Australian news and politics recap: Treasurer Jim Chalmers delivers fourth Federal Budget

RECAP: Australian Treasurer Jim Chalmers has unveiled a ‘cost-of-living’ Budget he never thought he’d have to deliver. But will it be enough to get the Albanese Government re-elected?

Scroll down for the latest news and updates.

Key events

25 Mar 2025 - 06:39 PM

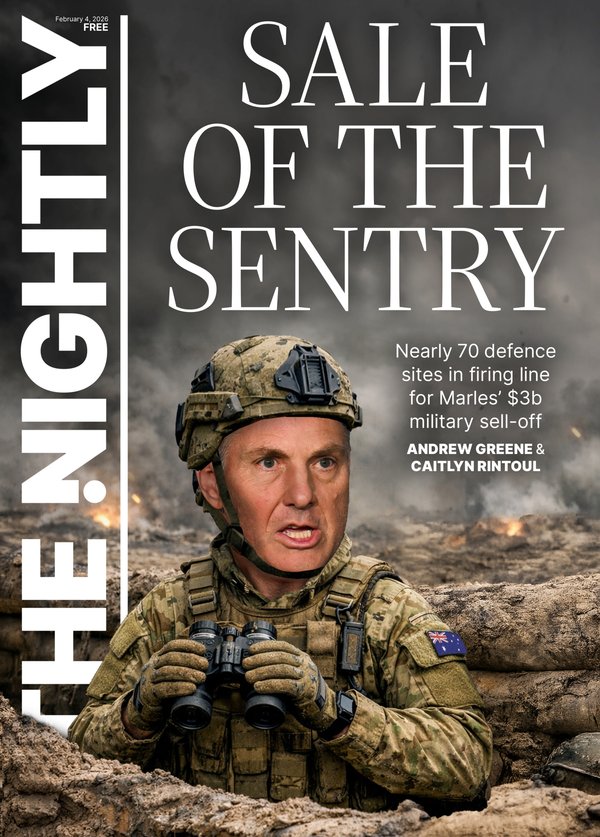

Defence dilemma a free kick to combat ready Coalition

25 Mar 2025 - 06:31 PM

The Budget that would make Jim Chalmers prime minister

25 Mar 2025 - 05:54 PM

Tax cuts a modest offering for hurting taxpayers as election looms

25 Mar 2025 - 05:11 PM

Labor defies Trump request for rapid defence spend-up

25 Mar 2025 - 05:08 PM

BUDGET WRAP: Labor pledges tiny tax cuts on election eve as deficits soar

25 Mar 2025 - 05:04 PM

Your five-minute guide to the 2025 Federal Budget

25 Mar 2025 - 04:56 PM

Income boost for aged care, childcare workers

25 Mar 2025 - 04:54 PM

Every household gets $150 for energy bill relief

25 Mar 2025 - 04:50 PM

Two new tax cuts for every taxpayer

25 Mar 2025 - 04:48 PM

The worst is now behind us

25 Mar 2025 - 04:45 PM

Private sector driving growth - soft landing likely

25 Mar 2025 - 04:42 PM

Global headwinds impact Australia’s budget

25 Mar 2025 - 04:39 PM

Five priorities of the Budget

25 Mar 2025 - 04:37 PM

Our ‘economy is turning the corner’

25 Mar 2025 - 04:35 PM

Chalmers is speaking now ....

25 Mar 2025 - 04:17 PM

Chalmers moments away from delivering Federal Budget

25 Mar 2025 - 04:11 PM

Today’s News Worthy podcast takes on influencers and the Budget

25 Mar 2025 - 03:04 PM

Ex-employee referred to police over law firm’s malicious email scandal

25 Mar 2025 - 02:15 PM

Rowing Australia worried Olympic venue won’t comply

25 Mar 2025 - 12:28 PM

TV personality Zempilas confirmed as WA’s new Liberal leader

25 Mar 2025 - 12:01 PM

The big winners from Brisbane’s Olympic venue plan

25 Mar 2025 - 11:39 AM

Alert issued as strong earthquake rocks New Zealand

25 Mar 2025 - 11:12 AM

Brisbane Live venue announced to take place of Gabba

25 Mar 2025 - 10:58 AM

Brisbane showgrounds and Pat Rafter Tennis Centre to get Olympics-style upgrade

25 Mar 2025 - 10:49 AM

Queensland set to become Swimming Australia home with new Olympic facility

25 Mar 2025 - 10:40 AM

Crisafulli says new stadium for 2032 Olympics will deliver lasting legacy

25 Mar 2025 - 10:33 AM

New Olympic Stadium build confirmed as Crisafulli announces 2032 project

25 Mar 2025 - 10:15 AM

Wilkie accuses Labor of ‘political fix’ on Tasmanian salmon farming

25 Mar 2025 - 09:59 AM

Big barrel of waste bobs up on Parliament House lawn

25 Mar 2025 - 09:31 AM

Social media influencers get prized spots in Canberra Budget lockdown

25 Mar 2025 - 08:37 AM

Calm before Budget storm for Albanese, Chalmers, Gallagher

25 Mar 2025 - 07:10 AM

Federal court win staves off potential train strikes

25 Mar 2025 - 06:58 AM

Monique Ryan supporters spotted using public property for election advertising

25 Mar 2025 - 06:43 AM

Trump hints at tariff relief for a ‘lot of countries’

25 Mar 2025 - 05:49 AM

Budget ‘will be a platform for prosperity in a new world of uncertainty’

Good news for uni students

The Budget allows for a 20 per cent cut to all student loan debts, raising the minimum repayment threshold and reducing repayment rates.

