CNBC: Here’s what a blockbuster Nissan-Honda merger could mean for the auto industry

The prospective tie-in ccould create the world third-largest auto group and comes at a time when auto giants are struggling to keep up with a shifting industry and market.

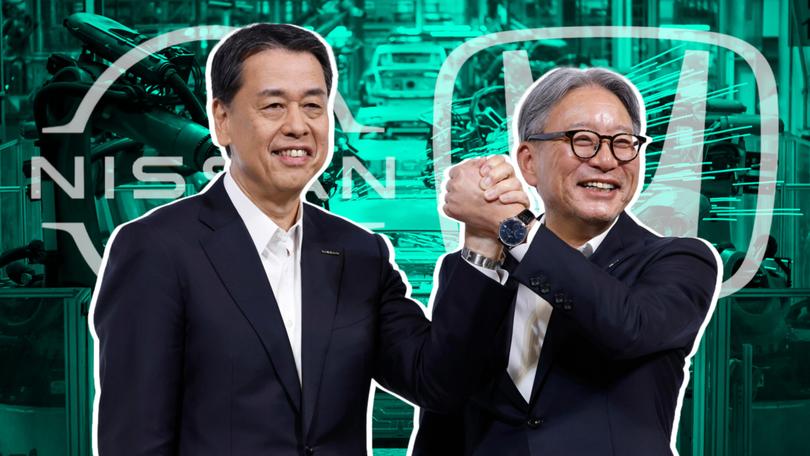

Top Japanese carmakers Nissan Motor and Honda Motor are understood to be exploring a blockbuster merger, sending shock waves through the global automotive industry as the two rival companies seek to stay competitive on the road to full electrification.

Nissan and Honda are planning to enter into negotiations for a merger, Japanese business newspaper Nikkei reported overnight, citing sources close to the matter and noting that the domestic peers expected to sign a memorandum of understanding shortly. The two companies will also reportedly look to bring Mitsubishi Motors, in which Nissan is the top shareholder with a 24 per cent stake, into the deal.

The prospective tie-up could create the world’s third-largest auto group by vehicle sales, with 8 million sales annually, according to Citi. That would place Nissan-Honda-Mitsubishi behind fellow Japanese automaker Toyota Motor and Germany’s crisis-stricken Volkswagen, respectively.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.In similar statements, Nissan and Honda neither confirmed nor denied the Nikkei report. The newspaper later reported that talks could begin as early as next week.

The merger report comes at a time when many auto giants are struggling to cope with increased global competition from bigger electric vehicle makers such as Tesla and China’s BYD.

Nissan and Honda previously forged a strategic partnership in March to collaborate on producing key components for EVs.

A mega-merger, however, is expected to face several obstacles. Analysts have expressed concerns about the likelihood of political scrutiny in Japan, given the potential for job cuts if a deal pushes through, while the unwinding of Nissan’s alliance with French vehicle manufacturer Renault is regarded as pivotal to the process.

Peter Wells, professor of business and sustainability at Cardiff Business School’s Centre for Automotive Industry Research, described the reported merger as a “really important” development — one that could help Nissan and Honda pool their assets, save money on costs and create the technologies they need for the future.

“There’s been a lot of speculation about the position of Nissan over the past 12 months or so. It’s been trying to equalise or balance out its relationship with Renault, but it’s been struggling,” Wells told CNBC’s Street Signs Europe on Wednesday.

“It’s been struggling in the market, it’s been struggling at home, it doesn’t have the right product line-up. There are so many warning signs, so many red flags around Nissan at the moment that something had to happen,” he added. “Whether this is the answer is another question.”

Shares of Nissan soared almost 24 per cent on Wednesday, notching the firm’s best trading day in at least 40 years, according to data firm FactSet. The firm’s Tokyo-listed stock price remains nearly 25 per cent lower year to date.

Honda shares, meanwhile, slipped over 3 per cent in New York.

Barriers to a possible merger

Asked whether consolidation between Nissan and Honda could emerge as a good recourse to combat the competition from Chinese EV carmakers, Cardiff Business School’s Wells said the deal could be characterised as “a traditional solution.”

“My concerns would be that perhaps they have left it a bit late, that they don’t have the current technology and set-up (or) the right product to compete in their key markets,” Wells said.

“For Nissan particularly, they are out of step with the US market. That’s their major concern, and they cannot fix that very quickly,” he added.

JPMorgan’s Akira Kishimoto shared similar views on some of the barriers to a prospective Nissan-Honda merger, saying “the hurdles to overcome would be high.”

“At a minimum, we think Nissan needs to clarify where its particularly complex capital relationship with Renault, which involves the French government, will end up and also provide details on the restructuring proposal it announced,” Kishimoto said in a research note published Wednesday.

“We think Honda needs to show how it will manage major [battery electric vehicles] and battery investments in Canada,” Kishimoto said.

JPMorgan said it would now need to wait for any concrete announcements from either company.

‘Full-scale transformation of the auto industry’

“This tie-up is not entirely unexpected because obviously they announced their partnership earlier this year,” Lucinda Guthrie, executive editor at Mergermarket, told CNBC on Wednesday.

“Some of the reports I’ve seen claim that this came about as a result of Foxconn making an approach to Nissan. Now, with this particular transaction, I question whether it is going to be a hardcore merger or whether it is going to be more of a partnership,” she added.

Apple supplier Foxconn approached Nissan about taking a stake, Bloomberg reported Wednesday, citing an unnamed source. The Taiwan-based company has been investing heavily in EVs in recent years. CNBC has contacted Foxconn for comment.

Echoing the latest development, Honda recently tested the water over a partnership with General Motors, before ultimately deciding to walk away.

Speculation over consolidation between Honda and Nissan could follow a similar trajectory, Guthrie said.

“You have to bear in mind that this would have to come with the Japanese government’s blessing because there is the potential for workforce cuts but then, how are the Japanese automakers going to compete with the low-cost vehicles from China?” Guthrie said.

Citi’s Arifumi Yoshida said a merger would likely have a negative impact for Honda, but a positive one for Nissan and Mitsubishi.

“Given Honda’s competitiveness in motorcycles and [hybrid electric vehicles] and the strength of its brand, we believe it is positioned to take on rivals for the next 5-10 years,” Yoshida said in a research note published Wednesday.

Yoshida nevertheless said the decision could be viewed as one made “in anticipation of the full-scale transformation of the auto industry.”

— CNBC’s Michael Wayland contributed to this report.

Originally published on CNBC