Tim Wilson makes Jim Chalmers’ super tax take his first order of business on parliamentary return

Jim Chalmers’ Division 296 policy received relatively little attention during the election campaign. But finance experts are warning that it could upend Australia’s investment landscape.

Newly elected member for Goldstein, Tim Wilson, has declared that Labor’s proposed tax on unrealised capital gains in superannuation will be one of his first priorities in Parliament following his return.

Widely credited with helping turn the tide against Bill Shorten’s electoral momentum in 2019 by mobilising self-funded retirees against a proposed tax on franking credits, Mr Wilson is preparing to take up the cudgel again.

“I’ll be fighting against it straight away,” Mr Wilson told The Nightly.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Labor has confirmed it will proceed with its controversial Division 296 policy, which imposes an additional 15 per cent tax on earnings from the portion of an individual’s superannuation balance that exceeds $3 million. Combined with the existing 15 per cent tax on super earnings, the effective tax rate on earnings above the threshold rises to 30 per cent.

As part of the policy, tax will also apply to unrealised capital gains – meaning increases in asset values that have not been sold.

Taxing unrealised gains has been described as “insane” by leading members of the investment community.

Ryan Stokes, chief executive of conglomerate SGH Group, called it a “terrible policy framework” that risks distorting markets.

The policy received relatively little attention during the election campaign, as voters focused more on cost-of-living pressures than future investment returns.

Superannuation balances above $3 million are held in only a small fraction of the 17 million superannuation accounts. According to the Association of Superannuation Funds of Australia, the median balance for men is $205,385, and $153,685 for women aged 60–64.

However, the $3 million cap is not indexed to inflation, prompting warnings that younger workers could eventually be caught by the tax.

AMP economist Diana Mousina noted that a 22-year-old on average full-time wages, experiencing typical wage growth and investment returns, would likely breach the cap before they hit retirement.

“Do you think that the proposed $3 million superannuation cap tax won’t impact you because the Labor government said it only impacts 0.5 per cent of people now? Think again!” Ms Mousina wrote on LinkedIn.

While the indexation of the threshold is one issue, the inclusion of unrealised gains has emerged as the key point of contention, drawing opposition from independent Senators David Pocock, Tammy Tyrrell, and Jacqui Lambie.

The bill had been stuck in the Senate but with a larger mandate, Labor would now require support from the Greens to pass the legislation. The Greens support the policy but want the threshold lowered to $2 million — while also calling for the cap to be indexed.

The Greens’ proposal would index the cap to inflation, but wouldn’t account for the average 7 per cent growth in asset values.

Mark Humphery-Jenner, Associate Professor of Finance at UNSW Business School, described Division 296 as “one of the most pernicious taxes considered in Australia.”

“Jim Chalmers has spun this as a small tax that would only impact very wealthy Australians. However, when you actually dig into the mechanics, it is designed to impact all Australians, is retroactive in effect, and sets a dangerous precedent.

“Extremely troubling is the precedent of placing a tax on unrealised capital gains. Once the precedent is set, why would one believe that the Government would not subsequently salami slice the policy into other areas?” he said.

Dr Humphery-Jenner said the policy could easily trap investors in start-ups who might be forced to sell assets to pay for gains that only exist on paper.

“Suppose an investor has devoted part of their portfolio to early-stage start-ups. Now suppose one of them were Canva, which is not listed. An investor in Canva cannot easily liquidate their holdings but, under Div 296, the unrealised gains on Canva would be deemed to be ‘earnings’ and taxed at 30 per cent. How then is this supposed to be paid?” he said.

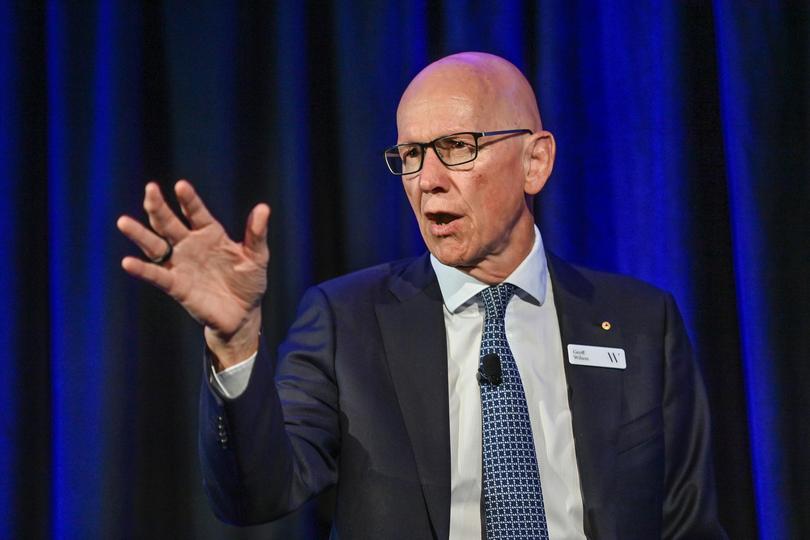

Geoff Wilson, founder of Wilson Asset Management — who previously led opposition to Shorten’s franking credit changes — warned the tax could upend the investment landscape.

Mr Wilson, whose shareholder register includes 130,000 mostly self-funded retirees, said many would be forced to move assets out of super and into other investments.

“We estimate $155 billion will come out of super and go into the housing market,” he said.

“Whatever additional money those self-funded retirees have above $3 million, they’re going to pull that out and they’re either going to put it in their own home or give it to their children or grandchildren to buy their principal residence, because there’s no tax on that.”

Mr Wilson said that of the hundreds of shareholders he had spoken to, “not one was concerned about paying the additional tax,” but they were deeply concerned about taxing unrealised gains.

“They understand that their investments can go up and fall significantly, but if you’re paying a tax on a gain you may never realise, that’s completely illogical,” he said.

Robert Breunig, director of the Tax and Transfer Policy Institute at ANU’s Crawford School of Public Policy, described the policy as “just strange, because we don’t do that anywhere else in our tax system.”

He said it failed the simplicity test by imposing inconsistent burdens across taxpayers.

A better approach, Professor Breunig said, would be to cap the amount of money allowed in super at $3 million and index it.

“Then you say to people, ‘You can save as much as you want, but you can’t do it through this vehicle.’

“That would be easier than trying to tax unrealised gains,” he said.