DAVID KOCH: Interest rate pressure is horrible for average Australians. But the rate rises are working for us

DAVID KOCH: It is awful that average Aussies are being squeezed by interest rate rises. But to keep it in perspective, the current cash rate of 4.35 per cent is not far above the average of the last 35 years.

Don’t count on interest rate cuts anytime soon. The March quarter inflation figure this week was a setback. Higher than expected, which means any possible cut in interest rates is a long way down the track. I reckon we’ll be lucky to get a cut this calendar year.

The Reserve Bank looks at the “trimmed mean” figure (takes out any abnormal variations in the CPI basket) which rose a higher than expected 1 per cent for the quarter and 4 per cent annually. That is still well outside the RBA target range of 2-3 per cent and is even above the 3.5 per cent that the RBA had in its forecasts.

Reserve Bank governor Michele Bullock has been talking about the “stickiness” of inflation and that it wasn’t coming down fast enough. This is exactly what she was fearing. That last drop in inflation to within the 2-3 per cent target range would take longer than people expected.

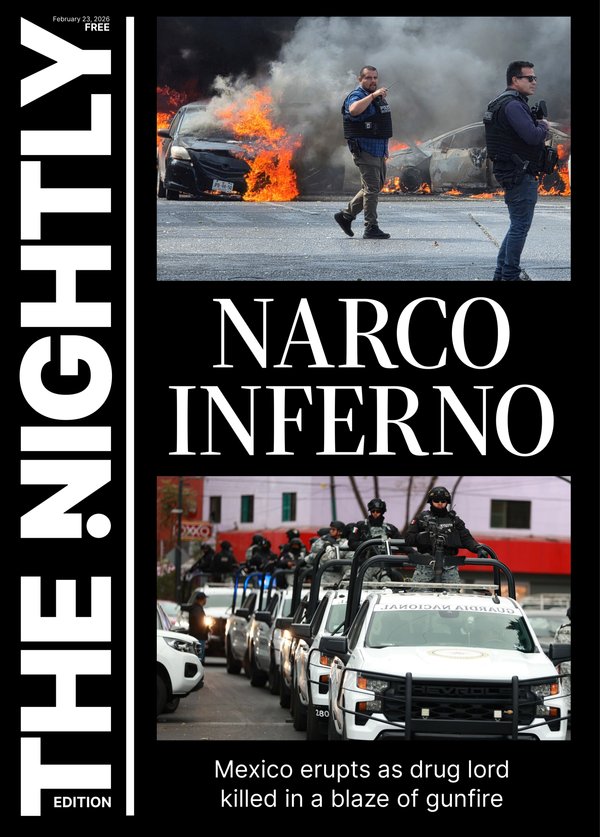

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.That means the RBA won’t cut interest rates anytime soon and some are even expecting another rate hike as a knockout blow for inflation.

The annoying thing is the inflation rise is being driven by factors beyond our control. Consumers are doing the right thing and tightening their belts to slow price increases on discretionary items like clothing, footwear, household goods and travel.

But the big price rises are on essential non-discretionary items beyond our control. The biggest drivers of inflation are:

- Rents, because of a shortage of available rental properties to cope with the influx of international students and migrants. Ask the Federal Government why they didn’t plan better;

- Secondary education. Basically rising private school fees which are well above inflation. So go and complain to your school council and ask why you are being ripped off;

- Health services and pharmaceuticals. Healthcare costs have always been a financial black hole as treatment costs and drugs keep getting more expensive. Our healthcare system seems to be hostage to pharmaceutical and medical equipment companies making huge profits;

- New dwelling construction costs. Building a new home has been hit by shortages of labour, materials and availability of land. As a result, all those costs have skyrocketed. Building approvals are at a 10-year low which, combined with high immigration, means these costs don’t look like slowing for some time;

- Vegetables. Unfortunately, mother nature plays a big role here with prices affected by seasonal factors and the weather;

- Insurance premiums and other financial services. Premium rises are extortionate. A year ago we were told it was because of natural disasters but this last summer was comparatively quiet when it came to bushfires and floods. The key here is never automatically renew your policies before comparing the market to see if there are better deals available.

Until these key inflation drivers are brought under control it is going to be tough to get down to the RBA’s 2-3 per cent target range and therefore bring interest rates down.

It is absolutely horrible that average Australians are being squeezed by the recent rise in interest rates and that so many small businesses have been sent to the wall because of the impact of those rate rises. Throw in high inflation as well and it has been a devastating combination.

But to keep it in perspective, the current cash rate of 4.35 per cent is not that far above the average of the last 35 years.

History tells us that the average official cash rate in Australia from 1990 to today has been 3.85 per cent. That’s 0.5 per cent below the current cash rate. Over that period the cash rate has ranged from the all-time high of 17.5 per cent in January 1990 to the all-time low of 0.1 per cent in November 2020.

The reason Aussies feel like they’ve been hit with a financial sledgehammer is that we’ve come off those all-time low rates and had to cope with the sharpest, fastest rise in rates back up to the current level which is only slightly above normal.

It has been a shock and brought enormous hardship.

But those record-low pandemic interest rates have skewed our perspective on rates. It has lured us all into a false expectation that we should be able to get back to those days of cheap money.

Frankly, I hope we don’t. It’s a fool’s paradise.

Low interest rates are used to stimulate a sick economy. They dropped to 0.1 per cent during the pandemic because Australia and the rest of the world had to be locked down. Economies were decimated.

Without low interest rates and huge Government support (JobKeeper and JobSeeker) we would have been in an economic depression.

Thankfully the economy has now recovered. Economic growth is slow but steady interest rates are appropriate for this inflationary environment.