Bunnings landlord BWP celebrates bumper profit

The property trust, 22 per cent owned by Bunnings owner Wesfarmers, made $157.1 million after tax for the December half-year, nearly triple the corresponding period’s profit of $53.2 million.

Shares in the biggest owner of Bunnings warehouse sites, BWP Trust, have leapt more than 5 per cent after soaring property revaluations fuelled a profit leap.

BWP, 22 per cent owned by Bunnings owner Wesfarmers, made $157.1 million after tax for the December half-year, nearly triple the corresponding period’s profit of $53.2 million.

Investors were rewarded with a modestly higher interim dividend of 9.2¢ a unit but also received a capital boost on the result as BWP shares closed 16¢ better at a near three-month high of $3.45.

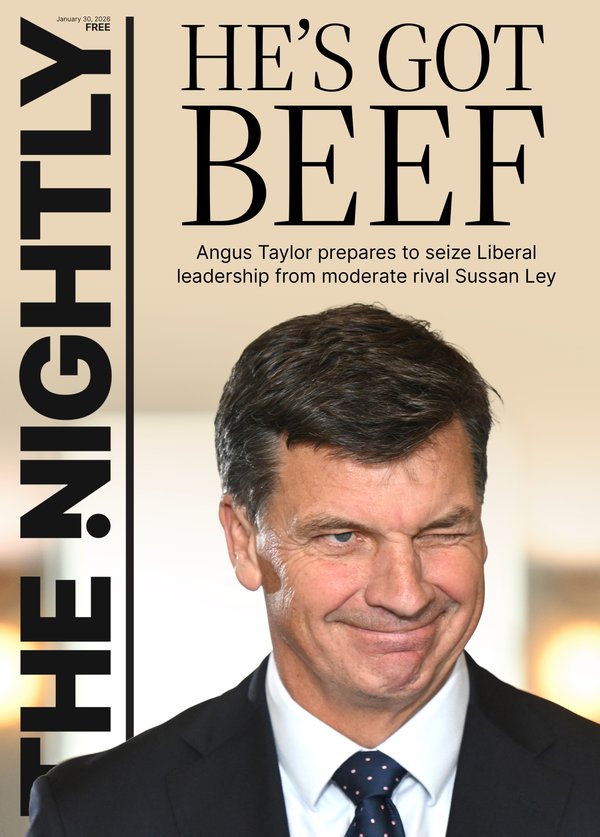

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Positive property revaluations of $91m, compared to a $4m loss previously, were the biggest contributor to the improved profit, but increased rental income on the back of last year’s takeover of fellow manager Newmark Property also helped.

The value of BWP’s portfolio stood at $3.6 billion at the end of 2024, up from $3 billion a year earlier.

BWP owns 82 properties, including 68 Bunnings sites around the country. Its portfolio is fleshed out with 11 big format retail showrooms and two industrial properties.

With the group’s focus including offloading closed Bunnings sites and upgrading others still operating, BWP said on Wednesday it had advanced the sale of Port Kennedy and agreed a $14m expansion of the Packenham store in Victoria as well as an $11m upgrade of a non-Bunnings property in Midland.

Looking ahead, BWP said it aimed to add to the portfolio while partnering with tenants to potentially, over time, to “participate in adjacent parts of the retail value chain”.

It said income in the June half-year would benefit from “incremental” rises in rent, with 73 leases to be reviewed during the period to inflation or by a fixed percentage increase.

BWP has forecast a final distribution of 9.46¢ for the 2025 financial year, subject to not being hampered by any major economic changes.