Ord Minnett says ‘zero probability’ of APM doing a takeover deal with major shareholder Madison Dearborn

Analysts at a leading stock research house have put the chances of embattled APM doing a deal with partner-turned takeover bidder Madison Dearborn Capital Partners at “zero”.

Madison Dearborn, which helped to list the struggling employment and disability services provider in a disastrous public float in November 2021, already controls about 30 per cent of APM’s register and is offering to pay $1.40-a-share for all other shares.

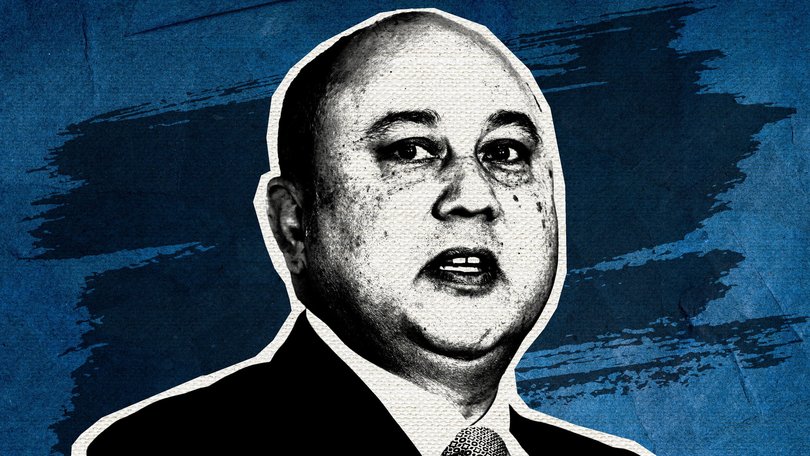

The Michael Anghie-led company has already described the price as “disappointing” but said it remains engaged with the private equity group to focused “on achieving an outcome that is fair and reasonable and in the best interests of all shareholders”.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.But Ord Minnett has poured cold water on the possibility that a deal can be done.

“We think the biggest hurdle will be the non-Madison Dearborn Partners directors unanimously recommending the proposal, given they currently see the offer as disappointing, and the APM board unanimously rejecting CVC’s initial offer of $1.60 cash per share on February 19,” analysts wrote in a research note.

Madison Dearborn snapped up its slice of APM from Quadrant Private Equity in 2020. Along with founder Megan Wynne and her Perth IVF specialist husband Bruce Bellinge, the trio already control about 64 per cent of APM’s stock.

Madison Dearborn’s near $1.3 billion offer was lobbed late on Friday and APM said it had spent the weekend assessing the deal.

The proposal is contingent on the backing of the full board. Madison Dearborn already has three directors around the table.

The offer also includes a rollover election for APM shareholders to receive all or part of the consideration in unlisted shares in the acquisition entity. It would also require certain shareholders — including Ms Wynne and founding related parties, managing director Michael Anghie and key management — to agree to receive all of their consideration in scrip.

APM said on Monday that Madison Dearborn’s offer does not require exclusivity and it could still engage with other potential suitors.

But given Madison Dearborn’s hold on the company — and the fact that fellow equity giant CVC walked away from an improved $2-a-share offer less than two weeks ago following four weeks of due diligence — a rival bid or chance of increasing the bid price seems unlikely.