Investor loans: the latest cuts and why now may be the best time to secure one

Commonwealth Bank has slashed rates on some of its investor home loans for the third time in just over a month, a move that's reigniting competition in the investor mortgage space.

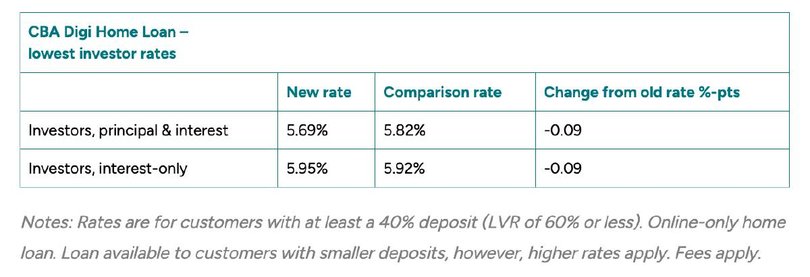

Following two cuts in May, CBA's latest round of rate cuts has trimmed its Digi Home Loan rates for new investor customers by between 0.07 and 0.12 percentage points.

The principal and interest (P&I) rate is now down to 5.69 per cent and the interest-only option to 5.95 per cent.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.

Cantsar believes CBA is sending a message to investors.

"CBA has trimmed its investment loan rate three times in the space of five weeks, while leaving its owner-occupier rate untouched," Canstar's data insights director Sally Tindall said.

"The bank is deliberately targeting property investors, particularly refinancers...it sends a clear message to investors that the door is wide open for their business."

CBA leads the pack in investor rate cuts

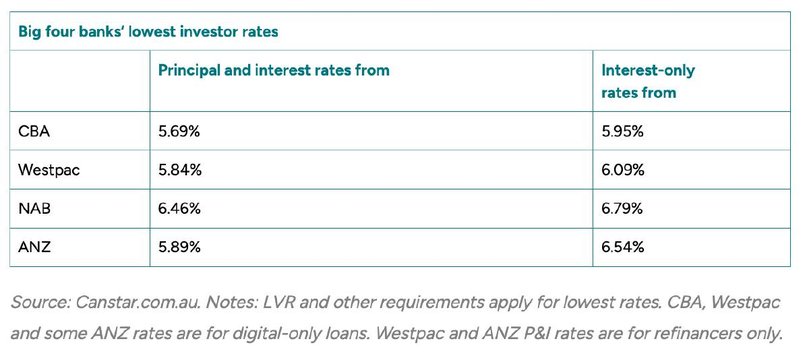

According to Canstar, CBA's investor rates were already the most competitive of the big four banks, with the current drop, more than the RBA's prescribed cuts, consolidating their position.

Their rates undercut Westpac (5.84 per cent P&I), ANZ (5.89 per cent P&I), and NAB (6.46 per cent P&I) on comparable digital or basic investor products.

This signals a deliberate shift from CBA, which holds the largest share of the home loan market at around 27 per cent, compared to Westpac's 22 per cent.

"It will be interesting to see if any of CBA's key competitors chase after it with investor rate cuts of their own," said Ms Tindall.

"Westpac is best placed to do this with a gap of just 15 basis points between the lowest investor rates from each bank.

"With variable rates likely to come down further, easing the pressure on borrowers across the country, we could see banks' appetite for investor loans increase."

Investor vs owner-occupier - the gap is closing

Since 2015, investor loans have carried higher interest rates than owner-occupier loans. But the latest CBA moves signals a market shift that is narrowing the gap.

"Right now, the gap between the average owner-occupier rate and the average investor rate is just 0.22 percentage points, however, this could get even narrower if competition continues to heat up," said Ms Tindall.

"However, banks aren't likely to be rolling out the red carpet to every borrower.

"They're going to want quality investments, ideally where the rental return is still strong and the owner has a good track record of paying their loan on time."

Previously, CBA's owner-occupier P&I Digi rate was 5.84 per cent, while the investor P&I rate was 6.03 per cent (as of early May).

After cuts, its investor loan is now 5.69 per cent, while the owner-occupier option remains around 5.84 per cent - meaning the gap has compressed to about 0.15 points.

According to RBA data, the average new investor is paying 0.22 percentage points more than the average owner-occupier, showing CBA's clear strategy to remain market leader in this space.

Why have investor loans historically been more expensive?

Mortgage broker Sheng Ye of Home Loan Experts said the roots of this pricing gap go back to regulatory changes a decade ago.

"Historically, banks offered similar rates for investment and owner-occupier home loans. However, in 2015, the Australian Prudential Regulation Authority (APRA) became concerned about the rapid growth of investment lending, particularly interest-only loans, fearing it could lead to instability in the housing market," he said.

"To mitigate this risk and rebalance their loan portfolios, banks were prompted to slow down investment lending, which led to an increase in interest rates for investment home loans."

Those restrictions have since eased, but the higher-risk perception of investment loans remains - especially among lenders concerned with repayment reliability.

Senior mortgage broker Jonathan Preston from Home Loan Experts agreed.

"I think the arrears rate is higher on investment loans, so banks charge more on a rate-for-risk basis," he said.

Is now a good time to lock in?

With the Reserve Bank still holding the cash rate steady, and signs of inflation are easing, some investors may be tempted to fix part or all of their mortgage.

But Mr Preston cautioned borrowers who might be planning to refinance in the near future to tread carefully.

"If someone has plans to regularly refinance, fixing might be risky, as you might get caught up with break costs," he said.

He also reminds property investors to stress-test their budget before diving in.

"Can you afford the mortgage for six months if the tenant doesn't pay and if the property needs major repairs?"

Once you've dotted your I's and crossed your T's, Ms Tindall sees now as a good opportunity, especially if you're happy to put in some work to find the best deal.

"If you've built up a decent deposit and have a solid rental return, now's a great time to shop around. There are competitive deals out there, but you've got to hunt them down to get them."

With interest rates appearing to stabilise and rental yields strong in many parts of Australia, now may be a rare window where investor loans offer real value.

CBA's latest cuts show the majors are starting to compete harder for investor borrowers - a group that has historically been sidelined by tighter regulations and higher costs.

Originally published as Investor loans: the latest cuts and why now may be the best time to secure one