Why HSBC warns Aussies the Reserve Bank may not cut rates at all

There’s an outside chance the Reserve Bank won’t cut interest rates at all in this cycle, according to economists at a major bank.

There’s an outside chance the Reserve Bank won’t cut interest rates at all in this cycle, according to economists at HSBC.

The warning marks a big change from 12 months ago, when many economists were arguing the RBA would lower rates this year. It’s also in sharp contrast with markets predicting a cut by February 2025

Top officials at the central bank are meeting on Monday and Tuesday and are expected to consider a hike, but ultimately leave rates on hold.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.HSBC chief economist Paul Bloxham said the benchmark rate would stay unchanged at 4.35 per cent and reckons a reduction is not likely until the June quarter of 2025.

“But there is some risk that it could take even longer than that,” he said.

“Perhaps by the time the RBA is in a position to consider cutting, the global backdrop has changed, global re-inflation is underway and the RBA chooses, even then, not to cut.”

Mr Bloxham said some economists were predicting the United States Federal Reserve would embark on a fast pace of easing after cutting rates 50 basis points last week.

That would change the playing field significantly.

He said the RBA could then be stuck with inflation above target and force a further rate rise. In a better scenario, the economy may recover without needing a rate cut as cost of living pressure eases.

The central bank will also need to consider the risk lower rates boost consumer sentiment and drive demand, potentially pushing inflation to resume rising. That has been a historical risk for central banks easing too early in the cycle.

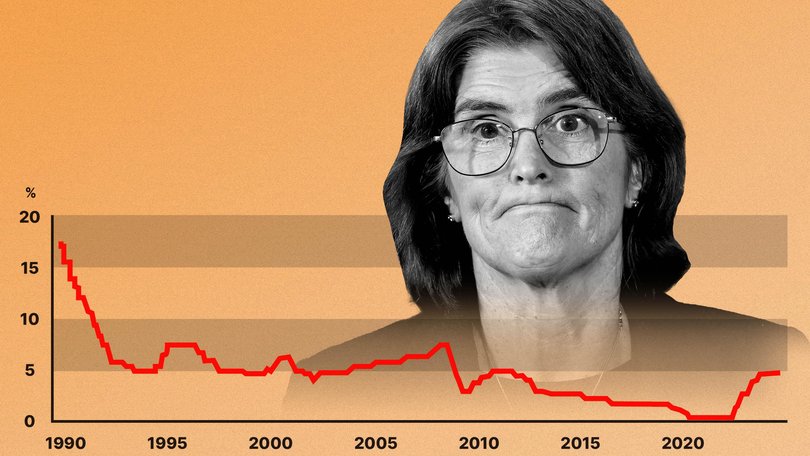

RBA Governor Michele Bullock hosed down speculation of any rate relief this year after the bank’s August meeting.

There was high drama in the background of that decision with a market meltdown in the United States briefly sparked concerns of a severe downturn.

But the US Fed’s supersized move to slash rates has sparked calls for Australia’s central bank to do the same here.

That’s despite a big difference in the inflation rates between the two countries — 3.8 per cent in Australia and 2.5 per cent in the United States.

Judo Bank chief economic advisor Warren Hogan said punters should not expect the RBA to follow.

“The RBA has maintained a hawkish stance for the past two months, warning (it) will not follow the Fed’s cutting cycle, given the difference in policy rates, resilience in the local labour market, and sticky domestic inflation levels,” Mr Hogan said.

He pointed to recent comments by Assistant Governor Sarah Hunter about the strong jobs market, which indicated unemployment was still below the long term sustainable level.

The latest numbers added to evidence the heat is still on, with almost 48,000 jobs created in August.

Also on Monday, new research from investment bank UBS tipped a modest recovery in consumer spending.

The Federal Government’s personal tax cuts would be roughly equivalent to a 100 basis point slash of interest rates, UBS calculated. But households have not yet spent much of the extra cash.

“We expect more of a positive impact over coming months,” UBS economist George Tharenou said.

Punters were also borrowing more through personal loans, which had accelerated to have close to the fastest growth since the Global Financial Crisis.

UBS predicted real consumption growth to roughly double in 2025 to be 2 per cent after a substantial slowdown this year.

Originally published as Why HSBC warns Aussies the Reserve Bank may not cut rates at all