Fisher & Paykel Healthcare share price jumps, mining stock South 32 looms as a watch for investors

One of the ASX’s leading healthcare stocks has returned to its 52-week highs as investors pile in after its May earnings results.

One of the ASX’s leading healthcare stocks has returned to its 52-week highs as investors pile in after its May earnings results.

Fisher & Paykel Healthcare is up over 29 per cent over the last 12 months with its stock hovering close to its 52-week high at $28 per share as of Thursday

The company released its results at the end of May and announced a slightly higher dividend, along with stronger forward guidance. The company is set to pay a final dividend of 23.5 NZ cents per share, up half a cent on last year, as it expects net profit after tax up to $360 million in the next financial year.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.This boosted trading activity on Raiz by 751 per cent to over, 600 shares traded. This is an 853 per cent increase over the month when there were fewer than 300 shares traded.

Also steamrolling forward this week on Raiz was mining stock South 32 ($32), which had a 422 per cent increase in trades this week. It’s been a strong stock over the month, despite coming down a bit off its highs in May.

Macquarie analysts this week listed this miner as a top stock and labelled it as a buy due to its exposure to copper.

Analysts expect it to outperform with a price target of $4.25 while it currently sits around $3.65. This would represent a potential upside of close to 16 per cent for investors over the next 12 months.

Sneaking into the Raiz top 10 list this week was the Goodman Group which saw an 143 per cent increase in shares traded. There were just over 1500 shares traded, however, this represents a massive 2000 per cent increase over the last four weeks.

It was one of the top-performing stocks last week, up over 5 per cent but there’s been a fair bit of media noise around the stock over the past week.

Motley Fool marked it as one of their high-quality stocks to hold forever, given its portfolio of assets globally. It also has exposure to AI through its data centre pipeline which is likely to be a key driver of future growth.

It can also benefit from the current warehouse shortage as it expects to grow its operating earnings per share by 13% in FY24.

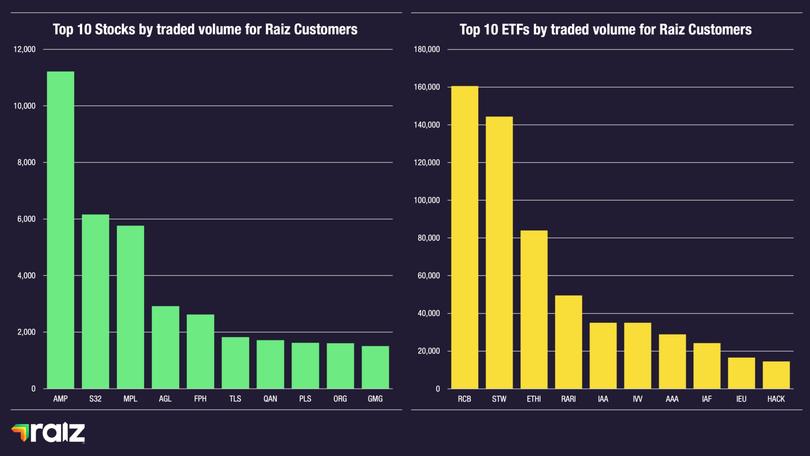

AMP has remained the top stock on Raiz with over 11,200 shares traded however it’s been slipping down each week. This week it’s down over 20 per cent and it’s down over 30 per cent from its high back in May.

It still remains a market leader but that margin does continue to narrow.

ETFs were a mixed bag this week, after last week’s bonanza of increases. Despite the mixed bag, the top two ETFs were able to bring up overall units traded by 2 per cent. Those two ETFs were the Russell Investments Australian Select Corporate Bond and the SPDR S&P ASX 200 which regularly feature in the top 10. They were up 6 per cent and 8 per cent respectively.

The real ETF leader this week was iShares Europe, which provides investors with the performance of the S&P Europe 350 TM Index. This company features a range of leading blue-chip companies including Shell, Novartis and even AstraZeneca.

Meanwhile, many of the ETFs lost some shine with the biggest laggard being the iShares Asia 50. It saw a 9.5 per cent drop in units traded as it dropped down to 35,000 units traded.

It has been trading near the 30,000 mark for the last few weeks so the slight drop may just represent a return to regular levels.

The information contained in this article is general information only and does not take into account your financial situation, objectives or needs.

Raiz Invest Australia Limited – Authorised Representative of AFSL 434776. The Raiz Invest Australia Fund is issued in Australia by Instreet Investment Limited (ACN 128 813 016 AFSL 434776) a subsidiary of Raiz Invest Limited and promoted by Raiz Invest Australia Limited (ACN 604 402 815). PDS and TMD are available on the Raiz Invest website and App. You should read and consider those documents before deciding whether, or not, to acquire and continue to hold interests in the product.