Goldman Sachs names AI winners and losers as tech stocks tumble in artificial intelligence shake-up

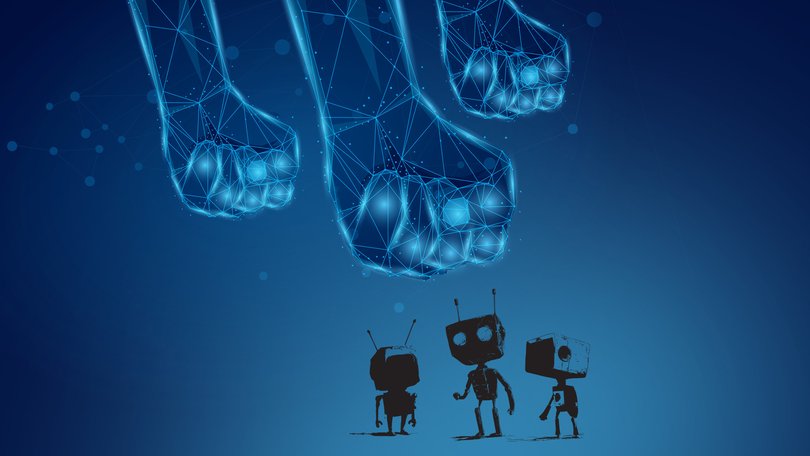

Goldman Sachs has bet on tech’s winners in AI and warned investors that some beaten-up software stocks may have further to fall.

Goldman Sachs has declared the winners and losers in the tech sector, as investors scramble to work out how to profit from the rise of technologies linked to artificial intelligence.

The top investment bank is so confident in its forecast that it has launched a basket of software stocks that bets on companies it expects to rise or fall in value due to the risks and opportunities from AI.

Worries over AI’s potential to disrupt business models mean the S&P/ASX Technology Index is heading for its seventh straight month of losses, with a 20 per cent tumble over just the past month.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Despite the general sell-off, Goldman Sachs says investors can profit from a valuation rebound if they buy businesses in the data centre, cybersecurity, cloud and AI development space.

It also suggests investors should sell or avoid software businesses that sell workflow platforms, which corporate customers may eventually look to replace with AI to save on expensive subscription costs.

Ellerston says AI could split market’s winners and losers

Nick Markiewicz, a leading Australian stock picker and portfolio manager at Ellerston Capital, also warned on Tuesday morning that a widening gap between AI winners and losers will be a key driver of market returns in 2026.

“While we are yet to form a confident view of the lasting impacts of (AI) agentic coding, the (software) sell-off is a reminder of how quickly AI is developing. The market is aggressively re-pricing perceived AI losers in a shoot first, ask questions later manner,” Mr Markiewicz said.

“We are also questioning whether markets may begin placing greater valuation premiums on businesses with difficult-to-replace tangible assets, which is a potential inversion of the past two decades, during which intangible-heavy firms have commanded expanding multiples.”

Tech stocks to buy and sell

In the whipsawed tech space, Goldman Sachs names digital or e-signature business DocuSign as vulnerable to AI disruption, given that some of its large corporate clients could use AI tech to replace its services in the future.

DocuSign’s shares have cratered 83 per cent over the past five years, and it’s among hundreds of former market darlings now getting dumped by anxious investors.

Goldman added that other software businesses that sell products likely to be replicated by AI coding are vulnerable to more competition.

These include language learning platform Duolingo, tech consultancy Accenture, and giant customer sales management system Salesforce.

Goldman Sachs’ predicted winners from AI are cybersecurity companies like Cloudflare, CrowdStrike and Palo Alto Networks because corporates will still demand the highest standards of protection from online crooks looking to steal funds, or data.

The investment bank also said it thinks $US3 trillion computing and software giant Microsoft is a winner for wealth creation, even after its shares tumbled 22 per cent over the past six months on worries that growth at its cloud services business is slowing.

Australian asset manager, Ellerston, is also backing data centre businesses as winners from the booming demand for computing power linked to AI services. It owns small holdings in Australian AI data centre hopeful Firmus, alongside US rivals Nebius, Galaxy Digital, Core Scientific, and GDS Holdings.