US Fed poised to cut rates to 2022 lows as slowing jobs market, trade tensions bite

The US Federal Reserve is set to cut the nation’s benchmark interest rates early Thursday morning to support a slowing jobs market in the world’s largest economy.

The US Federal Reserve is set to cut the nation’s benchmark interest rates early Thursday morning to support a slowing jobs market in the world’s largest economy.

The highly-anticipated move that will lower US rates to their lowest level since 2022 has already sent the US dollar lower against a basket of major currencies, including the Australian dollar, which advanced 2.5 per cent over the past month to buy a 2025 high of US 66.9 cents on Tuesday.

“The US Fed has seen enough weakness in the labour market to adjust policy from what are currently assessed to be moderately restrictive settings,” said National Australia Bank’s senior foreign exchange strategist Rodrigo Catril. “A 25 basis point cut early tomorrow is likely to be followed by at least one more this year.”

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.A 25 basis point rate cut is widely expected by markets to take US benchmark cash borrowing rates to between 4 per cent and 4.25 per cent, although traders have not completely ruled out the possibility of a 50 basis point cut on the back of August’s weaker-than-expected jobs data.

As of Wednesday afternoon in Australia, the market’s consensus forecasts call for two more US Fed rate cuts in October and December, before the central bank pauses until April 2026. If correct these forecasts mean US borrowing rates could fall as low as between 3.25 per cent and 3.5 per cent by Christmas, even as US inflation climbed to 2.9 per cent over the 12 months to August 31.

Traders look for guidance

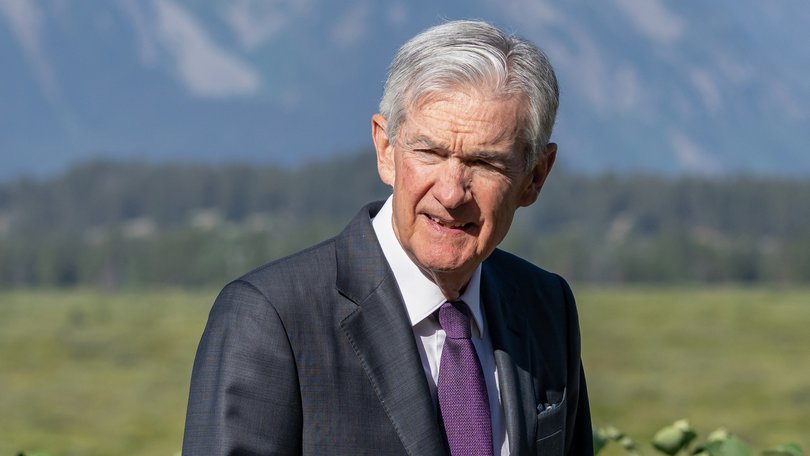

The US central bank’s announcement set for 4am AEST on Thursday will be followed 30 minutes later by a press conference from Fed chairman Jerome Powell that will be scoured by investors and high-frequency computer traders for clues as to the pace of interest rate cuts ahead.

Thursday’s announcement will also include an updated forecast to the US Fed’s guidance for future interest rate levels, as shown by its path of dot plots over the 12 to 24 months ahead.

“Whether the dot plots and associated commentary from Chair Powell prove more dovish [inclined to further cuts] or balanced is the key focus for markets,” said Westpac economist Ryan Wells. “The Aussie dollar continues to impress, building on last week’s momentum and and holding more sustainably above the US66.5 cents level.”

Economists and investors will also closely watch the Fed’s assessment of any hit to the jobs market and economic growth as a result of President Trump’s tariff wars.

Shares benefit

Basic economic theory suggests interest rate cuts should boost risk assets like shares as the value of today’s money falls versus the estimated future profit growth of companies.

The US tech-heavy Nasdaq 100 Index dominated by companies linked to advances in artificial intelligence has jumped nearly 16 per cent year-to-date to a record high of 23,343 points on Tuesday, with the broader US S&P/ 500 Index up 12.6 per cent year-to-date.

On Wednesday, Australia’s S&P/ASX 200 Index share index traded down 0.7 per cent to 8,816 points near the closing bell, but has added 7.5 per cent year to date. It includes major companies such as CSL, Cochlear, ResMed, James Hardie and Macquarie Group, with significant exposure to US economic growth and interest rates.

The gains from local shares have been boosted by the Reserve Bank’s three separate 25 basis point interest rate cuts in 2025, which took Australia’s cash borrowing rates to 3.85 per cent and eased pressure on mortgage borrowers.

AMP Group’s high-profile local economist Shane Oliver is now predicting the average national house prices to climb 5 to 6 per cent in 2025.