First home buyer rentvesters on the rise as they step into the housing market

Property investors are charging back into the market, led by Millennials and an expanding cohort of first home buyers choosing to rent out their new property and live somewhere else.

Property investors are charging back into the market, led by Millennials an expanding cohort of first home buyers choosing to rent out their new property and live somewhere else — a growing trend known as ‘rentvesting’.

“Investor lending growth continued to outpace the growth of owner-occupiers in June,” said Mish Tan, ABS head of finance statistics.

“The total value of new investor loans was 30.2 per cent higher compared to a year ago, while for owner-occupiers it was 13.2 per cent.”

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Tan said the return of investors, deterred by rising interest rates through the 2023 financial year, has been led by NSW, Queensland and Western Australia.

Dr Michael Baumannn, Executive General Manager Home Buying at CommBank, says 46 per cent of new investor loans in 2023 were to Millennials followed by their predecessors Gen X at 37 per cent.

Baumann said rentvesting is a common theme.

“What we continue to see from many Aussies is the inclination to ‘rentvest’, buying property where they can afford and then renting where they wish to live,” he said.

“Rentvesting gives Australians a chance to get their foot on the property ladder sooner rather than later and purchase a property in a lower cost area without having to give up the lifestyle they have become accustomed to while renting.”

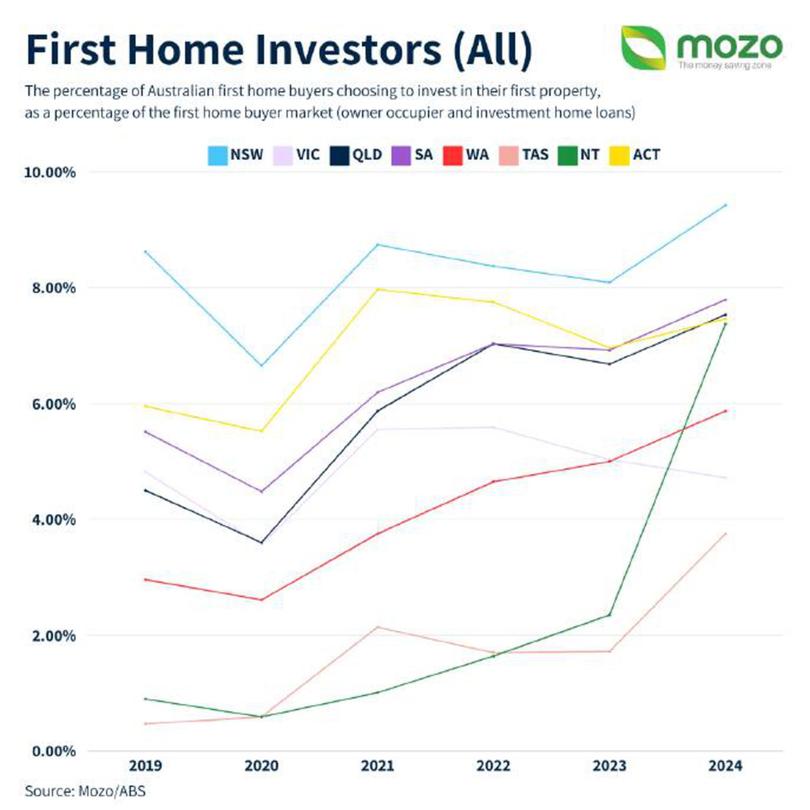

Analysis by financial comparison platform Mozo reveals the number of first home buyers renting out their property has risen 25 per cent since 2019 and now represents around seven per cent of the market.

“The data highlights a growing trend among first home buyers to invest as a strategy to enter the market, amid high property prices and borrowing costs,” said Rachel Wastell from Mozo.

Dr James Graham, a senior economics lecturer at the University of Sydney, says people considering rentvesting should weigh up the substantial costs and risks of property investment against owner occupation.

“Property investors face capital gains tax on the proceeds of property sales, unlike those selling their primary residence,” said Dr Graham.

“Banks also typically charge higher interest rates on mortgages to investors (and) highly leveraged properties require mortgage insurance too.

“Additionally, they need to carefully consider the alternative: simply buying their first home up front.”

Kelly Kennedy, Financial Advisor and Director at BDO, said higher interest rates have made rentvesting more difficult but the strategy can still be worthwhile if the rental yield and capital growth potential are strong.

This story first appeared as First home buyer rentvesters on the rise as they step into the housing market