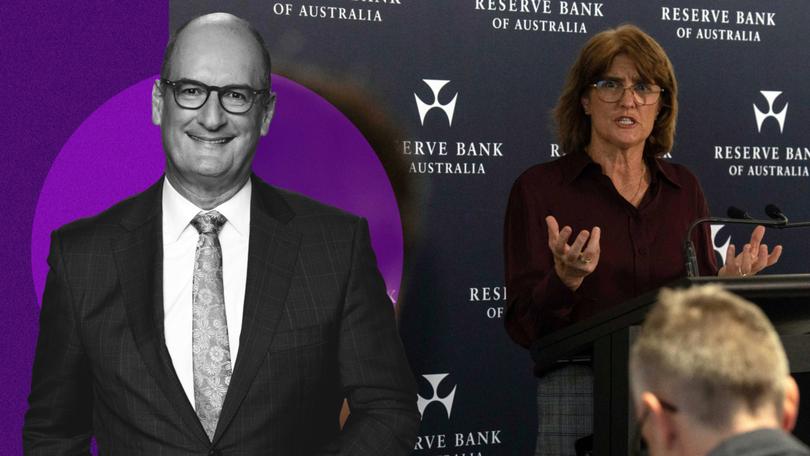

DAVID KOCH: Borrowers $18,000 worse off when RBA holds interest rates

DAVID KOCH: After hopes of an imminent rate cut were dashed thanks to stubbornly high inflation, mortgage-holders can expect the financial pain to continue.

Every time the Reserve Bank announces that interest rates are on hold, understand that means the average home borrower is $18,000 worse off than they were before rates started to rise.

That’s $18,000 in cold hard cash. After tax. You’d have to be earning at least an extra $25,000 a year in wages to just be financially standing still. That $18,000 in cash is why you can’t afford that family holiday, or the council rates, a new car or a regular night out at a restaurant.

And the RBA this week reinforced yet again that interest rates will stay at this level (or may even go up) until inflation gets down to their 2 to 3 per cent target band. So you’ll be having to do without that $18,000 in cash a year for some time to come.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.We’ve seen the cash rate climb from a historic low of just 0.1 per cent to its highest level since 2011 at 4.35 per cent. That means someone with an average loan of $610,000 has seen their interest rate increase from 2.2 per cent to 6.45 per cent and is now paying roughly $1500 more in monthly repayments, or about $18,000 a year.

If your home loan is higher than $610,000 then you’re down a lot more than $18,000 a year. On a million-dollar home loan, the increase in repayments has been over $31,000.

Yes, these higher interest rates are causing a lot of pain. But history tells us the current level of rates aren’t all that high and about average for these levels of inflation. The reality is, rates were arguably too low for too long and we took them for granted.

Many central banks lowered their official interest rates to near-zero levels to stimulate their economies during the pandemic and global financial crisis. If rates weren’t cut, and governments didn’t introduce rescue packages, the world could have suffered another great depression. No one ever wants that to happen again.

In March 2021, the then-governor of the Reserve Bank, Philip Lowe, told Australians that interest rates would very likely stay at the record low of 0.1 per cent until at least 2024. But he misled Australians and his forecast was horribly wrong.

What seemed like a good deal at the time has had all kinds of consequences.

Firstly, dropping the cash rate that low allowed many borrowers to enter the property market who otherwise wouldn’t have been in a position to do so.

Those who borrowed close to their maximum amount back then have since either had to sell or are just treading water because higher repayments have eroded away the 3 per cent serviceability buffer applied by most banks.

Figures from CoreLogic show a record 16 per cent of sales early this year were properties that had last changed hands less than three years ago, bought when interest rates were ultra-low.

According to SQM research, the number of residential properties sold under distressed conditions in Australia has risen to 256,000 — a 6.9 per cent increase. Thankfully property values have kept rising so hopefully those distressed sales made a profit.

This comes as Compare the Market research revealed almost a quarter of homeowners are worried they’ll have to sell, or have already sold, due to the rising cost of living. They’re asset-rich but cash poor. While values have risen, they simply don’t have the cash to meet rising repayments.

And it could get worse. The RBA actually considered a rate hike at the board meeting this week but decided against it. In more bad news for borrowers, money market investors are predicting a one-in-four chance of yet another rate rise by September this year.

Hopes of an imminent rate cut have been dashed by stubbornly high inflation.

After Tuesday’s RBA decision to keep rates on hold for the fifth straight time, economists are now 50:50 on whether we’ll even get a rate cut in December and believe it’s unlikely to happen until at least April next year.

According to RBA governor Michele Bullock, rates may have to stay high for even longer because of economic stimulus from State and Federal governments. Next month a bunch of energy relief subsidies kick in, as well as the stage three tax cuts.

While the RBA has been warning everyone needs to be tightening their financial belts to fight inflation, politicians have been splashing the cash with these energy subsidies and tax cuts to win voter support and be the good guys.

The recent Federal Budget forecasted a series of deficits over the next couple of years. In other words, the Government will be spending more than they’re earning and adding to Government debt: completely the opposite of what we’re being asked to do with our household budgets.

You sense that Bullock is fed up with doing the heavy lifting in the inflation fight and is ready to call out the actions of Government.