New Aged Care laws keep parents home longer - but will it ease the housing crisis?

There is a quiet shift underway in how aged care will be delivered in Australia and it's going to change the way many older Australians live out their final years - whether in their own homes or through multigenerational living.

If you have elderly family members, now is the time to get across these changes and understand the implications.

Only weeks before its intended launch date of July 2025, the federal government's new Support at Home program was pushed back to 1 November 2025 to give providers more time to prepare.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.It is a key part of the government's aged care reforms and aims to improve how people access in-home care. This includes nursing and personal assistance, cleaning, medication support and home modifications.

On the surface, it is a win for independence. But look a little deeper and questions emerge about whether we are simply entrenching the current system.

One that already struggles to keep up with demand and often leaves families filling the gaps. One that will see higher costs for Aged Care services moving forward and, frankly, will continue to put pressure on an already tight housing market (a controversial, yet uncomfortable truth).

What is the Support at Home program?

Support at Home will replace several current aged care offerings, including the Home Care Packages and Short-Term Restorative Care, into one streamlined program. The idea is to simplify a fragmented system, speed up access to care, offer more flexibility and transparency in what people receive and pay for.

Key changes include:

- Increased funding for those with high care needs (up to $78,000 per year)

- A means-tested contribution model based on income and assets

- Greater access to equipment and home modifications

- A system that allows recipients to opt in and out of services more easily

For many, the appeal is clear - stay in the comfort of your own home and community for longer, while receiving the support you need.

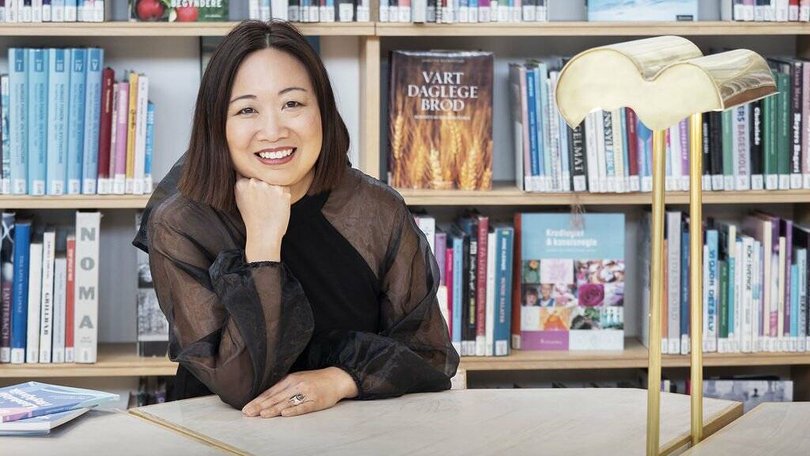

As Natalie Yan-Chatonsky, Founder of Full Time Lives and author of The Art of Full Time Living, explains, "Ageing-in-place can be an excellent option for older Australians who wish to stay in their longstanding homes and communities. Remaining in their familiar surroundings where they have established routines for their physical activities and connected social networks allows people to maintain their independence, reduce risk of loneliness and significantly improve their overall quality of life and wellbeing."

But the reality is more complicated

While the new system promises more support at home, there are concerns about whether that support will arrive on time and in full.

Delays to the rollout and long-standing backlogs mean there are tens of thousands of older Australian's currently waiting for services.

And as Yan-Chatonsky points out, there is a crucial caveat to ageing in place.

"If they choose to remain in their homes, they need to ensure it's modified to prevent falls. Particularly important since 6 out of 10 falls for older people happen at home. Good design means they don't have to sacrifice style for functionality."

For many, home maintenance becomes a burden - as mobility declines, people may go out less, withdraw socially, or struggle with daily tasks. This is often where families are often expected to step in. A role that can be emotionally, physically and financially taxing - especially if they do not live nearby.

And all of this is unfolding in a housing market already under immense pressure, with not enough supply of homes, let alone purpose-built aged care options to meet the needs of an ageing population, who want genuine independence and easy access to community and connection.

Nathan recently had to put an elderly family member into aged care stating: "Unfortunately, despite having access to some in-home support services, his dementia got to the point where we weren't confident he would be safe living alone at home. He also needed a lot of additional emotional support, most days included dozens of phone calls from him".

Nathan also acknowledged the heavy workload that wasn't fully covered by in-home support.

"Whilst support services were available, I found that because of the gaps and my other commitments of full-time work and young children, it unfortunately meant he had to move out of his home".

Navigating the complex aged care system was also something he was unprepared for.

"I was overwhelmed by the processes, all whilst I was trying to care for him," he said.

