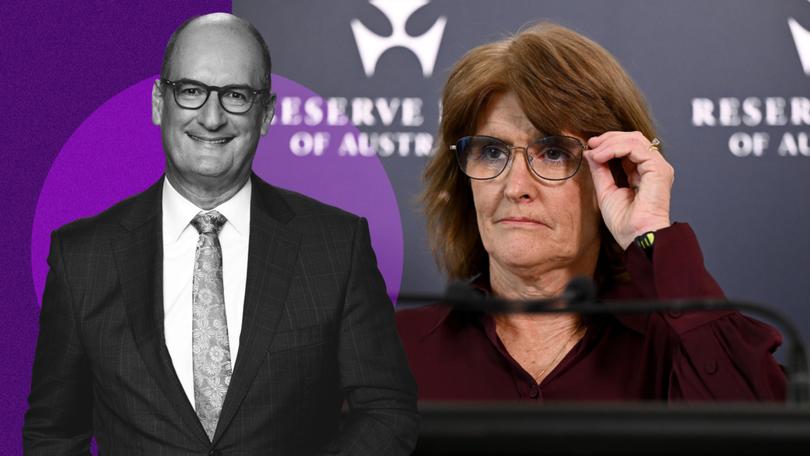

DAVID KOCH: Why unemployment rates could prevent an interest rate rise from the Reserve Bank

DAVID KOCH: While we’ve all focused on interest rates fighting inflation, we’ve ignored one critical factor.

History tells us that the last economic indicator to shift in a downturn is employment. My fear is that we are at that tipping right point now.

And history tells us that when employment turns, it does so quickly and surprises everyone.

The boss of the US Federal Reserve, Jerome Powell, made the point in his Senate testimony this week that while the Fed still remains vigilant about inflation, his fear is that the economy and employment is “cooling” fast. He talked about the “two-sided” risk to the economy of inflation and a deteriorating jobs market.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.I reckon Reserve Bank governor Michele Bullock, is on exactly the same page as the Fed chairman. Powell made the point to the US Senate committee that the timing of rate cuts is critical. Leaving it too long runs the risk of a sharp spike in unemployment which will be hard to turn around.

The Reserve Bank’s charter is to fight inflation and preserve full employment. While we’ve all focused on interest rates fighting inflation, we’ve ignored the impact on employment.

I think employment is very much on the mind of the RBA which is why I think they’ll be reluctant to increase interest rates at their next board meeting despite the surprise rise in the May CPI figure.

The all-important June quarter CPI is released before that next RBA board meeting and will obviously play a role in their decision as well. The worry about employment will certainly have to be balanced against any CPI result.

Australia’s unemployment rate is a very low 4 per cent. But the official figures just don’t seem to match the reality.

Business insolvency figures are spiking toward new records. The media seems to have a daily focus on prominent restaurants/cafes/bakeries that are closing. I walk through a major shopping centre on my way from the office to the gym and am amazed at how many shops have closed and sit dark with “for lease” signs plastered across the windows. I’ve been supporting a small online cocktail business since they started three years ago. I received an email this morning that they’re closing.

Then, at the big end of town Telstra, the big banks, mining companies and media empires have been announcing mass redundancies.

That 4 per cent unemployment rate just doesn’t seem believable. Particularly when we’ve soaked up record levels of migration over the last year.

There is no doubt the economy has been slowing but many of the economic indicators have been buoyed by the 500,000 new customers who have settled here through migration and international students.

It’s important to understand there is always a gap between being retrenched and being able to apply for JobSeeker (unemployment) benefits and be included in the official statistics.

First of all, there’s the “liquid assets” waiting period which applies if you and your partner have enough money to live on for a while held in, for example, bank accounts, financial investments and term deposits. Depending on how much money you have, the waiting period for eligibility for JobSeeker could vary from one to 13 weeks.

Then there’s the “income maintenance” period which applies if you left or lost your job and your employer paid you for sick leave, annual leave, termination of employment or a redundancy payment. You may not receive any income support payment for this period or you may receive a reduced rate.

Given these waiting periods you get a foreboding sense that there is a huge bulge of unemployed coming down the social security pipeline and about to hit the official numbers.

There is no doubt the economy has been slowing but many of the economic indicators have been buoyed by the 500,000 new customers who have settled here through migration and international students. Unfortunately, these new arrivals have become convenient political pawns, scapegoats for the housing crisis and the surge in property values and rents.

As a result, the Federal Government has vowed to cut migrant and student numbers. The reality is that the housing and rental crisis has been caused by a lack of new homes being built because of rising construction costs, building approvals at 10-year lows and a lack of new land being released.

This has meant Australians have been asset rich but cash poor as they fight rising interest rates, the cost of living crisis and the economic slowdown. They’ve coped so far because they’ve been running down their savings, their biggest asset (home) has been rising in value and they’ve had a job.

But that is all set to change as savings have run out and retrenchments are starting to pick up pace.

There are some worrying signs for the employment market. According to the huge employment platform, Seek, in June the number of jobs being advertised dropped 1.7 per cent and were down 17.1 per cent compared to the same month last year. The number of people applying for each vacant job rose 3 per cent in June.

The job market is deteriorating quickly and this is likely to force the RBA to rethink any rate rise in August and, depending how quickly the unemployment rate rises, could even bring forward interest rate cuts.