increase in any proposed repayments if they can get into the market.

That confidence in interest rates could provide a bit of a push for them to buy before any further uncertainty arises.

There is also a possibility we see an increase in property prices as confidence in interest rates leads to increased buyer activity, whilst the lack of increase in rates provides relief for people in mortgage stress and keeps them from having to sell their homes.

This article originally appeared on view.com.au.

Originally published as What will happen with interest rates next?