Mineral Resources reconsidering Chris Ellison’s mid-2026 departure

Presentation notes to be used by new chair Malcolm Bundey in meetings with investors and proxy advisers this week says Mr Ellison’s planned exit timeline is being ‘reviewed’.

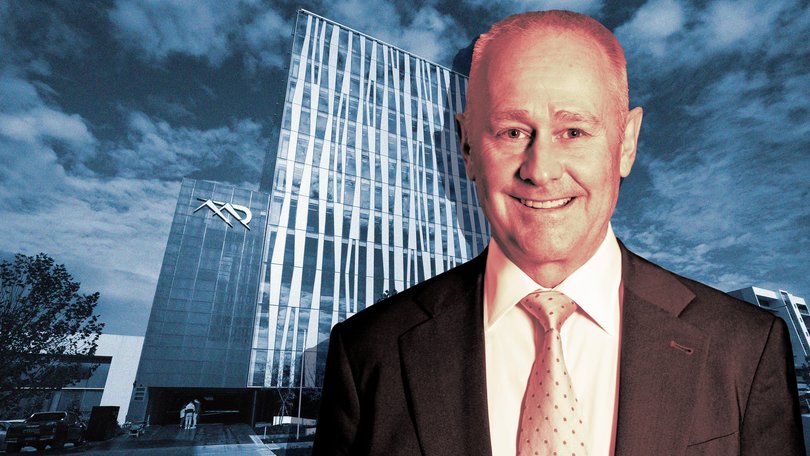

Mineral Resources has for the first time suggested Chris Ellison could retain the reins of the mining and services group beyond his promised retirement date of mid-2026, despite the scandals that have tarnished his leadership.

Presentation notes to be used by new chair Malcolm Bundey in meetings with investors and proxy advisers this week say Mr Ellison’s planned exit is being “reviewed” and will now be determined by the best interests of shareholders.

Shares in MinRes were 20¢ lower at $24.26 as at 10am, having recovered from $23.60 after the company’s potential change of heart came to light.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.In November, MinRes committed to an “accelerated” succession with the aim of finding a replacement for Mr Ellison, MinRes” co-founder and chief executive, within “12 to 18 months”.

The decision followed damaging disclosures around a series of related-party dealings involving Mr Ellison that seriously damaged his and MinRes’ reputations, contributed to a hefty plunge in the company’s share price and attracted the scrutiny of the corporate regulator.

However, the corporate governance scandals have divided investors, with some - including vocal hedge fund L1 Capital - arguing Mr Ellison is too important to lose and others insisting he has to step down if the company is to restore its credibility.

Announcing his proposed exit last year, MinRes said an accelerated transition was in “the company’s best interests”.

When queried about the timeline and suggestions Mr Ellison wanted to remain at MinRes, the group has insisted November’s commitment remained unchanged.

However, Tuesday’s presentation notes have muddied the waters.

“MD/CEO process being reviewed by new chair, which will be effected in the best interests of shareholders,” MinRes said.

Mr Bundey, a Melbourne-based director with no mining experience, was parachuted into MinRes this month, replacing James McClements as chair.

He faces one of corporate Australia’s toughest board jobs, fixing MinRes’ governance while working in tandem with a tough-talking company founder and major shareholder with a blunt management approach.

As well as his appointment, MinRes also on Monday injected more financial expertise into the board with the addition of Lawrie Tremaine and Ross Carroll as independent non-executive directors.

The appointments follow the abrupt resignations more than two months ago of the three female directors that comprised the ethics and governance committee.

Despite industry speculation that there is a reluctance by some potential board candidates to join MinRes, the company said there had been “keen interest” and additional prospects were being reviewed.

MinRes noted on Tuesday that as revealed by The West Australian last month, the Australian Securities and Investments Commission is investing the company’s role in last year’s float of WA lithium junior Kali Metals.

“As has been noted publicly, ASIC is investigating certain matters including in relation to related party transactions; the Kali Metals initial public offer; continuous disclosure and general corporate governance and directors’ duties,” the company said.

Friends and family of Mr Ellison acquired holdings in Kali ahead of its float, pocketing big profits when the stock more than tripled on its ASX debut in January 2024, helped by buying by MinRes.

Originally published as Mineral Resources reconsidering Chris Ellison’s mid-2026 departure