Nick Bruining Q+A: $20,000 a year to run a self-managed super fund. Is our adviser taking us for a ride?

Q+A: The costs of running a self-managed super fund aren’t cheap but they can be overlooked if your adviser is doing the work to pull in big returns. So how do you know if you’d be better off elsewhere?

Question

I was very interested in your comments of a couple of weeks ago regarding financial advice costs (Your Money, July 22) and hope you can help.

My wife and I are both octogenarians. We have our own self-managed super fund which currently stands at $1.6m, established by our financial planner who charges $7000 a year.

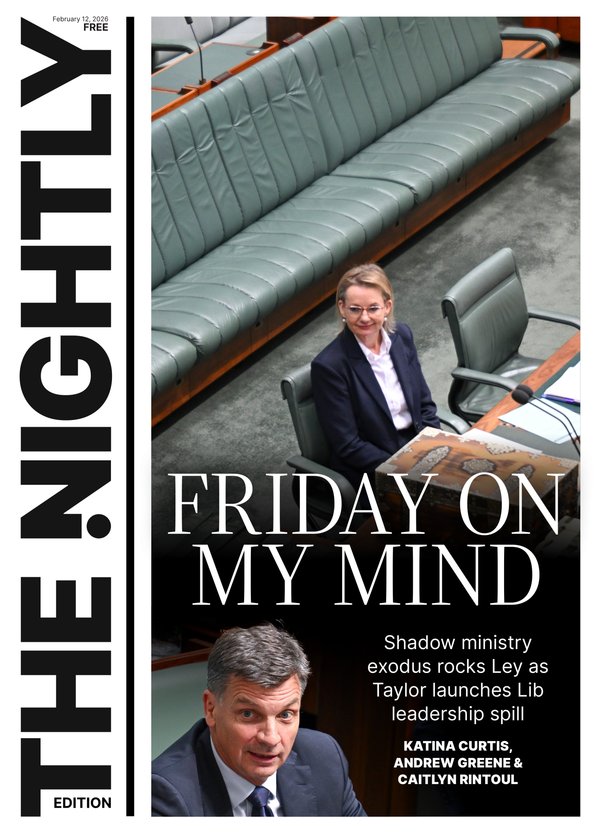

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.He, in turn, invests the money through industry super funds that charge around the same each year.

Our accounting and Australian Securities & Investments Commission fees are around $5200 a year. Is almost $20,000 a year a reasonable amount to be paying for our portfolio or are there better options?

Answer

I would question the suitability of an SMSF in your circumstances as it seems an overly complicated arrangement.

The obvious question is, why wouldn’t you use the industry super fund instead of an SMSF to manage the same investments?

Currently, your total operating fees total $12,200. On $1.6m, that represents fees of 0.76 per cent a year.

Transferring the funds from the SMSF to the industry fund direct using identical investments would cost around $10,250 — or 0.64 per cent. That’s nearly $2000 a year less.

Plus, you no longer have to worry about the considerable responsibilities of operating an SMSF.

I would also question the advice fees, relative to the actual services provided to you. Without an SMSF, those fees should also fall.

Question

I am 67 and retired. My wife is 63 and still works three days a week. I have $1.5 million in a superannuation retirement income account and my wife has $200,000.

We own our house worth $2m. The house is in my name and I bought it in 2001. We were married in 2010.

We have both lived in the house since 2004 but would now like to downsize.

Am I able to withdraw $1m from my super as a lump sum to purchase another property before we sell our existing house and then sell our house and deposit some of the sale proceeds back into our super?

If so, how much can we deposit back into both of our super funds, bearing in mind the house is in my name. Can we redeposit $1m or maybe more?

Answer

As you have “ceased employment since turning 60”, all of your super can be accessed tax-free. As for recontributing, there are a couple of issues to consider.

Firstly, you may be able to add your wife’s name to the title deed at minimal cost. Under special provisions of the Stamp Duty Act, adding a spouse or de facto partner through “natural love and affection” means you do not pay the normal rate of duty.

Once you sell the house there would be two ways to recontribute to super. Assuming neither of you has made any non-concessional contributions to super over the past three years, you can both make use of the bring-forward provisions where you make three years worth of non-concessional contributions in one payment.

Thanks to the recent July 1 increase, this could be $120,000 times three — or $360,000 each. In addition to this, provided you make the payment within 90 days of settlement, you can make use of the super downsizer contribution rules. That would allow for an additional $300,000, lifting the total contribution available to $960,000.

The issue is whether your wife can also make use of the super downsizer concession as her joint or tenant-in-common ownership will not have been in place for the 10-year minimum. Enquiries have been unable to ascertain if this is available in your circumstances, though some experts suggest the answer is no.

I suggest you apply to the Australian Taxation Office for a private ruling, setting out the circumstances, actions to date and what your query is. In your case, can your wife make a downsizer contribution to super?

This can be done on a form you can download from the ATO website. Make your request as soon as possible so that you know what your options will be.

Nick Bruining is an independent financial adviser and a member of the Certified Independent Financial Advisers Association