Couple in their 40s is worth nearly $1.5m. Why a money expert and self-made millionaire says they’re ‘broke’

Michelle, 42, and Ryan, 43, love their three young kids. And spend a lot of money to show it.

“I don’t say, ‘We don’t have the money, we can’t afford it.’ I don’t say those things,” Michelle told self-made millionaire Ramit Sethi on a recent two-part episode of his I Will Teach You to be Rich podcast. Their last names were not used.

Ryan earns nearly $US140,000 ($205,000) a year as the sole financial provider, and the couple has a net worth of around $US970,000. But they’re stressed about their day-to-day finances and constantly dip into their savings to cover their regular expenses.

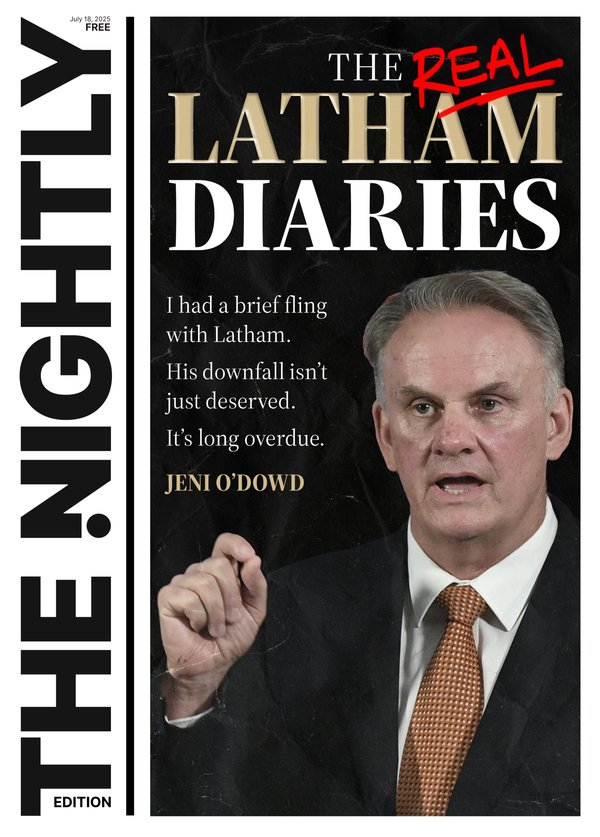

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“It’s a sinking ship,” Ryan said. “It can’t continue this way because we will run out of money.”

Their fixed costs, including their mortgage, insurance, transportation and other necessities, total more than their monthly income. Plus, their spending has gotten out of control on what the couple calls “little things,” that just add up.

Sometimes it’s necessary purchases like a carbon monoxide detector, but often it’s more discretionary like a beach canopy. They spend nearly $US2000 a month at Target and Amazon alone.

“You are losing money every single month,” Sethi told them. “You’re broke.”

Here’s why the couple feels stuck in their situation, and Sethi’s advice to help them to move forward.

‘Death by 1000 paper cuts’

When Sethi asked about their spending problems, Michelle and Ryan kept referring back to Target and Amazon purchases.

In addition to necessities like groceries and diapers, the couple also rack up $US15 to $US30 impulse buys, such as kids’ sunglasses, soccer equipment and bike tires, that ultimately add up. “It really is death by 1,000 paper cuts on the Amazon front,” Michelle said.

Sethi wasn’t sold, however. Making a more conscious effort to cut out unnecessary spending can help, but the couple needs to look at the bigger picture, he said.

It’s not just that they make a lot of spontaneous purchases, but that they have no systems in place to help them make better decisions. When Sethi asked the couple where they could cut, Michelle was sceptical that she could significantly reduce those bills because many of those expenses felt necessary.

“This is what happens when you let your spending get out of control,” Sethi said. “It becomes incredibly difficult to downsize because the human mind convinces you that everything you have accumulated is absolutely necessary.”

He recommended looking at their big discretionary spending areas, like dining out and shopping at Target, and gradually cutting their spending by 50 per cent over six weeks until they’ve stabilised. From there, they will hopefully be able to see things more clearly.

It’ll take an adjustment to start telling their kids “no,” but it will help their children develop a better relationship with money as they grow up, too, Sethi said.

‘Right now, we’re screwed’

Sethi doesn’t often tell people they’re saving too much money. But with Ryan and Michelle, it’s part of the problem.

Michelle takes pride in the way she built up her savings and investments by sticking to good habits throughout her 20s. Ryan wasn’t as prudent with his cash, Michelle said, but bought their house on his own before they got together.

Overall, that has helped the couple amass around $US585,000 in assets, including their home and nearly $US468,000 in retirement savings and other investments.

“In retirement we’re set, and right now we’re screwed,” Michelle said.

At the time of the podcast’s recording, the couple was allocating 14 per cent of their take-home pay toward retirement and other post-tax investments. While that’s a great strategy to build up investments, especially while they’re fairly young, it doesn’t work with the rest of their monthly spending.

“When it comes to your spending, you’re spending way too much,” Sethi told them. “And when it comes to your investments, you already have enough if you were to literally stop today.”

The couple realised cutting back those monthly investments will give them the cash flow they need to cover their necessities and feel confident in splurging on things that are important to them but have gone neglected, like date nights.

“The biggest breakthrough happened when they finally realized that they actually have control over their spending,” Sethi said. “It’s a nice cherry on top that they are over-investing so they can reallocate their cash.”

CNBC