It’s an athletic leisure wear five-setter at the US Open and Nike is being aced

Tennis is in the middle of a popularity boom both in terms of participation and cultural cache.

When Taylor Fritz stepped on to the court for his quarterfinal match against Novak Djokovic on Tuesday at the US Open, he did so sporting unremarkable black shorts and an understated shirt in either tan or black, depending on the time of day of the match.

Fritz’s simple look bucks the expectation that tennis stars be flashy on court these days. Carlos Alcaraz has played his previous two matches in bubblegum pink and plum, and Coco Gauff sported a backless, cherry-red crop top with coordinated neon shoes. Even Djokovic’s all-black outfit has some pizzazz, with its metallic gold trim and sneakers to match.

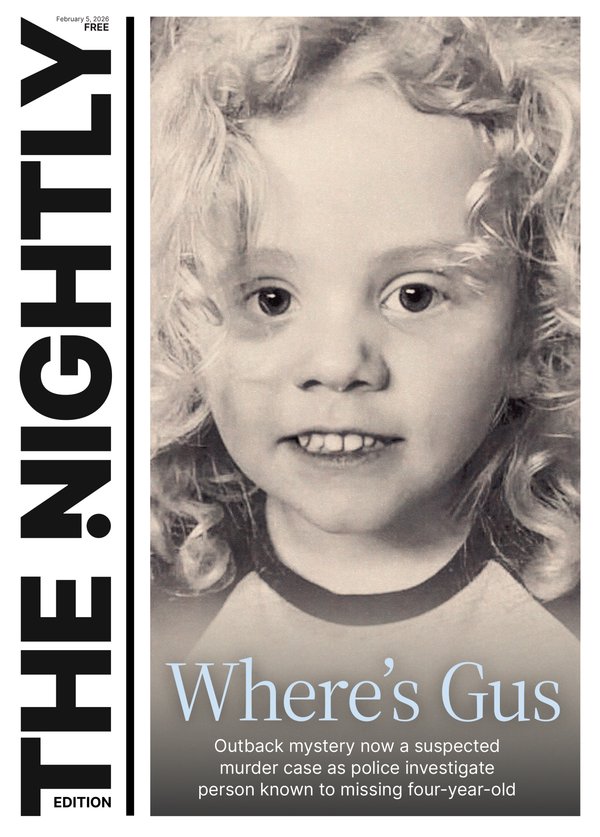

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.But Fritz, the fourth-ranked player in the world doesn’t just stand apart for his lack of glitter. He stands apart because of the brand, too.

The 27-year-old Californian has worn clothing from the German fashion label Hugo Boss since 2024, part of a trend of highly ranked players breaking away from traditional sportswear brands such as behemoths Nike and Adidas, and their smaller brethren, such as New Balance and Lacoste. The companies du jour have slimmer histories outfitting athletes and may, at least in the mind of most consumers, not carry an association with tennis at all.

