JACKSON HEWETT: Why tomorrow’s RBA rate cut predictions could be premature

JACKSON HEWETT: As Labor, banks and borrowers clamour for long-awaited rate relief, one economist is warning that the current data points to a different course of action.

The clamour for a rate cut has become deafening.

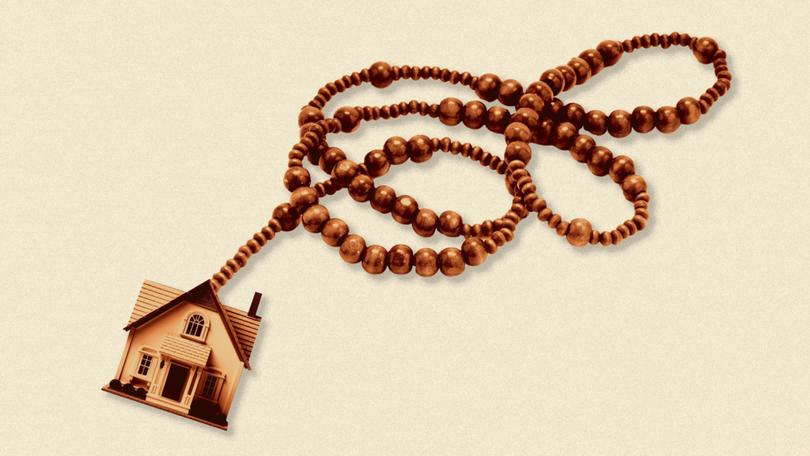

Stretched mortgage holders want it, the market is predicting it and Labor’s future is hanging on it.

Junior minister Matt Thistlethwaite said mortgage holders deserve it, Tanya Plibersek said they were hoping for it. Not that they are trying to influence the Reserve Bank board members as they headed into Martin Place this morning.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Treasurer Jim Chalmers certainly wouldn’t want to do that.

“I have a lot of respect for the independence of the Reserve Bank, its Governor and its Board, and that’s why I don’t engage in a running commentary about their deliberations which are under way right now. I’m not going to make predictions or pre-empt the outcome of their discussions,” Dr Chalmers told reporters today.

The Treasurer has been very cautious not to get ahead of himself cheering his economic policy, regularly telling the media that the cost of living fight is not “mission accomplished”.

He needs the RBA to do that.

If the RBA comes through with a cut then that will signal to voters that the inflation that has bedevilled every Western country since the pandemic is no longer a concern.

If the Bank holds the collective groan from stretched mortgage holders, who have been sitting on the highest interest rate in 13 years, will reverberate down the corridors of Parliament house.

Careful what you wish for

Inflation has been falling back to target. The trimmed mean, with distortions like the Government’s energy rebates stripped out, is easing back to the top of the RBA’s band of two to three per cent at 3.2 per cent.

Last quarter’s better than expected inflation figures had all the major bank economists, as well as bond traders, forecasting a rate cut of 0.25 per cent tomorrow.

But Warren Hogan, chief economic adviser to Judo Bank and managing director of EQ economics, believes a herd mentality has taken hold.

His view is the current data does not support a rate cut and that analysts have convinced themselves that the clamour for rate cuts by the government and voters has clouded their views.

“We haven’t seen inflation for generations,” he said. “I just think that the majority of economists aren’t taking in a broad enough assessment of the economy and the risks.”

Mr Hogan worries that the RBA board is considering cutting rates at a time when unemployment is at record lows, business confidence is rising and consumer spending is going up.

Not only is unemployment at record lows but labour productivity - a core consideration of inflation expectations - is going in the wrong direction.

He said wages adjusted for productivity, which affects the cost of businesses and therefore pricing, are growing at faster than four per cent and well above the long-term average of 2.7 per cent.

“Labour is the biggest cost in the economy,” Mr Hogan said.

He points to Canada and New Zealand, who currently have higher interest rates than Australia, as examples where rate cutting has been appropriate, given their unemployment rates have been rising.

“Their unemployment rate has not only been rising for almost two years, but it is well above the level of 2018/19 pre-pandemic,” he said.

Mr Hogan believes that Australia is already through the slowdown that likely peaked mid-year last year, and says the RBA should hold the line.

“This soft landing is in the rear vision mirror, and we’re now seeing a pickup. It’s that pick up in activity which will push the economy against its capacity that will create inflation down the track.”

The composition of the pickup is different this time, Mr Hogan said, and was being driven by business investment, with business lending up 10 per cent for the year.

“This is an investment-led economy, whether it be infrastructure, whether it be businesses,” he said.

The big banks are certainly keen to see a rate cut impact.

After a year of flat returns, the country’s major financial institutions are looking for green shoots.

In announcing profit of $1.7 billion for the quarter — up three per cent after extraordinary items — Westpac boss Anthony Miller turned his eye to the future. One that requires a shift in interest rates.

“Encouragingly, inflation has eased, and we could see the Reserve Bank of Australia reduce the cash rate as early as tomorrow,” Mr Miller said. “This should provide some relief to households and, over time, support business activity.”

That echoed a similar stance from CommBank’s Matt Comyn last week, who said a dip in interest rates “should provide some relief to many households and improve business confidence.”

With housing affordability at record lows, the banks aren’t getting too excited about rate cuts fomenting a house price revival however. Instead banks turning their guns to the business lending market, with Westpac recently significantly beefing up its team of business bankers.

A 0.25 per cent interest rate cut, assuming it is fully passed through, would mean an extra $98 per month in the pocket of a homeowner with an average-sized mortgage of $640,000.

That’s hardly enough to encourage a home-buying frenzy, particularly with the cost to service a mortgage at an all-time high. But spread that $98 over the 3.2 million mortgages in the country however, and that’s $3.7 billion of extra dosh sloshing around the economy annually. Add to that the stage three tax cuts and it should be no surprise that the banks are so focused on how that flows through to businesses.

As the RBA runs through its deliberations tonight and tomorrow morning, it will have the nation on tenterhooks.

Markets have a cut as a shoe-in but the data is more line ball.

No-one will be watching more closely than the nation’s politician’s who know this election is on a knife-edge.