Interest rate cuts push house prices up in June with more increases to come

Home prices have risen again across Australia in June with experts predicting that future price hikes are expected throughout the year.

Nationally dwelling prices rose 0.6 per cent in June, marking a fifth straight month of growth according to property data company Cotality.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy."The first rate cut in February was a clear turning point for housing value trends," said Cotality Research Director, Tim Lawless.

"An additional cut in May, and growing certainty of more cuts later in the year have further fuelled positive housing sentiment, pushing values higher."

The national dwelling value now sits at $837,586.

The price rise was spread across both city and regional markets in Australia, with only Tasmania falling behind.

"It's pretty hard to find a region where values are not rising at the moment," Mr Lawless said.

Darwin saw the highest rise in prices with a 1.5 per cent rise in dwelling values in June.

Perth followed with 0.8 per cent, then Brisbane with a 0.7 per cent rise.

Sydney remains the most expensive city, with a 0.6 per cent rise in value bringing the median home price to $1.210 million.

Melbourne dwelling values rose by 0.5 per cent to a median of $796,952.

Regional home prices fell below growth levels of capital cities, for the second month running.

The regional market nationally saw home values rise by 0.5 per cent bringing the median value to $685,193.

Why the rise?

A fall in interest rates has now impacted prices.

"It's really clear that this is mostly about interest rates coming down," said Mr Lawless.

He expects a further rise in home values going forward.

"There is also a growing sense of some expectations that rates are going to be falling further, which tends to fuel housing demand, so I wouldn't be surprised if we do see prices continuing to rise, even accelerating further from here," Mr Lawless said.

Following a lower-than-expected inflation rate in May, released last week, Westpac and Commonwealth Bank changed their forecast for the next RBA interest rate cut to be in July.

Mr Lawless said he also felt this could be the case and said such a move would further influence house prices.

"It looks like we'll see a rate cut in July, maybe another one in August and another one later in the year.

"So I think we could have a cash rate of 3.1 per cent by the end of the year."

He said that was below the pre-pandemic 10-year average for the cash rate of around 2.6 per cent.

Other factors could also limit home prices going up significantly.

"It's fair to say there are still plenty of barriers to keep a lid on price growth like affordability, household debt and lending conditions."

Less homes for buyers to choose from

While interest rates are going down, the number of homes being put up for sale has gone down, causing more pressure on prices.

"The flow of new listings coming onto the market has been tracking below average for most of the year," Mr Lawless said.

"The national numbers are down about 17 per cent on the five-year average and about 6 per cent lower than a year ago."

"Vendors have been reluctant to put their property on the market, probably because selling conditions haven't been great up until recently.

What's ahead

Meanwhile, Australia could be looking at annual house price growth of around 12.7 per cent by mid-2026 - nearly double the current 7.0 per cent annual rate according to leading real estate group Ray White

Unit growth could accelerate from 5.2 per cent to 7.4 per cent annually said Ray White Group Chief Economist Nerida Conisbee.

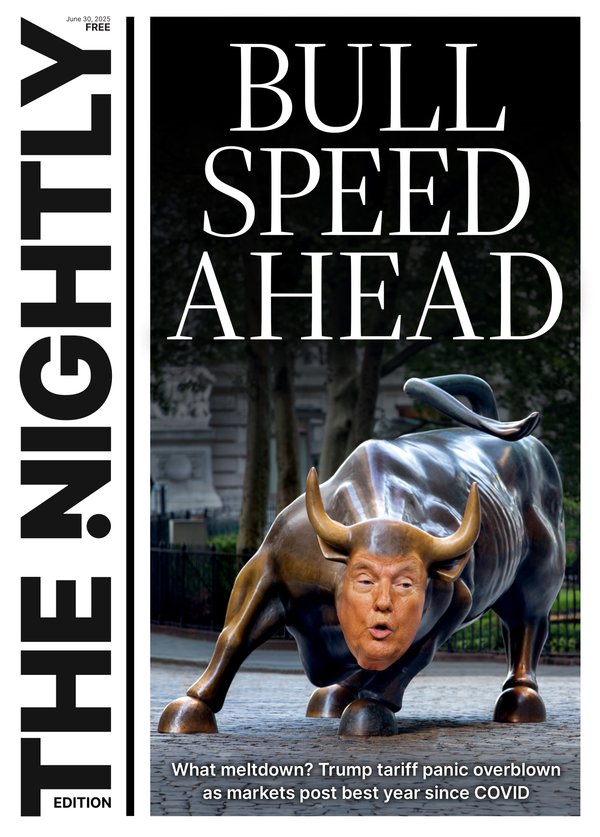

<img src="https://cue.wanews.com.au/webservice/thumbnail/article/19208292" id="_eba4f669-5cbf-459f-93f0-251d9c033ffe" alt="Not Supplied" caption=""Australia's housing market is now in a coordinated acceleration phase, with every single major market now exhibiting monthly growth rates," said Ray White senior economist Nerida Conisbee." credit="View">

That would push the national median house price from $941,000 to over $1.06 million within 12 months, representing a $119,000 increase.

The unit median would rise from $695,000 to $746,000, an increase of around $52,000.

"With further rate cuts expected to provide additional stimulus, this coordinated acceleration phase may well strengthen further," Ms Conisbee said.

"Australia's housing market is now in a coordinated acceleration phase, with every single major market now exhibiting monthly growth rates that signal significant momentum building across the nation."

Originally published as Interest rate cuts push house prices up in June with more increases to come