‘You can bank on us’ Treasurer Jim Chalmers tells Pacific forum, bringing cash to fight financial crime

Treasurer Jim Chalmers has pledged $6.3 million to fight money laundering and chase criminals in a boost for the financial sector across the Pacific Islands.

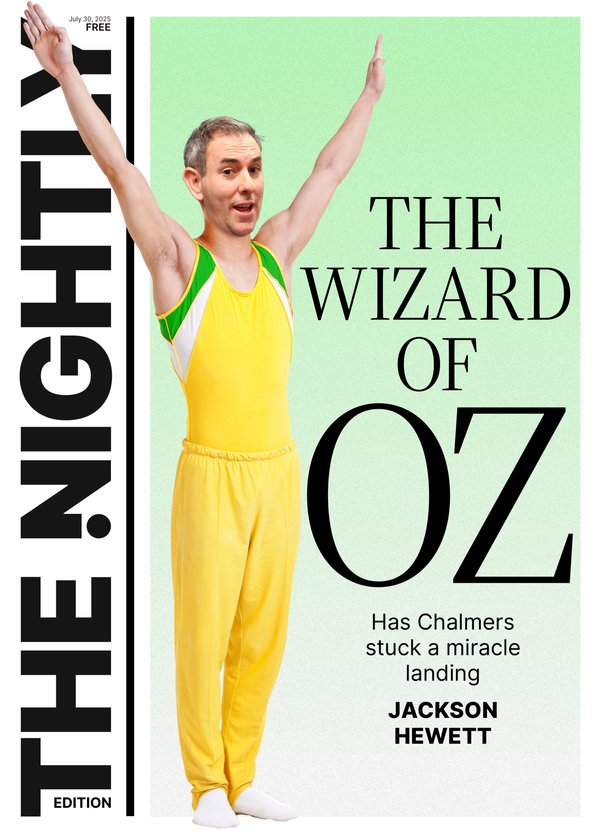

Mr Chalmers told delegates at the Pacific Banking Forum in Brisbane “you can bank on us” as the Federal Government works to build influence in the neighbourhood amid the rise of China.

The cash comes as $2 billion is promised to be pumped into the region in development assistance this year.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The Tuesday announcement will fund three programs.

The World Bank will get $2.9m to develop digital identity infrastructure for the region.

The Asian Development Bank will be funded to level up compliance with anti‑money laundering and counter‑terrorism financing rules and the Commonwealth Attorney-General will get cash to support law enforcement in the region.

Mr Chalmers said the Government wanted to “arrest the decline” of financial services in the Pacific.

Australia has worked with international partners to help build payments systems in Fiji, Papua New Guinea, Samoa, Solomon Islands and Vanuatu, he said.

The forum has focused on correspondent banking — where institutions provide links to other banks, particularly overseas — highlighting how a strong financial system is crucial for economic growth.

“We know the Pacific has seen the fastest withdrawal of correspondent banking services of any region in the world,” he said in Brisbane.

“We know these vital services help communities to access foreign currencies and international payment systems.

“And we also know that without them, large parts of the Pacific risk being cut off from the global financial system.”

Earlier this week, US Secretary of the Treasury Janet Yellen also talked up international support for the Pacific.

She said correspondent banking created opportunities “for everyday people”, promoted competition in the sector and facilitated trade.

“The United States is committed to an Indo-Pacific that is free and open, connected, prosperous, secure, and resilient,” she said.

ANZ chief executive Shayne Elliott said correspondent banking relationships in the Pacific Islands had fallen by about 60 per cent in the past 11 years.

The big four bank exited American Samoa and Guam in 2022. But Mr Elliott talked up ANZ’s services to the region, facilitating almost a quarter of all payments into the Pacific.

He said banks found it tough to build scale in the Pacific Islands and battled high costs in a time when returns were falling.

“Few banks have an appetite to get financial crime wrong and we have seen higher due diligence and expectations from correspondent banks across the globe,” Mr Elliott said.

“These two pressures mean that high-cost and high-risk countries that don’t offer scale have become less attractive for banks to serve.”