EDITORIAL: Inflation figures put an end to the fantasy of a rate cut before the end of the year

EDITORIAL: The Government had hoped that the electricity rebate would artificially lower the headline inflation figure, by pushing down the power component of CPI. Clearly, that hasn’t turned out as planned.

You can kiss goodbye any hopes of a rate cut before the end of the year.

Wednesday’s inflation figures put an end to that fantasy.

Data from the Australian Bureau of Statistics put inflation at 3.6 per cent in the year to April, meaning price growth has increased now two months in a row.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.It’s bad news for homeowners.

That much longed-for rate cut, which seemed tantalisingly close at the beginning of the year, is slipping from grasp.

It wasn’t supposed to be like this.

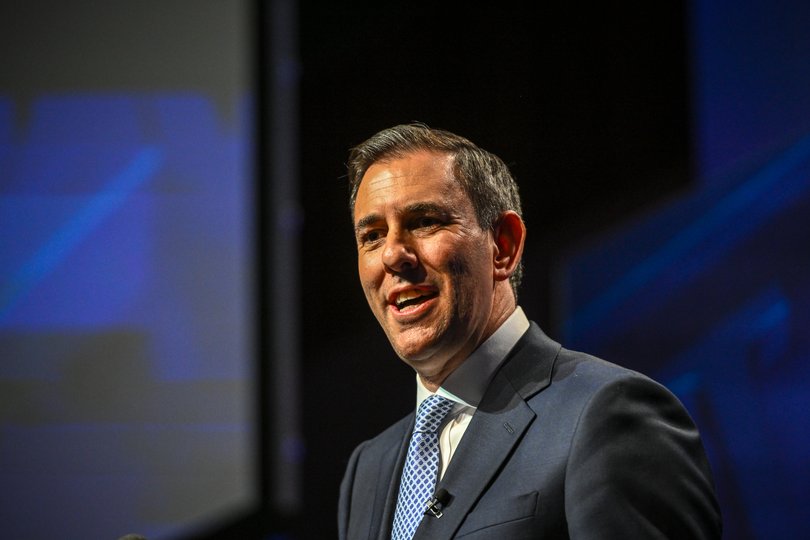

It was only a fortnight ago that Treasurer Jim Chalmers was spruiking fresh Treasury forecasts which predicted inflation would fall to 2.75 per cent — safely within the RBA’s target band of between 2 and 3 per cent — before the end of this year.

That was always a little optimistic.

Now it seems plain delusional.

Economists now believe the RBA is likely to hold the cash rate steady at 4.35 per cent until May 2025.

And if inflation continues to creep back up, there’s a chance that the RBA will even hike rates further.

“Inflation above target for longer will mean the RBA will be unable to lower interest rates any time soon,” Business Council of Australia chief economist Stephen Walters said.

“Further interest rate hikes are unlikely but, after (Wednesday’s) upside inflation surprise, no longer can be ruled out.”

Worryingly, the inflation bump has preceded billions in State and Federal government stimulus flowing to households.

All households will receive a $300 power rebate courtesy of the Commonwealth. States are also offering electricity bill relief — up to $1000 in Queensland.

As economists warned at the time of the Federal Budget, putting more money into householders’ pockets — ostensibly in the name of cost-of-living relief — could have a further inflationary effect.

The Government had hoped that the electricity rebate would artificially lower the headline inflation figure, by pushing down the power component of CPI. Clearly, that hasn’t turned out as planned.

Even if it did, it was a trick the RBA was never going to fall for.

It’s a case of a Government being too clever for its own good and it’s Australians who are paying the price.

Dr Chalmers was sticking to the script, downplaying the significance of the figures.

“As we’ve said many times the monthly inflation indicator can be volatile and is less reliable than the quarterly measure because it doesn’t compare the same goods and services month to month,” he said.

“We know there is more work to do in the fight against inflation because it is still too high and people are under pressure and that’s why the Budget had such a big focus on providing responsible cost-of-living relief.”

Families want rate relief. Not half-baked measures like a bit of Budget pocket money that does nothing but add to core inflation.