Nick Bruining: Ever worked in the UK? Here’s how to get a UK state pension and free up your super savings

As you polish off the last of your Easter eggs, be aware that if you worked in the UK for three years or more a big fat golden retirement nest egg also awaits you.

If used properly, it could free up much of your superannuation savings so that when you retire you’ll be able to use your super for fun things instead of generating a retirement income.

The UK National Insurance scheme is the equivalent of our age pension system but differs because there are no means tests applied. Anyone who ticks the boxes, including multi-millionaires, receives a pension.

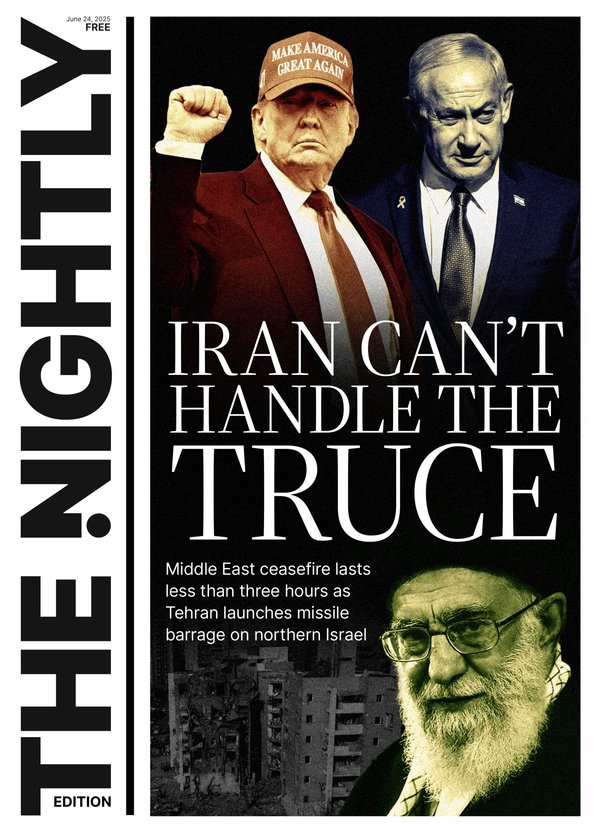

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Like the Australian system, the UK scheme has undergone many changes over the years, so for simplicity we’ll stick with the rules as they are now for anyone not yet retired.

The amount you receive under the UK system depends on how many years you and your employer made compulsory contributions to the NI scheme. To receive the maximum amount possible, the system assumes that a working person worked at least 35 years. If you don’t tick that box, you may still qualify for a portion of the full amount.

You don’t have to be a British citizen to qualify. It applies to anyone who worked continuously in the UK for three years or more and, as required by law, joined the National Insurance scheme at the time.

Thanks to ongoing UK inflation, anyone who becomes eligible could receive up to £221.20 ($425.40) a week for life. That’s up 8.5 per cent from last year’s rate of £203.85.

The weekly amount you receive when you qualify is the rate you’ll keep until you die. The fact that this doesn’t increase for people living in Australia has been a source of irritation that dates back decades.

Based on the current exchange rate, a couple that each qualifies for the full rate would receive a combined amount of more than $44,000 a year from the UK. To generate a similar risk-free income for a 65-year-old couple, you would need to invest about $700,000 in a lifetime annuity offered by a commercial provider.

To qualify for a part UK pension, you need to have at least 10 years of contributions, and that would see you receiving 10/35 of the full rate — or £63.20 a week.

The best part about the UK system is that if you don’t meet the 10-year minimum or you want to keep boosting your entitlements towards the 35-year maximum, you can make top-up contributions.

You can only do that if you have at least three continuous years of contributions already in the scheme. And no, you can’t join from overseas.

There are different classes of contributions depending on your work status now and immediately prior to your departure from the UK.

At worst, each additional year could cost you £907.40 for a Class 3 contribution and, at best, £179.40 for a Class 2 contribution.

Someone who simply ticks the three-year eligibility box and makes a one-off payment of £6351.80 of Class 3 contributions to meet the minimum 10-year requirement becomes entitled to £63.20 a week. Over a full year, that adds up to £3286. That’s an effective return on your “invested” outlay of 50 per cent a year for life.

But it gets better.

The percentage will be based on the actual weekly pension rate when you retire. It could easily be 10/35 of £300 a week if you are 10 years away from pension age.

While Class 3 contributions can be made by almost anyone, the numbers based on Class 2 contributions are even more extraordinary.

To be eligible to pay Class 2 contributions, you need to have been working immediately prior to your departure from the UK and have worked here in Australia. The vast majority of people who top-up their UK entitlements qualify for Class 2 contributions.

For a similar seven-year back-pay scenario, a total outlay of about £1255 translates to an effective return of an incredible 260 per cent on the money sent to the UK. In other words, you’ll receive your money back in less than five months after claiming.

And herein lies the only real risk. If you die before qualifying, your estate receives nothing back and when you die, the payments stop.

The pension eligibility age depends on your date of birth but will sit somewhere between 66 and 68 years of age.

Under special rules which end on April 5 next year, you can back pay up to 16 years worth of contributions and you can keep topping up your account, until you reach your eligibility age.

For more detailed information, you can access “how-to” fact sheets from the not-for-profit association, bpia.org.au. There’s a $30 joining fee, but for the returns listed above, it’s well worth the outlay.

Nick Bruining is an independent financial adviser and a member of the Certified Independent Financial Advisers Association