Debit card surcharge: Federal Government looks to ban charge to ease cost-of-living pressures

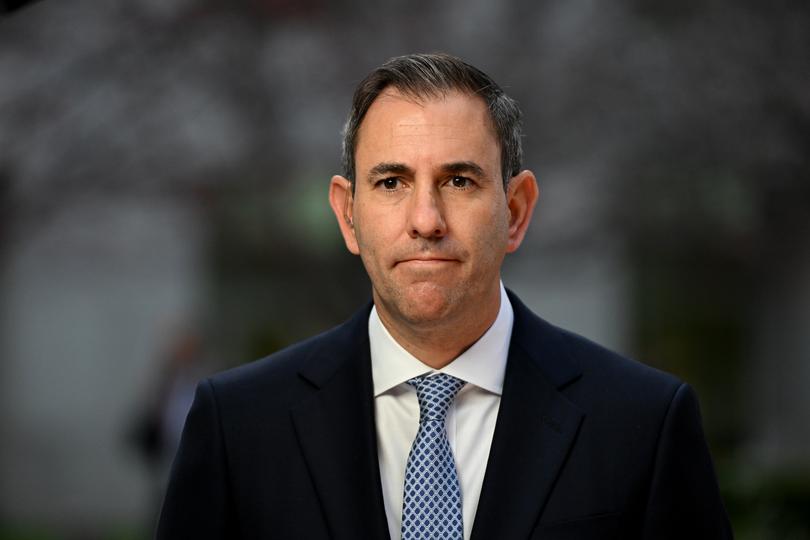

The way Australians pay with certain cards could soon change, with Treasurer Jim Chalmers stating, ‘consumers shouldn’t be punished for using cards or digital payments’.

Debit card surcharges could be banned in little more than a year as the Federal Government chases more cost-of-living relief for households ahead of next year’s election.

Backed by a new consultation paper from the Reserve Bank of Australia, the Albanese Government says it is “prepared” to follow Britain and the European Union from as early as January 2026 in banning surcharges imposed by merchants, or retailers, on customers using debit cards.

Its deliberations come as the fees attract increasing political scrutiny amid Australia’s growing cost of living pressures.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The money collected from debit card surcharges, which range from less than 0.2 per cent of a transaction value to more than 2 per cent, has been growing as the use of cash diminishes and more payments are made via cards.

Small businesses are particularly vulnerable, as they are often forced to recover the contentious costs from customers to protect their profits and meet the card processing fees they, in turn, are slugged by banks, payment platforms and card companies such as Visa and Mastercard.

“Consumers shouldn’t be punished for using cards or digital payments, and at the same time, small businesses shouldn’t have to pay hefty fees just to get paid themselves,” Federal Treasurer Jim Chalmers said.

“We’re prepared to ban debit card surcharges, subject to further work by the Reserve Bank and safeguards to ensure small businesses and consumers can both benefit from lower costs,” he said.

The RBA, which regulates the payments system, has been looking into merchant costs and surcharging, with its first consultation paper due out on Tuesday.

Bank governor Michele Bullock told a parliamentary inquiry in August that “everything is just getting surcharged” because fewer Australians were using cash.

“We are going to be looking at the economic circumstances now, and whether surcharging is still fit for purpose as an instrument to improve efficiency in competition,” Ms Bullock said.

Announcing $2.1 million of new funding for the Australian Competition and Consumer Commission to tackle “excessive surcharges”, the Government said on Monday it wanted “to ease costs for consumers without added costs for small businesses, or unintended consequences for the broader economy”.

The ACCC funding would enable the watchdog “to crack down on illegal and unfair surcharging practices and increase education and compliance activities”.