JACKSON HEWETT: How data is driving a modern day gold rush

JACKSON HEWETT: The old saying that data is the new oil needs to be updated. Data centres are where the money is flowing.

The AI space race is becoming stratospheric.

In just the last two weeks, some of the world’s largest companies have announced eye-watering AI investments.

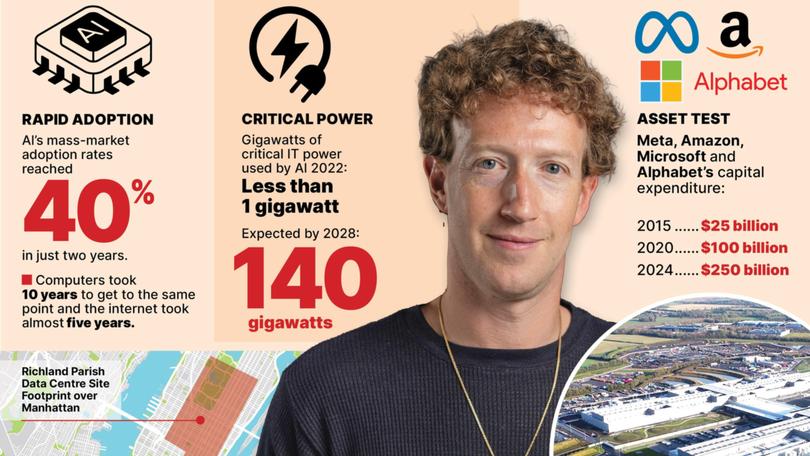

Meta (owner of Facebook and Instagram) said it will spend an additional $US65 billion to enhance its AI capabilities. CEO Mark Zuckerberg posted a schematic of the planned infrastructure over a map of New York, writing, “Meta is building a datacenter so large it would cover a significant part of Manhattan. Let’s go build!”

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Not to be outdone, Alphabet (owner of Google) announced a $US75 billion AI investment — 43 per cent more than the previous year. Microsoft pledged $US80 billion. Amazon, which spent $US83 billion last year, and will increase that to $US100 billion in 2025.

The numbers are staggering. Investors are growing uneasy, fearing an endless stream of expenses on technology that has yet to prove its value.

But the tech giants have little choice. Every CEO knows that without an AI strategy as ambitious as their closest rival’s, they risk obsolescence.

“It’s a once-in-a-lifetime type of business opportunity,” said Amazon CEO Andy Jassy.

Zuckerberg told shareholders that making massive investments now would give Meta a long-term edge over companies unable to afford similar spending.

A decade ago, data was the new oil. Today, AI is the engine where the world’s wealthiest tech firms hope to tap that data to construct their version of a digital Fort Knox.

“People don’t all want to use the same AI,” Zuckerberg said.

“They want AI that’s personalised — their interests, their personality, their culture, the way they see the world.”

The holy grail is an AI system so seamless, intuitive, and personalised that users will willingly embed Meta, Alphabet, or Amazon into their daily lives — generating billions in micropayments along the way.

The companies, no strangers to toppling incumbents with technology, see an existential threat on the horizon.

Donald Trump echoed similar concerns, citing China while announcing $US500b in AI investments — most of which had already been earmarked.

China is no slouch in the race. The investment world was stunned when DeepSeek, a Chinese hedge fund-backed Large Language Model, claimed to achieve similar AI results for just $US6 million using cheaper, less power-intensive chips.

Analysts later estimated the real development cost at closer to $US2.5 billion, likely subsidised by the Chinese government.

Meanwhile, Chinese giants like Alibaba and ByteDance claim their AI tools rival the best of Silicon Valley.

Parallels to the Dot-Com Boom

The $US240 billion invested in data centres in 2024 alone mirrors the telecommunications spending of the early 2000s, drawing comparisons to the dot-com boom.

The valuations, particularly for semiconductor firms like NVIDIA, are eerily similar. But unlike the 2000s, today’s AI leaders — NVIDIA, Microsoft, Alphabet, and others — are highly profitable.

Like the dot-com boom, the use cases — and the revenue streams — are less clear.

The adoption is not. It has taken just two years for AI to adopted by 40 per cent of the US population.

It was almost five years before that was the case with the internet, and 15 years for the computer.

Tech firms can see the take-up and for now, that means burning shareholder funds to be ahead of the race.

Satya Nadella says it will become a self-fulfilling prophecy.

“As AI becomes more efficient and accessible, we will see exponentially more demand,” he said.

Australian opportunities

“The outcome of that enormous spend of the dot-com era was the internet became a core factor of our lives, and that was the long-term value it created,” said Andrew Pankevicius, co-founder of AI startup Redactive.AI.

“The US recognises by making these deep investments, they are leading the horse here, which is that there’s an inevitability of AI usage these days.”

Pankevicius, a former Atlassian employee noticed that as companies were racing to adopt AI experiments, they were letting the models loose on their information.

“Security teams have spent years controlling which employees have access to which tools. But now, AI tools are acting on behalf of employees, using their access. If those access controls aren’t locked down, AI is pulling information from places you didn’t intend.”

Redactive.AI is one of those companies that stands to benefit from being one of the “picks and shovels” of the AI era.

The company works with global conveyancing platform PEXA, the big four banks and a superannuation fund.

Demand for their services are so strong they are expanding into America.

Pankevicius said that there were an expanding number of AI startups gaining traction in Australia, and said that as computing costs got cheaper and cheaper, it would become a core feature of the tech world.

“The sentiment leveraging this technological innovation to change the way that your product looks and works. Every successful software-as-a-service business is looking at a way to implement it,” he said.

The rollout of the technology is not just as the software layer.

Private equity firms are eyeing off boring, niche businesses with low profitability — think customer service, accounting and property management — and wondering what they would look like with AI taking over from staff.

That aligns with World Economic Forum research that found that 40 per cent of global employers anticipated reducing their workforce where AI can automate tasks, and small consulting firms in Australia that told The Nightly that AI would help companies more fully offshore jobs.

For now, the serious investment money is heading toward data centres here.

Firms like NextDC, Megaport and Goodman Group have all benefited from the desire to manage data, and analysts don’t see that slowing down anytime soon.

Despite the concern that DeepSeek, with its cheaper, and less power intensive technology might change the way customers use AI, most analysts expect strong earnings growth from the ASX big data players, with buy ratings on the stocks.

As investments go, they are safe infrastructure-style returns to cash in on the boom in AI, but Pankevicius hopes for a more transformative outcome.

AI companies are often solving global challenges from day one, but for Australia to take advantage of local founders building companies to tackle these challenges, there needs to be a greater risk appetite for Australian Investors.

“There’s a very Australian attitude that people base their status on their property portfolio, versus the US where there is this appetite to invest in companies,” Pankevicius said.

“You have to take a bet on pre seed investments to support founders to do as Redactive has done which is take success in Australia, and have enough jet fuel to get to the US and scale there into that market.”