Commonwealth Bank expects RBA to hold cash rate in what should be a ‘straightforward decision’

Economists at Commonwealth Bank have had their say on what the Reserve Bank of Australia will do with interest rates next week.

Economists at Commonwealth Bank expect the Reserve Bank of Australia to keep the cash rate on hold next week in what they say should be a straightforward decision.

The RBA on Tuesday will reveal its latest decision on interest rates but most economists expect they will be kept unchanged at 4.35 per cent.

In a research note on Friday, CommBank head of Australian economics Gareth Aird said the latest national accounts — which revealed Australia’s economy grew by just 0.1 per cent over the first three months of 2024 — and May’s unemployment rate slipping lower to just 4 per cent, were largely in line with the RBA’s latest economic forecasts.

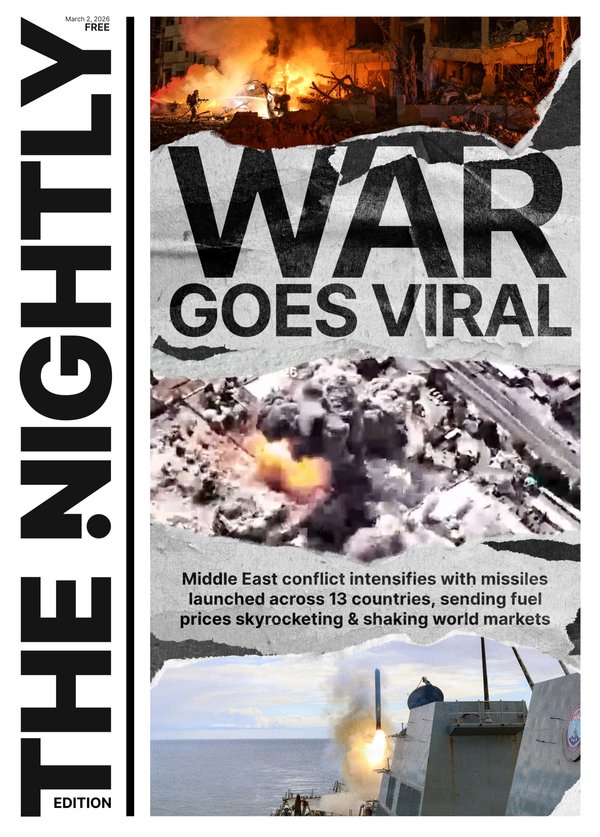

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“Put simply, there is nothing in the recent labour market data that would influence the RBA to change their tune in either direction on the policy outlook at,” he said.

“Notwithstanding, the labour market is loosening on all key measures. Trend unemployment and underemployment are on a gradual upward path. Hours worked is weak. And job advertisements are on a clear downward trend.”

“Our expectation for a more material loosening in the labour market relative to the RBA’s forecasts is a key reason why our base case sees the RBA commence an easing cycle in late 2024.”

The June Board meeting comes in the wake of the Federal Budget, although RBA governor Michele Bullock has previously refused to buy in to economic speculation about whether it was inflationary or not.

The other key economic development since the May RBA board meeting was the Fair Work Commission’s decision to give millions of workers on minimum and award wages a 3.75 per cent pay rise from next month.

The increase means the national minimum wage will be $915.90 per week, up from $882.80, or $24.10 per hour, up from $23.23.

Mr Aird said the FWC decision would have been welcomed by the central bank behind closed doors.

“The wages story in Australia should not be a problem for the Board in restoring inflation back to the target band provided that productivity growth lifts,” he said.

“Our expectation is that productivity growth will lift over the period ahead due to the significant business investment undertaken over the last few years (with more to come).”

It comes after ANZ this week became the first of the four major banks to officially push back their rate cut forecast to next year.

Moving its prediction beyond November this year, ANZ now expects the RBA to keep the cash rate steady at 4.35 per cent until at least February, with another cut likely in April or May.