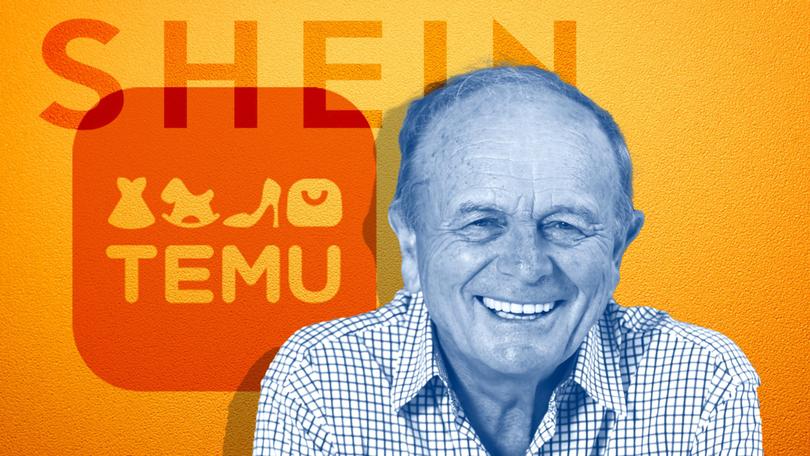

‘A pariah’: Harvey Norman chair Gerry Harvey calls for inquiry into ultra-cheap retailers Shein, Temu

Harvey Norman chair Gerry Harvey has proposed a government inquiry into Chinese ultra cheap retailers Shein and Temu, calling them pariahs that don’t pay taxes or employ local people.

Harvey Norman chair Gerry Harvey has proposed a government inquiry into Chinese ultra-cheap retailers Shein and Temu, calling them pariahs that don’t pay taxes or employ local people.

The recent entry of Shein and Temu in Australia has further intensified competition as they gain market share due to heavy discounting and aggressive social media marketing.

They pose as another threat for local retailers already facing pressure from US giant Amazon, which recorded sales of more than $3 billion at its Australian business in 2023.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.When asked if online players were killing off local businesses, Mr Harvey said: “Yes, yes and yes.”

“(Shein and Temu) are a . . . pariah, it’s a very difficult situation for Australian retailers to combat,” he told The Nightly on Thursday.

“They never pay any tax here, they don’t employ anyone . . . there should be a government inquiry into it as to what ramifications are there and whether they should or shouldn’t do something about it.

“It’s a real worry, do you let it just go or not, I think it’s worth an investigation.”

Flagging potential safety concerns, the billionaire businessman said consumers could have “a lot more comfort” buying from trusted brands despite it being slightly more expensive.

“But there’s a lot of online retailers selling some of the stuff we sell but it’s unbranded, you don’t know which factory it’s made in,” Mr Harvey said.

“Price (is the drawcard). Mind you the picture looks good, whether the picture is as good the product might be another thing.”

Recent data from Roy Morgan revealed 3.8 million Australians purchased from Temu in the 12 months to August 2024, while 2 million shopped from Shein.

It estimates Shein and Temu had close to a combined $3 billion in annual sales in the year to last June.

Australian Retailers Association chief industry affairs officer Fleur Brown said that while online shopping was showing no signs of slowing down, the majority of consumers preferred an in-store experience.

“Around 80 per cent of purchases happen in-store, with shoppers and retailers utilising online tools like click and collect, or virtual shopping assistants, to streamline the purchasing process,” she said.

“Retailers are consistently monitoring marketplace competition, and for many, their drawcard continues to be high-quality, locally sourced goods, that make them a stand-out from overseas online competitors.”

Mr Harvey’s comments come as Macquarie this week said sales in clothing, footwear, accessories grew just 1.8 per cent across the Christmas trading period. This was after posting a 9.1 per cent increase during the week of Black Friday.

“We think this reflects the impact of online, which is dominated by international apparel retailers Amazon, Shein and Temu,” Macquarie said in a note.

“The recent popularity and growth in designer dupes, another emerging fashion and apparel market segment, would have adversely impacted local mid-market budget brands.”

Advisory firm Kroll had also previously said competition from new entrants who have captured significant market share had been a key reason for the collapse of many Australian apparel brands including Oroton and more recently, Noni B’s parent Mosaic Brands.

Mr Harvey reckons most retailers had “a very good November/December, probably a bit better than we all expected”.

“That would mean that it’s going to be quite difficult for the Reserve Bank to lower interest rates as quick as they might’ve hoped,” he said.

Mr Harvey expects the rest of the year to be “okay”.

“You’ve got January sales then it falls away in February, and then it starts to pick up from March onwards,” he said.