Stock tips 2026: Australia’s elite share market investors share wealth creation opportunities set to take off

Australia’s most famous stock picking conference has thrown up some unusual ideas that fund managers think will thump the market in 2026.

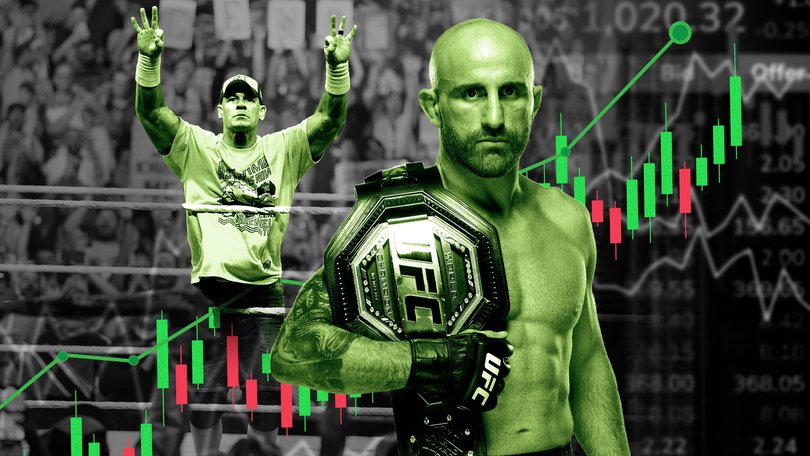

Artificial intelligence, the energy transition and even the popularity of cage-fighting sport UFC are being highlighted as the leading wealth creation opportunities for the coming years by Australia’s elite share market investors.

The call for Australians to think about investing abroad came at the Sohn Hearts & Minds investment conference at Sydney’s Opera House on Friday, where hundreds of business leaders gathered by the harbour to share their market-thumping stock tips for 2026.

Ride UFC’s growing popularity

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.One business backed as a hidden gem to make money is TKO Group. It is the parent company of wildly popular martial arts sport UFC and listed on the New York Stock Exchange.

Xiao Ma, a professional Sydney-based stock picker at Munro Investment Partners, told the conference that the soaring popularity of UFC and its talismanic business leader Dana White means investors can profit from buying TKO shares.

“Investing in sports has traditionally been reserved for billionaires only,” she told the conference. But now anyone can get exposure to UFC’s potential to grow its fanbase and broadcast fees, according to Ms Ma.

Shares in TKO Group are up 55 per cent over the past 12 months and it expects to earn up to $US4.7 billion in revenue this financial year from its professional fighting business, which also includes the WWE wrestling franchise.

Another US business tipped to create wealth for investors is Monday.com. It was backed at the Sohn Conference by Ben Hensman, an investor at one of Australia’s most famous investment businesses, Square Peg Capital.

Mr Hensman told the Opera House audience that Monday.com is a wealth winner due to its software products’ use of artificial intelligence to help office workers manage workflows and save time.

“Monday’s flexible building blocks really allow customers to make AI generally useful,” Hensman said, according to The Australian newspaper.

Monday.com’s shares are traded on the tech-focused Nasdaq Index in the US, but have fallen 30 per cent in 2025 as worries around a price bubble in tech stocks sent Australia’s benchmark S&P/ASX 200 Index to its fourth straight day of losses on Friday.

On Wall Street shares posted their worst day in more than a month on Thursday, even after the longest US government shutdown in history ended this week.

Defensive investing

Another investor at the Sohn Conference made the case for the old-fashioned precious metal, gold, to offset the risk that ballooning global debt levels spark a share market crash.

Matthew McLennan, a portfolio manager at First Eagle, said the recent rise in the gold price to a record high above $US4,400 ($6700) an ounce reflected investors’ worries that the US government is accumulating too much debt.

Gold is viewed as a safe-haven asset and Mr McLennan reportedly has about $15 billion of his $95 billion fund in the precious metal.

“There are assets like gold, a block of land, great businesses that are variable in their nominal price, but more fixed in supply. And the paradox of time is that as you extend your horizon, what is volatile in the short term can be more secure in the long term,” Mr McLennan told the conference, according to The Australian.

Elsewhere, anyone looking to ride the green energy investment boom could buy shares in US-listed Steel Dynamics, according to Peter Rutter, one of the UK’s most successful share market investors over the last 10 years.

According to Mr Rutter, Steel Dynamics is a long-term winner from increased recycling and the US push to reshore industrial manufacturing over the long term.

The steel manufacturer’s Nasdaq-listed shares have surged 38 per cent year to date and Mr Rutter said they have room to double over the medium-term.

Other stock picks recommended included Finnish retail chain Puuilo and a Hong Kong-listed construction business named Morimatsu International.

Zero ASX-listed businesses made the list. Over this calendar year Australian shares have lagged their global peers, as the 19.3 per cent rise for the MSCI All World Index heavily outpaces the 4 per cent return for the S&P/ASX 200.