JACKSON HEWETT: Trump tariff ripple effect risk to Australia as trade barriers go up in Asia

The inmates are back in charge of the asylum.

If anyone thought sense had permeated the US Administration during the tariff pause, they were wrong.

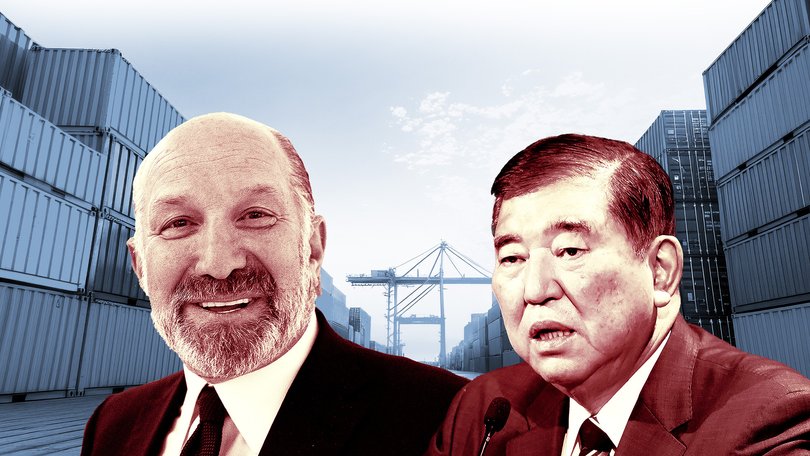

Despite the urbane presence of Treasury Secretary Scott Bessent, who many on Wall Street figured would talk Donald Trump off his tariff cliff, it is Commerce Secretary Howard Lutnick who appears to have the ear of the President.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr Lutnick, with a net worth of more than $US2 billion, worked his way to the top of bond firm Cantor Fitzgerald, cosying up to the firm’s founder before taking over as chief executive at the age of just 29. Now 63, he is described as one of Mr Trump’s closest confidantes.

“Howard’s not a regular Wall Street guy — he’s a real MAGA guy. Have you heard him talk about tariffs? Have you heard him talk about shredding the deep state bureaucracy? He’s one of us,” Donald Trump Jr described him to the Wall Street Journal.

In the rough and tumble world of bond trading, where Mr Lutnick made his fortune, deal makers are by necessity ruthless.

The Japanese now have fist hand knowledge of it.

Japan’s chief trade negotiator Ryosei Akazawa spoke with Mr Lutnick for 45 minutes on Thursday and an hour on Saturday, according to Bloomberg. Prior to that Akazawa has made seven trips to the US for largely unproductive talks.

The best Mr Akazawa got out of that was a letter, published to Mr Trump’s Truth Social account, declaring a 1 per cent increase in the initial tariff rate to 25 per cent.

“If you wish to open your heretofore closed Trading Markets to the United States, eliminate your tariff, and Non Tariff, Policies and Trade Barriers, we will, perhaps consider an adjustment to this letter,” the letter to Japan said.

“If for any reason you decide to raise your tariffs, then, whatever the number you choose to raise them by, will be added onto the 25% that we charge.”

Japan is one of 14 countries that have been slapped with this updated ambit tariff claim, with the deadline for implementation pushed to 1 August.

South Korea will also be hit with a 25 per cent tariff, Thailand remains at 36 per cent, while Malaysia rises to 25 per cent. Indonesia, Cambodia, Bangladesh, and Myanmar are each subject to tariffs of 32 to 40 per cent.

A deal with China appears to have been finalised, with the US to impose a 55 per cent tariff on Chinese goods, comprising a 10 per cent base tariff, 20 per cent China-specific levy, and 25 per cent carried over from Mr Trump’s first term. China’s tariffs on US products remain at 10 per cent. Vietnam has also done a deal, getting their tariff rate cut from 40 per cent to 20 per cent.

Dr Jenny Gordon, a former economist at DFAT and a non-resident fellow at the Lowy Institute believes that the US is “shaking the tree” by issuing these new tariff letters aimed at Japan, Korea and others, in a bid to force them to offer up concessions ahead of the August 1 deadline.

Dr Gordon said the move appeared also to disrupt collective resistance by dangling the prospect of bespoke deals, splintering coordinated pushback.

“It’s about keeping every country negotiating on its own, hoping they’ll win concessions,” she said. “Because if they cooperate, that’s the one thing that can really push back against this whole US tariff strategy.”

While many of the updated tariffs land on round numbers — 25 per cent for Japan and Korea, 36 per cent for Cambodia and Thailand —Gordon sees this as a superficial re announcement designed to revive headlines. “It’s a reminder. ‘Hey, wake up — these are still coming.’ That’s the signal.”

She also pointed out that many countries, such as South Korea, already have free trade agreements with the US and may have little left to offer. Instead, she said US trade negotiators would be trying to erode not-tariff barriers such as environmental standards, social policy carve outs, or administrative barriers.

There’s still time for deals to be struck, but the numbers suggest tariffs are unlikely to fall far from their original targets. If close allies like Japan and South Korea can be treated so harshly, other trading partners have little reason for optimism.

For Australia, the ripple effects are significant.

Japan and South Korea are our second and third largest trading partners, taking $75.6 billion and $42 billion of Australian exports last year, largely in coal, gas and iron ore.

A 25 per cent US tariff would seriously crimp their own exports — Japan and Korea send about 20 per cent of their goods to the United States, making it their first and second largest markets respectively.

“This is going to hurt,” Dr Gordon said. “Access to US export markets is critical to scale, and if demand drops or supply chains shift, those countries will look to divert product elsewhere.”

With China already looking for places to redirect its tariffed products, trade barriers may rise elsewhere.

“Demand is going to go down as a result, because other countries will try and protect their markets,” she said.

That is bad news for Australia, which has built its wealth on a open, free market trading system.

The growth story is just one side of the coin. Last rates decision, the Reserve Bank noted a global trade conflict could result in the kind of supply chain disruption that led to spiking inflation.

If companies are holding back on investing for uncertainty on tariffs, or if they are trying patch together complex systems of components for products like cars or machinery, the just-in-time wheels of commerce seize up.

Once again, the world waits for a signal from the US, which this time has gone from three months, to three weeks.