“Combined with our existing student debt relief, we will slash $19 billion in debt for more than three million Australians,” Mr Chalmers said.

Supermarket crackdown flagged

Mr Chalmers acknowledged shoppers were hurting at the checkout and vowed a supermarket crackdown.

“By empowering the competition watchdog, making the food and grocery code mandatory, increasing penalties and boosting competition.

“At the same time we are targeting excessive surcharging and scams and unfair trading practices that harm consumers.”

Income boost for aged care, childcare workers

An additional $2.6 billion has been set aside to fund pay rises for aged-care nurses from March this year.

Mr Chalmers said the Government would also reforming non-compete clauses to lift wages by up to $2500 a year for workers covered by them.

“We’ve supported an historic wage increase for the early childhood educators and care workforce, and we’ve backed pay rises which ensure the national minimum wage has risen by almost $7500 a year.”

Every household gets $150 for energy bill relief

In more good news for struggling households, Mr Chalmers has announced $150 energy rebates off bills this year.

“The Government will also be using the powers and penalties of the energy regulators and the ACCC to help ensure that energy companies offer customers cheaper deals, that pensioners receive the discounts that they are entitled, to and thatAustralians get the value that they deserve.”

Two new tax cuts for every taxpayer

Every Australian taxpayer is set to get a tax cut next year and the year after to top up the tax cuts which began in July.

“This will take the first tax rate down to its lowest level in more than half a century,” Mr Chalmers said.

“These additional tax cuts are modest, but they will make a difference.

“The average earner will have an extra $536 in their pocket each year when they are fully implemented.

“Combined with our first round of tax cuts, this is $2190, and the average total tax cut will be $2548, or about $50 a week.

“We will also increase the Medicare levy low income thresholds which is extra tax relief for more than a million Australians.

“Our $17 billion in tax cuts are the biggest part of the responsible cost-of-living package in this Budget, but they are not the only part.”

The worst is now behind us

“Because of our collective efforts, the worst is behind us and the economy is now heading in the right direction,” Mr Chalmers said.

“But there is more work to do because we know that people are still under pressure.

“The cost of living is front of mind for most Australians, and it is front and centre in this Budget.”

Mr Chalmers said the Budget works to rebuild living standards starts with cost-of-living help and wages growth.

“It includes more hip pocket help for households.”

Private sector driving growth - soft landing likely

Mr Chalmers said the private sector was “resuming its rightful place” as the main driver of growth.

Treasury has upgraded forecasts for growth in private demand to more than double next year, compared to this one.

“Unemployment is now projected to peak lower at 4.25 per cent. Employment and real wage growth this year will be stronger and participation will stay near its record high for longer,” Mr Chalmers said.

“Inflation is coming down faster as well.

“Treasury now expects inflation to be sustainably back in the band six months earlier than anticipated.

“Now, all of this means that the soft landing that we have been planning for and preparing for is now looking more and more likely.”

Global headwinds impact Australia’s budget

Treasury expects the global economy to grow 3.25 per cent in the next three years, the slowest since the 1990s.

Mr Chalmers said it was already forecasting the two biggest economies in the world will slow next year, with risks weighing more heavily on both.

“Australia is neither uniquely impacted nor immune from these pressures, but we are among the best-placed to navigate them.

“We are emerging from this spike in global inflation in better shape than almost any other advanced economy.

“Growth is forecast to pickup from 1.5 per cent this year to 2.5 per cent in 2026-27.”

Five priorities of the Budget

Mr Chalmers says his Budget is responsible at a time of global volatility and unpredictability.

It has five main priorities: Helping withthe cost of living, strengthening Medicare, building more homes, investing in every stage of education, and making the economy “stronger, more productive and more resilient”.

Our ‘economy is turning the corner’

Mr Chalmers says Australia’s economy is turning the corner.

“Inflation is down. Incomes are rising. Unemployment is low. Interest rates are coming down. Debt is down, and growth is picking up momentum.

“On all of these fronts, our economy and our Budget are in better shape than they were three years ago.

“Now, this progress has been exceptional but not accidental.

“The credit belongs to Australians in every corner of our country. We’ve come a long way together, but there is more work to do.

Mr Chalmers said it was a Budget for a new generation of prosperity in a new world of uncertainty.

“It is a plan to help finish the fight against inflation, rebuild living standards and maximise our national advantages into the future.”