Ex-rental listings in Victoria have soared. Should we be concerned?

The number of ex-rental property listings in Victoria has significantly increased in the past year, a new data analysis shows, with some experts saying investors are exiting the state due to land-tax changes.

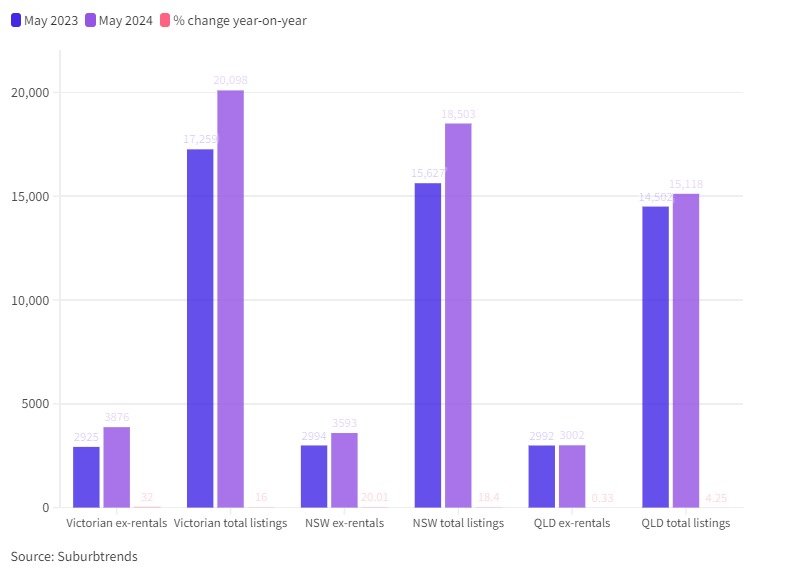

Victoria saw a 32 per cent surge in ex-rental listings in May this year compared to a year ago — the largest increase of any state - an analysis of data from Suburbtrends showed.

The number of former rentals listed for sale grew from just below 3000 to about 3900 across the state.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Suburbtrends founder Kent Lardner said the total number of listings also rose, albeit not by as much.

He said it was more telling to compare the percentage of ex-rentals with total listings, as well as figures on new investor loans, to get a clearer picture of investor activity.

“I don’t see anything alarming in the trends,’ Mr Lardner said.

Investor loans on the rise

“This is due to the trend in recent months for investor loans increasing.

“As a general guide, I mainly notice when the percentages of ex-rentals rise above the rental tenure, which is usually about the 30 per cent mark,” Mr Lardner said.

Victoria’s former rental listings made up just over 19 per cent of all listings in May this year, and though that was more than the 16 per cent at the same time last year, it was not a cause for concern, Mr Lardner said.

“I also have a view that on average, about 30 per cent of purchasers are investors, creating the rental-recycling process,” he said.

New investor loans in Victoria had been steadily increasing since January - when the changes to land tax for investors were introduced according to ABS Data, he said.

The investor loan data was only current to April, but it showed there were about 800 more investor loans in April this year than in the same period last year - representing a 25 per cent increase.

National changes

However, in other states such as Queensland and Western Australia, investor loans were up by between 1000 and 1500 for the year — representing increases of 52 and 70 per cent.

Ray White head of research Vanessa Rader said Victoria’s slow house price growth in the past couple of years coupled with recent regulations for landlords meant investors were beginning to look at other states.

“The inclusion of compulsory land tax this year and additional regulatory costs for landlords such as mandatory bi-annual electric safety checks are all adding to the expense of owning an investment property in Victoria,” Ms Rader said.

“With these costs less in other states and the expectations surrounding rental growth and capital value growth greater in those states, owners are looking closely at alternative investment opportunities.”

Mr Lardner said though QLD and WA were seeing growth in their investor markets, they were potentially riskier than Melbourne and Victoria, as their housing markets were more cyclical due to fluctuations in mining and infrastructure projects, which attracted people to the states.

“Closer to what I am hearing on the ground, many investors are chasing houses under $750,000 and yields over 4 per cent,” Mr Lardner said.

Lower risk

“Victoria offers up plenty of suburbs that meet that selection criteria.

“In fact, many investors are heading into what I think are much riskier markets than Victoria and Melbourne right now under the belief they can get quick capital growth and ignoring the risks.

“There is a lot to like about Victoria as a housing market.”

This article first appeared at view.com.au.

Originally published on view.com.au