Black Friday: Australians snap up sales giving boost to retail spending

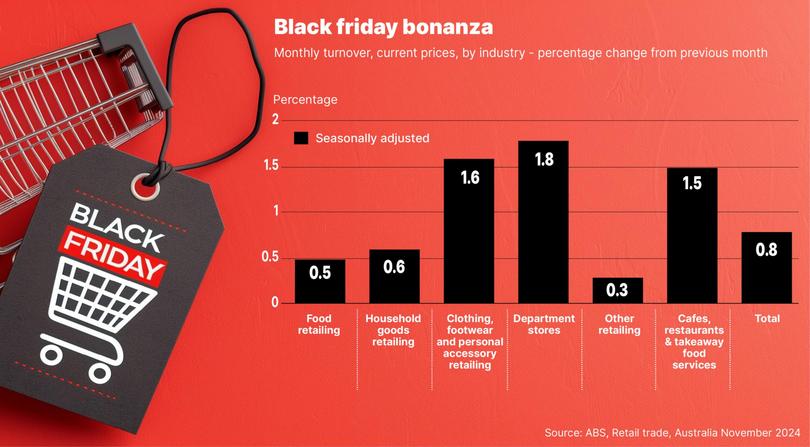

The Black Friday period continues to be a powerhouse for the retail economy powering a 0.8 per cent surge in sales according to the latest official figures from the Australian Bureau of Statistics.

The Black Friday period continues to be a powerhouse for the retail economy powering a 0.8 per cent surge in sales, however the strong rebound in consumer spending will be on the RBA’s watch as it determines whether the economy has cooled sufficiently to cut rates.

Australian Bureau of Statistics figures for November continued the strong showing from October and September, suggesting that despite ongoing elevated interest rates, shoppers continue to spend. October’s strength was boosted by retailers pulling the Black Friday discounts forward to entice shoppers to spend.

“Black Friday sales events proved once again to be a big hit, with widespread discounting and higher spending across all retail industries.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“The popularity of Black Friday sales continues to grow with promotional activity now stretching across the entire month of November, not just solely focused on the Black Friday weekend,” said Robert Ewing, ABS head of business statistics.

There were rises in all retail industries in November, with department stores sales up 1.8 per cent, clothing, footwear and personal accessory retailing up 1.6 per cent), and household goods up 0.6 per cent.

Services also performed strongly, with cafes, restaurants and takeaways rising 1.5 per cent to experience the fourth straight monthly rise.

All states saw sales rise, led by the Northern Territory, Queensland and South Australia which were up more than one per cent, while the other states grew between 0.5 and 0.8 per cent. The ACT grew sales by just 0.1 per cent.

Originally an American concept, the Black Friday sales period has become a key calendar event for retailers, drawn by the lure of discounts in the lead up to Christmas.

“Consumers have taken advantage of Black Friday sales once again, with discounting seen across clothing items, furniture, electrical goods and cosmetics,” Mr Ewing said.

“Discounts were also seen in essential goods, with businesses in food retailing boosted by higher spending due to Black Friday price cuts and points incentives through rewards programs.”

The continued shift in consumer preference to shop online was confirmed by the figures, with a 22 per cent jump in sales - equating to almost $1 billion - for the month. While the Black Friday, Cyber Monday lift was down slightly on the 27 per cent rise last year, total online sales topped $5 billion for the first time. Based on total retail turnover of $37b, online shopping now accounts for 14 per cent of all sales.

RBA to watch spending strength

While the 0.8 per cent monthly increase was lower than economists expected, retail spending has rebounded significantly in the last six months. On an annualised basis consumers have upped purchases by 5.3 per cent, significantly above the average growth rate for the previous period of three per cent.

It suggests that financial conditions are easing for consumers, with energy rebates, stage 3 tax cuts and a lift in wages amid low unemployment, along with continued high immigration prompting more spending.

“The rebound in retail spending suggests that Australian households aren’t quite as stretched financially as they used to be, at least not collectively. Recent growth has been undeniably strong and completely at odds with the widespread view that Australian households have rarely had it harder,” said Callam Pickering, APAC economist for job site Indeed.

“The recent surge in retail growth, reflecting fiscal stimulus via tax cuts and government subsidies, could potentially impact inflation going forward. Strong consumer demand, high population growth and low unemployment sounds like a recipe for high inflation.”

The sales data will be pored over by the Reserve Bank as it ponders whether the inflationary environment has stabilised enough, while the economy has sufficiently slowed to cut rates.

The retail sales figures figures follow encouraging data on inflation, released yesterday, that showed underlying prices falling from 3.5 per cent to 3.2 per cent on an annualised basis in the month of November. That puts inflation on track with the Reserve Bank’s forecast of a return to target inflation by the end of the year, prompting bond markets to forecast a 75 per cent chance of a rate cut by February.

Retail sales traditionally dip in December following the Black Friday shopping spree, but if the data are a sign of a longer-term in lift in spending, the Reserve Bank will be concerned that continued consumer demand will start flow through to prices. According to RBC Capital Markets chief economist Su-Lin Ong, the Australian Retailers Association suggested a firmer December sales period than the previous year.

“Retail sales and broader consumer-related data take on more importance than usual in our view at this juncture of the monetary policy debate,” Ms Ong said.

“These data are being viewed through the prism of the lift underway in real household disposable income after a sustained period of negative annual growth in 2023 and (the second half) of 24.”

US rate call a potential wildcard

The inflation and retail spending data come amid a growing change in sentiment on interest rates in the United States.

Federal Reserve minutes released overnight, revealed that Board members were concerned that getting inflation back to target range “could take longer than previously anticipated” and the “committee was at or near the point at which it would be appropriate to slow the pace of policy easing.”

That suggests that the rate cutting cycle in the US is nearing an end, which would put further downward pressure on the Australian dollar. A falling Australian dollar has an inflationary impact as goods in US dollars become more expensive.

“The meaningful repricing (pushing out) of Fed expectations for easing this year since the last RBA meeting... has pushed the Australian Trade Weighted Index to levels that will be potentially inflationary,” investment bank Morgan Stanley wrote to clients.

“We still expect an on hold decision for February with a first cut in May - with labour market and spending strength key offsets.”

Even if the RBA feels confident enough to reduce rates at the February meeting, the likelihood that the US rate cutting cycle has ended, and the possibility of higher global inflation if President-elect Donald Trump introduces tariffs, means that rate cuts are likely to be relatively small. The RBA will be keen to avoid any further depreciation of the Australian dollar and will have little room to reduce rates significantly for fear of capital outflow from Australia to higher yielding markets.

Long-dated global bond rates are already showing significant increases, a warning sign that investors are concerned about rising inflation and the impact of ongoing deficits in the United States. 20-year bond yields hit their highest point in over a year as the US government issued a staggering $119 billion worth of new debt this week.

UK bond yields hit their highest point since 2008.

As yields rise globally, the RBA is not only hamstrung by how much it can cut rates domestically but businesses that borrow money internationally, such as Australian banks will have to pay a higher price for debt. That would flow to mortgage rates in Australia.