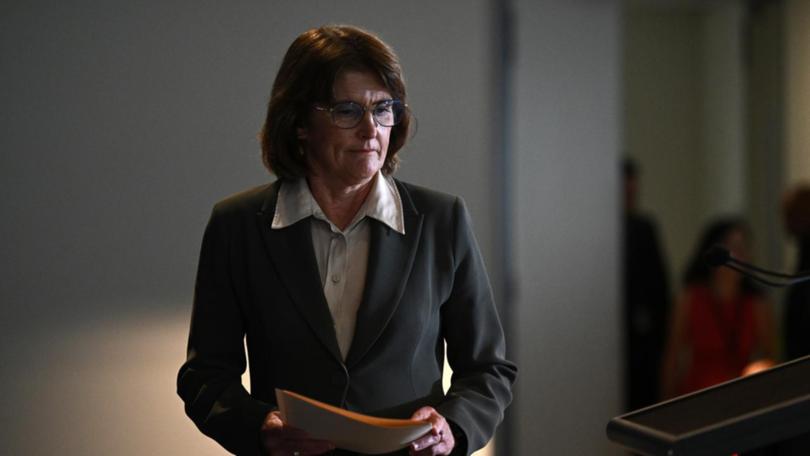

JACKSON HEWETT: Michele Bullock’s RBA is on high alert for global trade war

JACKSON HEWETT: The US President has everyone on tenterhooks, Australian mortgage holders included.

The Reserve Bank is on high alert for a global trade war.

In its decision to keep rates on hold, effectively on the eve of the Trump administration’s ‘Liberation Day’ the Bank devoted the longest section to concerns about the Donald.

“Uncertainty about the outlook abroad also remains significant,” the Bank stated, using the strongest language available to such a conservative institution.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“Recent announcements from the United States on tariffs are having an impact on confidence globally and this would likely be amplified if the scope of tariffs widens, or other countries take retaliatory measures.

“Geopolitical uncertainties are also pronounced. These developments are expected to have an adverse effect on global activity, particularly if households and firms delay expenditures pending greater clarity on the outlook.”

Mr Trump has everyone on tenterhooks, Australian mortgage holders included.

“The recent commentary from the Federal Reserve and other central banks is worth noting,” Governor Michele Bullock told the media. “They’re all conscious of the impact on global growth but uncertain about the medium term inflation implications. We’re not on our own in navigating this period.”

The good news, according to the Governor, is that Australia is “well positioned” to deal with the potential fallout.

“We have made good progress on bringing inflation down and keeping unemployment low,” she said.

But Ms Bullock revealed that the bank, which is “paid to worry”, was running through the scenarios of global trade upheaval “on steroids”.

The RBA is most closely watching how China responds.

It sees a number of scenarios, the first where China is forced to slow down, which would hit commodity prices and flow through to Australia’s growth. A fall in the dollar would offset some of that pain.

The other is where China “leans in” to a stimulus program which will “help us in the short run”.

The RBA’s other concern is inflation.

“The immediate impacts in terms of fragmentation, stopping of trade, increasing in price levels, they’ll all be felt. But I think the issue of longer run, the sorts of impacts this has is going to be quite dramatic,” Ms Bullock said.

“Countries that put on tariffs will experience rises in price levels to the extent that production now is going to take place domestically, possibly in less efficient industries, then that will impact supplies.”

Either way, the trade war will be detrimental for Australia, which has thrived under an open trading system.

A world trading system that that is fragmenting, that’s not good for us, she said.

Another rate cut not baked in

Most economists expect a cut in May, but Governor Bullock was keeping her cards close to her chest.

Recent economic data, including a sharp drop in employment in February, and inflation data that showed it falling to its lowest level in three years, hadn’t moved the RBA, yet.

“We’re gradually getting more confidence but we don’t have 100 per cent confidence” in the path to the getting inflation back to 2.5 per cent.

The RBA saw the labour market as still too tight at 4.1 per cent unemployment, even as others are forecasting it is weaker than expected.

“A number of things for us indicated (labour is) still tight, including liaison from businesses, survey measures that come from businesses, also vacancies, job ads. We are alert to the fact that it might not be quite as tight as that, and we can sustain an unemployment rate down around these levels without adding to inflation pressure. But we are still alert to the possibility that it might still be a little bit tight, and that might put wages, wages under upward pressure, and hence inflation,” she said.

Ms Bullock noted an issue raised by The Nightly yesterday that the forecasts for wages in the Budget required a significant lift in productivity despite years where it had gone backwards.

The Budget is relying on wages rising by over 3 per cent in the next four years, while inflation stays static at 2.5 per cent.

To do that, productivity needs to dramatically improve. If it doesn’t Ms Bullock said, it would cause inflation, which would force the RBA to slow the economy down by hiking rates and slowing wage growth.

“Over the trend, you need nominal wage rises that will deliver you the inflation target 2.5 per cent, which is what we’re aiming at. And if you don’t have any productivity, then naturally you can only have lower wage rises,” Ms Bullock said.

If the country wants to get living standards back up again, that means solving that productivity puzzle.