AMELIA BRACE: How Commonwealth Bank managed to boom in an economic downturn

Which bank can boom in an economic downturn?

Commbank Can.

Australia’s largest bank — and company — has plenty to celebrate.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

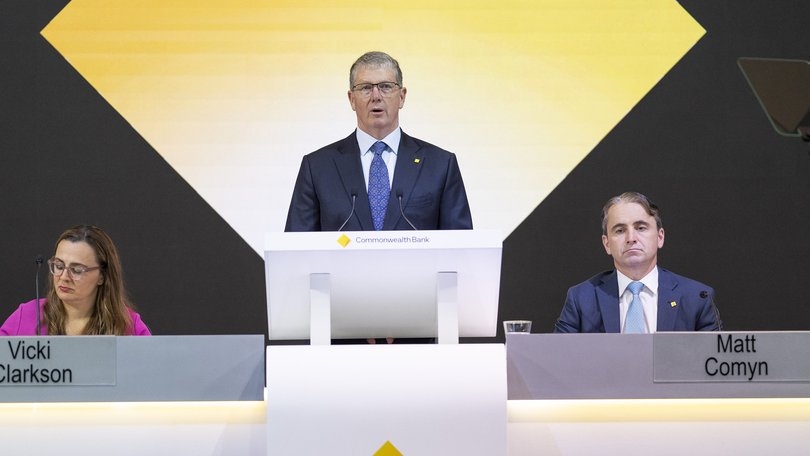

By continuing you agree to our Terms and Privacy Policy.And while today’s Annual General Meeting was more conference than carnival, the on-brand yellow lighting illuminated the faces of many happy shareholders.

The Commonwealth is the banking bubble that won’t burst. It made almost $10B last financial year. $8B was returned to shareholders in dividends and buybacks.

On the markets, there appears to be no end in sight for the rally of its (widely considered overvalued) stocks — up almost 40 per cent at this time last year. Defying bearish analyst forecasts and ignoring a dip in profits.

Moody’s ranks CBA as one of only five banks globally with the highest financial strength.

And Kantar lists it as the only Australian company in its global 100 most valuable brands.

Chair Paul O’Malley said today, “our strength allows us to continue lending, supporting, and investing for our customers, and all Australians through the current economic cycle”.

But that economic cycle is spinning at very different speeds when it comes to the bank’s shareholders and its customers.

More than one in three Australians and more than one in four businesses now consider CBA as their main financial institution.

That’s 17 million Australians.

And today CEO Matt Comyn confirmed tens of thousands of them, are struggling to make ends meet.

“We are doing more to help our customers, making that help easier to access, and, as always, we are encouraging people to reach out early if they need it”, he said.

That amounts to 132,000 people who have – and are now on hardship arrangements – to ensure they can pay their mortgages.

A near 25 per cent increase.

Mr Comyn says Commbank is also offering “flexibility with loan repayment deferrals, customised payment arrangements, and in some cases a loan repayment pause if required”.

The juxtaposition between CBA’s two main stakeholders couldn’t be starker.

If the bank owns a share of your house — you’re struggling.

If you own a share of the bank — you’re laughing.

But the leadership team says it’s not that simple, arguing its skyrocketing stock success helps everyone.

“We have the strength and stability to support customers when needed”, Mr Comyn told shareholders.

Mr O’Malley added that the biggest of the big four had a “responsibility” to help in the challenging economic times, “we know many people are finding the times difficult”.

“Our strong balance sheet anchors our efforts to expand help to these customers.”

And thus Commbank finds itself in the bizarre position of handing out dividends with one hand while blocking defaults with the other, something that doesn’t seem to faze its boss Matt Comyn: “As the Bank for all Australians, our role is to support all customers through good times and bad.”

Even when the good times and bad, collide.