Nick Bruining: Start of new financial year brings changes to tax and superannuation. Here’s how it affects you

The start of a new financial year ushers in a raft of tax and superannuation changes, with almost every Australian affected one way or another. Here’s what changes from midnight.

With just a few hours to go until the new financial year, now is a perfect time to map out the year ahead and to adjust your settings for new rates and thresholds that kick in from midnight.

To simplify things, we’ll break it up into the three distinct areas of tax, superannuation and Centrelink.

Tax

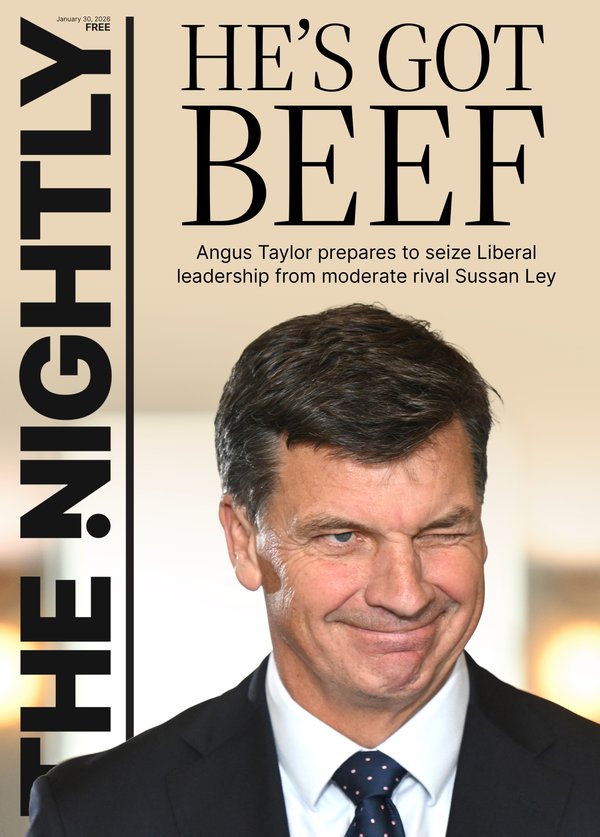

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.While July 1 won’t see any changes to marginal or personal income tax rates, there’s plenty of other things going on in the background that might affect you.

The maximum Family Tax Benefit Part A rises to $227.36 a fortnight for children under 13, and $295.82 for those aged between 13 and 19. After 16, the child needs to be a secondary student.

The maximum rate is means-tested, but the base rate works out to be $72.94 per dependent child.

Lower income earners may also qualify for Family Tax Benefit Part B.

Both benefits are subject to complicated income means-testing, combined with the number of children you have and their ages. But in essence, a person with income above $125,100 would lose their FTB Part A

For any child born after midnight heading into Tuesday July 1, paid parental leave increases. Currently 110 days, it rises to 120 days. The individual cut-off limit for PPL increases by $4219 to $180,007, with the family disqualifying limit rising to $373,094.

Small business owners will be relieved to know the $20,000 instant asset write-off has been extended yet again.

Those who will be using depreciation should remember the amount you can claim as a tax deduction is generally linked to the number of days in a financial year the asset was owned. Buying the asset on Tuesday morning means you’ll get the full benefit for the 2025-26 tax year.

Interest paid to the Australian Taxation Office for an outstanding tax debt is no longer tax-deductible from midnight on Monday night, meaning reducing or getting rid of any tax debts becomes even more important.

Those with a HECS or HELP debt will see the income threshold — where repayments are compulsory — lift from $54,435 to $56,156. This figure is likely to change when legislation to raise the threshold to $67,000 is passed sometime in the next few months.

Superannuation

Compulsory superannuation increases to 12 per cent of ordinary time earnings from midnight. If you’re currently salary sacrificing to max out the concessional contribution cap of $30,000 a year, make sure you adjust your voluntary contribution to reflect the new 12 per cent rate so you don’t exceed the limit.

The Transfer Balance Cap increases by $100,000 — rising from $1.9 million to $2m. This is the amount you can transfer from the 15 per cent tax-on-earnings environment of superannuation in accumulation phase to the completely tax-free retirement phase.

This $2m figure may have greater significance if flagged changes by the Greens to the new $3m super tax are adopted by the Labor Government.

Whereas the Government proposes that the extra 15 per cent tax will apply on earnings attributable to balances above $3m, the Greens are keen to see that level linked to the TBC. In other words, the $2m figure will ensnare tens of thousands of super fund members.

When the legislation is passed, the tax will probably be applied retrospectively to the proposed July 1, 2025 start date.

The full $500 superannuation contribution payment now applies to anyone who contributes $1000 to their super and has an adjusted taxable income of $45,400 or less. Shading out at 3.33¢ per $1, it’s not payable if your adjusted taxable income exceeds $60,400.

ATI is essentially your pre-tax income without any tax tricks you’ve used to reduce your taxable income. That includes negative gearing losses and voluntary concession contributions to super. Ten per cent of your income needs to come from employment.

Centrelink

Centrelink payments themselves aren’t set to change until the next round of indexation kicks in on September 20. But for those on a part-pension or benefit, the annual Consumer Price Index indexation to various thresholds will mean an increase in your payment could apply from Tuesday.

A single home-owning, asset-tested pensioner, for example, will benefit from the $7500 increase in the means test threshold. That will translate to an extra and automatic $22.50 a fortnight in pension payments.

A home-owning couple will collect a combined extra $34.50.

On top of these figures, non-home-owning asset-tested pensioners will collect an extra $18 a fortnight.

Income-tested benefit recipients don’t fare quite as well, with the increases translating, at most, to an extra $4 per fortnight.

Nick Bruining is an independent financial adviser and a member of the Certified Independent Financial Advisers Association