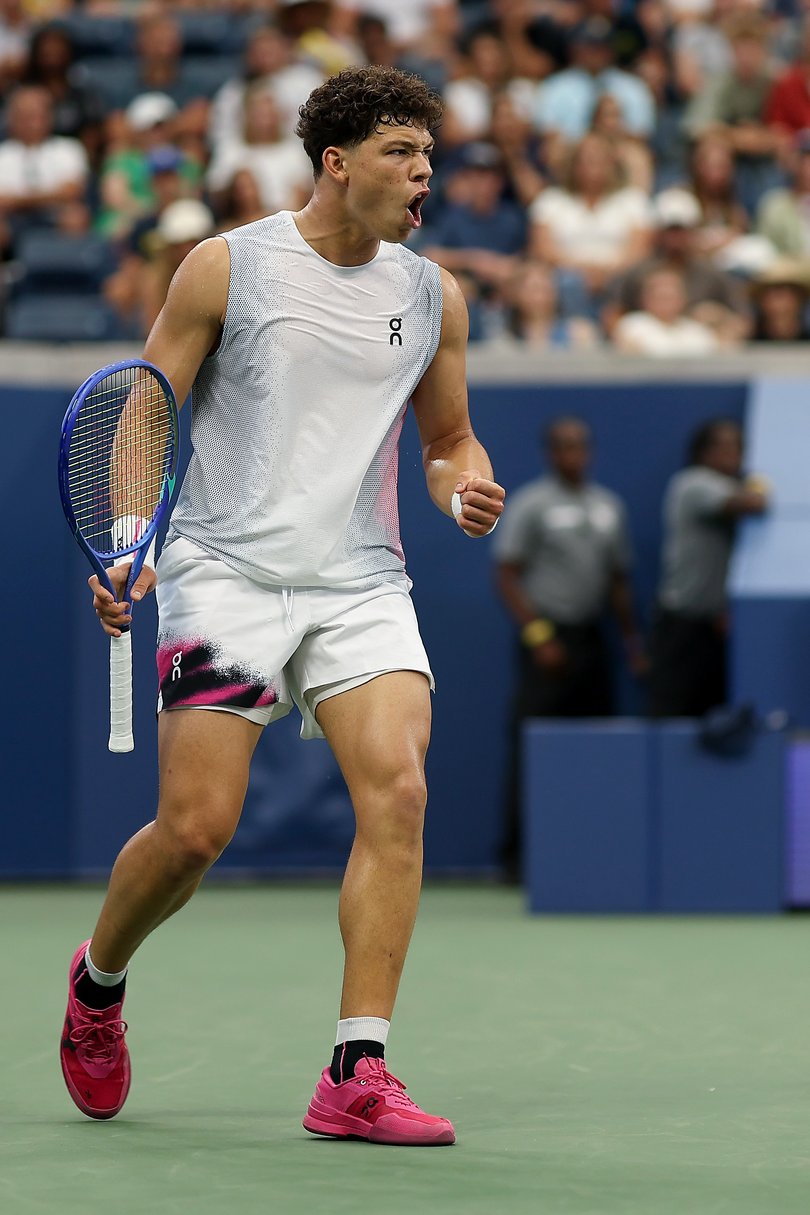

Before Fritz signed with Boss, Grand Slam champion Iga Swiatek and rising American star Ben Shelton signed in 2023 with On - a company that now has Roger Federer’s backing but first gained renown for its running shoes.

In January, the United States’ most electrifying male tennis star, Frances Tiafoe, left Nike to join Lululemon, known best for its pricey ath-leisure wear.

And just before the US Open, world No. 5 Jack Draper became the latest Nike defector when he signed on with upstart athleisure brand Vuori in a deal that will pay him around $5 million per year, according to a person with knowledge of the contract.

“Vuori came in with an opportunity I couldn’t turn down,” Draper said last week before he withdrew from the tournament with an arm injury. “I’ve always been someone who has wanted to sort of do a bit of something different anyway.”

Tennis is in the middle of a popularity boom both in terms of participation and cultural cache, as evidenced by the ever-climbing attendance numbers at the US Open - this year, the tournament used a reformatted mixed doubles event to help draw a record 239,307 attendees during “fan week” alone, the six days before main singles draw matches begin.

The investment has paid off for brands that made the leap years ago.

Just before the US Open, Forbes reported that Federer’s investment with On, which he helped develop a tennis shoe, has made him a billionaire. The company’s shares have increased 86 percent from when it went public in 2021. It has a market capitalization of almost $15 billion.

“The landscape is changing because there’s a lot of money out there,” said Mike Nakajima, who spent 30 years as the director of Nike’s tennis division, managing the brand’s business with athletes such as Federer, Rafael Nadal and Serena Williams. “… It used to be that no matter what, kids were signing with Nike. Now some of these companies are just throwing such big numbers that they have to consider the options.”

For premium brands, tennis is ideally situated at the intersection of lifestyle - a wealth-infused lifestyle, that is - fashion and sport. Tennis-inspired outfits have blown far past the lines of an actual tennis court and are now considered trendy streetwear, as commonly seen at the grocery store as they are at social events.

The tennis-to-fashion pipeline has long worked both ways, too, with players dating back to Williams and Maria Sharapova positioning themselves as fashionistas. Gauff, a two-time Grand Slam champion, anchored a collaboration between New Balance, her longtime sponsor, and high-fashion brand Miu Miu this year. Fritz has walked in New York Fashion Week, and Draper, a Brit, has modeled for Burberry.

For Vuori and Lululemon, that made for a natural transition into tennis.

Vuori’s niche: decadently soft clothes for both lazing about and working out. The brand has gained traction among corporate types who have traded suits for stylish joggers since the pandemic.

