JACKSON HEWETT: With the S&P 500 expecting bumper returns again, there are warning signs of a market bubble

JACKSON HEWETT: In a record breaking year for US stocks, two stats are ringing alarm bells.

In a record breaking year for US stocks, two stats are ringing alarm bells.

For the first time in more than 20 years, the major US index — the S&P 500 is experiencing what market watchers call “bad breadth”.

The run in US stocks has been remarkable.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Barring a big sell-off before the end of the year, the S&P 500 is on track to show a more than 25 per cent return, if dividends are included. The S&P 500 achieved a similar return last year.

A 50 per cent gain over two years is extraordinary.

The long-term average annual return for the S&P 500 is around 10 per cent.

These gains have been driven largely by the so-called “Magnificent Seven”: Tesla, Amazon, Alphabet, Apple, Meta, Microsoft, and Nvidia. All these companies have benefited from the seemingly limitless promise of artificial intelligence.

Trump’s election also put a rocket up stocks, with investors feeling that the Donald’s low regulation, low tax promise will juice earnings.

In market parlance, the index is being boosted by what is called a momentum trade – otherwise known as FOMO.

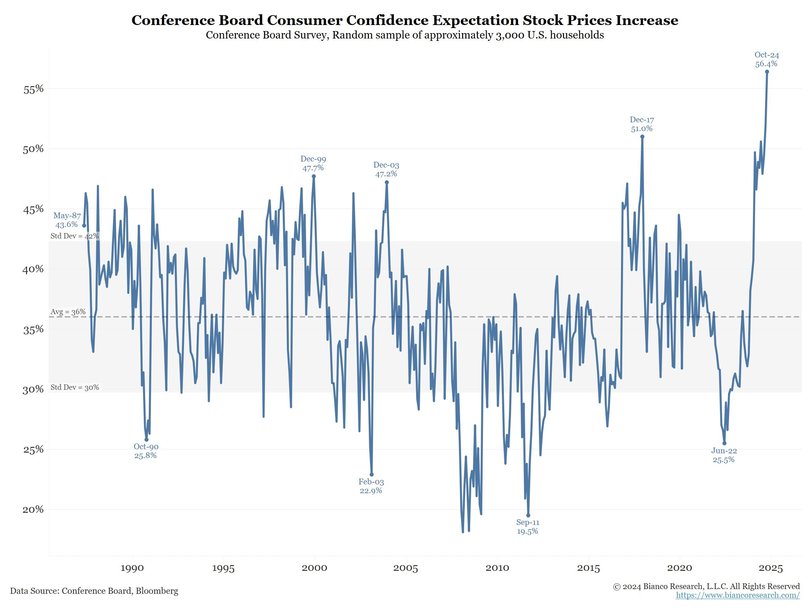

American retail investors haven’t been as bullish on US stocks in 40 years. Sixty per cent expect stocks to rise over the next 12 months.

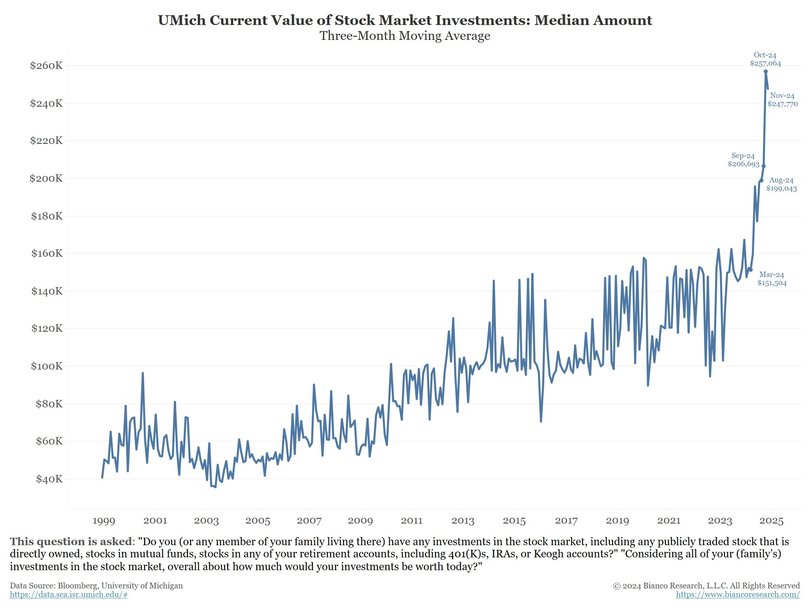

You can see why they are are, with the median holding of a stock portfolio rocketing to $250,000 compared to 150,000 just 18 months ago.

But while retail investors are FOMOing into equities, those actually running the companies appear to be getting out.

The number of corporate executives selling down their shares has reached the highest level in 20 years.

According to Bloomberg data, there are six times as many executives selling their company stock as there are those buying it.

And another key metric suggests that smart money is rolling out of their holdings, while the overall market is melting higher.

For the last nine days, more stocks in the index have fallen than risen. The last time that the market saw consecutive declines of that nature was back in 2001 in the days after 9/11 ,in 1998, when the market eventually crashed 22 per cent, and in 1996 when the market dropped 11 per cent.

It makes the US market a dangerous place to be when there are more declining stocks than advancing, particularly given how much the S&P 500 has bounced on weak fundamentals since Trump.

Investment bank Macquarie thinks that the US market is “overly bullish” and is advising clients start looking at defensive stocks.

“We see surprises turning negative in January,” MacBank wrote to clients.

Watch the US consumer

The big market gains may still hold if the US consumer continues to spend.

So far they haven’t disappointed, with American shoppers increasing their spend by 3 per cent over the three months to October. Add in the prospect of rate cuts, and rising wages and disposable income may rise further.

But there are Trump and Elon sized clouds on the horizon that may change the consumer spending picture.

If Trump adds more tariffs, that will make goods more expensive, not only reducing sales but potentially forcing the Federal Reserve to raise rates to contain inflation.

At the same time, the Department of Government Efficiency is looking to rip through the public sector and those public dollars eventually find their way into private pockets.

Impact on Australian stocks

Our market has not performed anything like the S&P 500. Our ASX 200 is up a mere 8.5 per cent year to date, compared to the 25 per cent on the S&P 500.

Stripping out the miners, Macquarie finds the price to earnings ratio paid for the Australian market is near an all time high. Prices are at 22 times earnings, just under the post-COVID stocks boom when cheap money was flooding the economy and higher than the tech boom of the turn of the millennium.

With stock prices so far ahead of earnings, something will eventually have to give. That’s why the US warning sign is becoming increasingly important because when the US sneezes, the world catches a cold.

Macquarie has told clients it has already gone mostly defensive and advised them to pivot to health stocks like CSL and Resmed, real estate investment trusts and gold in advance of a US market meltdown.

Even if the US maintains its momentum, Australian stocks don’t have much further to rise unless earnings start to catch up. For that to take place, interest rates here will have to fall.

That’s why Macquarie takes the view that February is when investors should be looking to pick up any stocks like banks and tech companies that are linked to a cyclical economic upturn.

It might be time to cash in and take a bit of pre-Christmas cheer, and keep an eye out for post-Christmas bargains.