Millennials like me are turning 40. So, why don't we own a house yet?

When my parents turned 40, I distinctly remember thinking they had officially become old. By then they, like many others, had bought properties, started a family and had built a solid financial foundation.

As an 'old millennial' with only a few more years in my thirties left, it struck me that I don't at all feel like the 'old' adult I thought I would be by now and how, in just one generation, so many 'norms' aren't in fact normal at all anymore.

Plenty of my friends moved to rent in bigger cities to chase income and job opportunities, many swapped human babies for the fur kind and I don't have a single friend that has a house with a picket fence in sight.

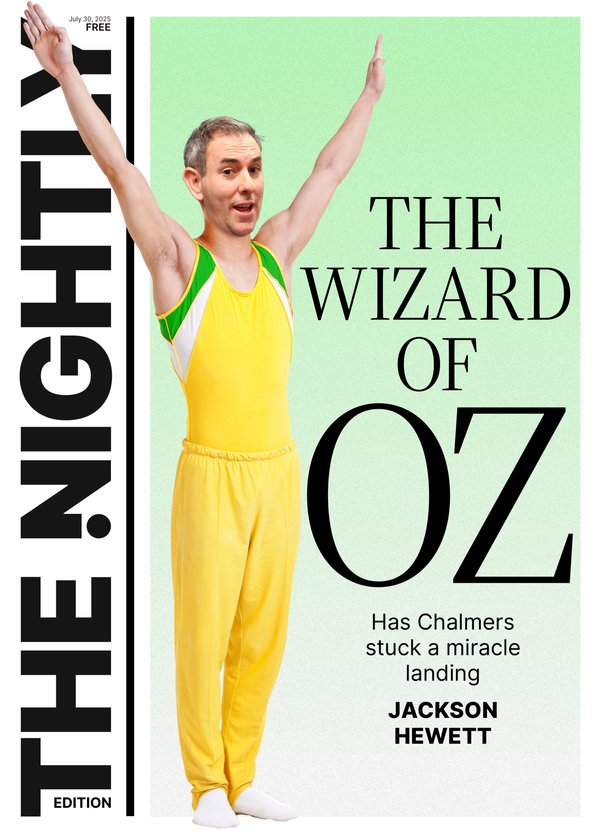

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Staring down the barrel of any significant birthday often forces us to confront what we expected life to look like vs. what it actually is. One of the common gripes for people my age is 'shouldn't I have bought a property by now?'. They are usually stressed and worried that they've left it too late. That maybe it's a dream that won't ever be a reality.

But Millennials are facing a very different property market than their parents did. According to the latest Cotality Home Value Index (June 2025), the national median dwelling price is now $837,586. In Sydney, it's over $1.21 million. In Brisbane, it's just over $926,000. That's a huge increase from only five years ago, with values up more than 75 percent in some cities like Brisbane and Perth.

Yet income hasn't kept up. ABS data shows the average Australian full-time salary was just under $103,000 in 2024. That means a typical home in Australia now costs more than eight times the average income. In contrast, homes in the 1980's and 1990's only cost around three to four times average income. The average age of a first home buyer is now 36 years old, it was 27 years old in the early 1990s.

Research from the Australian Institute of Health and Welfare shows home ownership levels peaked amongst Australians aged 40 to 44 in 1981 (77 per cent), and it has been tracking down since - with only 65 percent of people in that age band owning their home in 2021. That's before the last few years of significant house price increases.

With high cost of living pressures, slow wage growth and more recently large rent increases - more and more people in their late 30's are finding it hard to save up a deposit, especially single income households.

Even as interest rates edge down, affordability is still a problem. While the national median price only rose 0.6 percent in June, that still added nearly $6,300 to the cost of the average home in one month. And over the first half of 2025, the median value increased by around $22,749. That's an average increase of approximately $3,790 per month, most people cannot out save that level of growth in the market and manage day to day costs.

At the same time, home sales are slowing. Cotality's latest data shows housing turnover is tracking well below average, with 16.7 per cent less listings than the five-year average.

Less stock generally means one thing; more competition. More competition normally = prices increases. So where does that leave millennials turning 40?

Firstly, I've heard quite a few people of late say '40 is the new 30' and maybe they aren't wrong? All of the life milestones of generations gone by, are becoming ones that people are now doing later in life (if at all). It's important to remember that comparing yourself to the people around you, or what prior generations had achieved by your age, is rarely helpful.

If you're serious about getting on the ladder soon, you're going to need to sit down and map out a strategy that is realistic. Some people are exploring co-ownership models with friends or family. Others are getting their parents to go guarantor, or buying in regional areas or choosing to rent long term while investing elsewhere. The traditional path of buying a home is no longer a given.

For millennials, turning 40 might not look exactly like you thought it would, but the wisdom and resilience you've gained from life so far can be used to help you find new ways to move forward.

Jessica Brady is a qualified Financial Adviser and leading money expert. She is on a mission to educate and empower everyday Australians to be better with money through her online money programs and via the Financially Fierce Podcast. You can learn more at jessicabrady.com.au

This article is general advice only, all of the comments above do not take into account your objectives, financial situation or needs.

Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. Jessica is licenced through Paragem Pty Ltd - AFSL 297276. ABN 16 108 571 875, Authorised Representative Number 001259972.

Originally published as Millennials like me are turning 40. So, why don't we own a house yet?