It first dipped a toe into tennis in 2023 when it began outfitting world No. 55 Marcos Giron, whom CEO Joe Kudla was introduced to through an investor. As the company expands - Kudla said Vuori recently opened its 100th U.S. store and will have 15 stores internationally across China, South Korea, the United Kingdom, Mexico and the Middle East by next year - partnering with tennis players such as Draper helps show off its technical know-how.

“We take performance very seriously here, and a lot of people don’t understand that,” Kudla said in an interview. “An athlete like Jack will help us to establish more performance credibility.”

In return, Vuori - and Lululemon for Tiafoe, On for Shelton and Swiatek, Boss for Fritz and even New Balance for Gauff - can offer something Nike and Adidas can’t: distinction. While Lululemon also outfits world No. 30 Leylah Fernandez, 17th-ranked Tiafoe is the face of the brand’s tennis gear. That’s meaningful as he and his team of agents build his brand.

He was one on a long roster of athletes at Nike that includes Jannik Sinner, Alcaraz, Naomi Osaka and Aryna Sabalenka. With Lululemon, Tiafoe gets bright, bold outfits that suit his play and personality as well as custom-made outfits, including a Washington Commanders-themed kit for his hometown tournament at the DC Open.

In New York, Lululemon did him one better - it put his face on a massive billboard above the Fifth Avenue storefront during the U.S. Open.

“I kind of decided, why not do something different?” Tiafoe said last week, “Why not be ‘the’ guy instead of one of them?”

Nike has always seemed to have the world’s most popular tennis players in its stable - even if they occasionally strayed, as Federer did to sign with the Japanese brand Uniqlo in 2018.

It still does, with multiple-time Grand Slam winners Alcaraz, Sinner, Osaka and Sabalenka among the active players anchoring its roster along with Chinese star and world No. 7 Qinwen Zheng. But the sportswear giant has ceded some ground to other brands willing to pay more - in both dollars and personalised marketing - when it comes to young players on the rise.

That includes 22-year-old Shelton, who wore Nike as a junior player and has risen to No. 6 in the world with On, and 19-year-old Brazilian João Fonseca, whose game has tennis nerds titillated. Fonseca signed with On in 2023.

Sinner and Alcaraz dominate the men’s game, but Nike’s tennis division was built, in part, on its ability to scout. Nakajima, the former director at the brand, signed Sharapova when she was an 11-year-old prodigy who barely spoke English.

“Our sport has become Sinner and Alcaraz. But eventually, that’s going to fade,” Nakajima said. “That was my job for 25 years, to make sure I know, okay, who is the next one? Nike’s expectation is that you sign them. Sign the wrong athlete, man, you’ll take s--t for it in the office. But if you don’t sign the right athletes? You pay for it.”

Their current tennis division isn’t as competitive as it used to be in signing young players, in part because of where tennis falls on the pecking order within a brand that also has massive deals with the NFL, NBA, WNBA, international soccer and college programs across the country.

But Nike does have one major advantage - aside from the fact that it’s still, well, Nike.

When it comes to tennis gear, nothing matters more than a player’s racket and shoes, and Nike knows shoes. With input from Federer, On has developed a tennis sneaker in recent years, but Tiafoe wears K-Swiss footwear. Draper had been wearing Asics at the U.S. Open, and Fritz wears Asics as well.

It is Nike’s ability to outfit a player from head-to-toe combined with decades of experience in footwear that, in Nakajima’s perspective, keeps it ahead of the competition. He recalled one instance in which Nadal mentioned offhandedly to a higher-up at the company that his shoes fit well but felt a bit heavy. Nike sent a representative to Asia to make the Spaniard the exact same shoe - but lighter - in two weeks.

“Apparel has become more and more technical over the years. But at the end of the day, it pales in comparison to footwear. If you can’t run around, if you have blisters, if it’s not fitting well and all that, well, then, you know what? You’re not going to be able to play,” Nakajima said. “They know how to fix that, and they have the ability to fix it right away.”

Then there’s the other bragging rights Nike gets, at least in men’s tennis. While the women’s game has seen a Nike-sponsored athlete win just four of the past 11 major titles, a man wearing a swoosh has lifted the trophy in the past seven grand slam tournaments.