Nathan sought expert Aged Care Advice after receiving an unexpected $40,000 bill from the Aged Care home.

"Once I met with an Adviser it set a path for me, with a clear direction on what financial actions I needed to take and the implications for his RAD payments and continued support."

What about Residential Aged Care?

While Support at Home focuses on in-home support, there are also important financial changes coming to residential Aged Care from 1 November 2025. These changes relate to means testing and accommodation payments.

Kerri Mendl, Managing Adviser, Lifestyle and Care at Alteris, notes: "The means tested portion of the care fees is changing - which means more people will now pay the maximum co-contribution towards their cost of care. The maximum means tested fee under the current system is just over $34,000 a year / $82,000 lifetime, but now the maximum is almost $42,000 a year / $130,000 lifetime."

This shift affects those entering permanent residential aged care, where the cost of accommodation and care is split between the resident and government, based on a means test.

Currently, maximum payments are required if you have more than $2 million in assets, however the new threshold will be significantly reduced, anyone with over $1 million in assessable assets will be required to make the maximum payments - meaning many more people are likely to pay the maximum under the new reforms.

On top of that, new rules from 1 November 2025 will also introduce a retention amount on the Refundable Accommodation Deposit (RAD).

"New agreements from 1 November 2025 will introduce a retention amount. 2 percent of the RAD balance will be retained each year for the first five years," says Mendl.

That means a maximum of 10 percent could be withheld if someone stays in care for 5 years, which is a substantial change to consider when planning their estate or managing cashflow.

For those considering residential care soon, locking in the current arrangement and thresholds could have considerable financial benefits.

What families should do now

Whether your parents are fiercely independent, or starting to need more help, there is a strong case for having the uncomfortable conversation earlier rather than later.

Kerri suggests:

- Request an Aged Care Assessment, especially if there are changes in their health status

- At least annual reviews of assets recorded with Centrelink or Department of Veteran Affairs (or if you need to add, or remove assets)

- Confirm your family member has valid Enduring Power of Attorney and Guardianship documents (that you know where to find when needed!)

- Getting advice before downsizing or gifting assets, as these have consequences if within five years of care needs

She adds: "Care costs can be considerable when health declines, especially if you are paying these costs out of pocket and have missed out on accessing Support at Home care."

It's also worth reviewing whether their home is fit for ageing. Not just structurally, but emotionally. Are they isolated? Are the stairs, garden, or upkeep wearing them down? Could there be a better quality of life in a purpose-built environment with social support built in?

My own stubborn Grandfather will tell you he is much better at home - but I'm not sure that's true. He, like many, can no longer easily potter in the garden, or even brave the three small steps at his front door to get his own mail. His house is too large for his frail 97-year-old frame to manage. His days of being connected to his local community are too long gone, he barely even speaks to the neighbours now. All the reasons he's stated he wants to stay at home are no longer realities of his life. His self-imposed house arrest is one he is happy with, but how long can it last?

It can be emotionally taxing to try and figure out which option may suit a loved one best... There is emotional safety and security in the known for a person, but there can be real physical risks that can keep family members up at night.

Families are complex at the best of times, when the time comes to make big decisions for a family member, tensions and conflicts can flare fast.

If you need assistance weighing up the options, an Aged Care Specialist can help you understand the financial implications before any decisions are made.

A bigger question for the sector

While the reforms aim to buy time for the system to catch up, it is hard not to feel that we are still avoiding the real structural and funding issues needed to improve the sector at large. Aged Care professionals work tirelessly to provide the best care they can with the resources they have, but there is much work to be done. The Royal Commission into Aged Care made this clear.

Our system needs facilities and models that are dignified, community focused and future ready for our aging population. One that people would be delighted to have their family members enter into. One that improves health outcomes, social connection and longevity - so when a mischievous and stubborn elderly gentleman, like my Grandfather, is given the option to go into care - it's a decision that doesn't worry him financially and actually sees him reconnect with the world around him (without the worry of collecting mail).

I fear that even with these proposed changes, that is still a way off.

----------------------------------------------------------------------------------------------------------

Jessica Brady is a qualified Financial Adviser and leading money expert. She is on a mission to educate and empower everyday Australians to be better with money through her online money programs and via the Financially Fierce Podcast. You can learn more at jessicabrady.com.au

This article is general advice only, all of the comments above do not take into account your objectives, financial situation or needs.

Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. Jessica is licenced through Paragem Pty Ltd - AFSL 297276. ABN 16 108 571 875, Authorised Representative Number 001259972.

Originally published as New Aged Care laws keep parents home longer - but will it ease the housing crisis?