Guzman Y Gomez betters forecasts on rush for Mexican breakfasts

The newly-listed fast food group has bettered both earnings and revenue forecasts in its June float prospectus and revealed stronger-than-expected growth for the first weeks of the new year.

Newly-listed Guzman Y Gomez has romped past its prospectus forecasts, aided by customers’ growing appetite for a breakfast burrito.

The fast food group on Tuesday reported that both earnings and revenue for the 2024 financial year bettered the forecasts in its June float prospectus, attributing the result to demand “for clean fresh food delivered at high speed”.

Guzman also revealed it was off to a robust start for the new year, with stronger-than-expected sales growth of 7.4 per cent for the the first seven weeks.

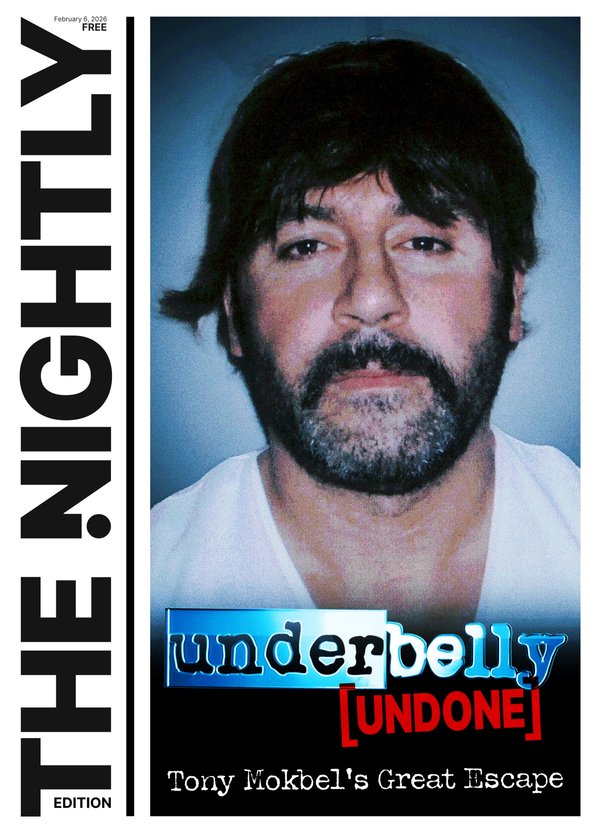

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Its share of revenue from its 216 restaurants in Australia, Singapore and Japan came in at $342.2 million, up 32 per cent on a year earlier and bettering the prospectus by 0.7 per cent.

Sales across the network were 26 per cent better at $948.9m.

Excluding the costs associated with the highly successful $335m initial public offer, net profit was 71 per cent better than tipped in the float at $5.7m.

Guzman attributed the performance to strong comparable sales growth and the expansion of its Australian network, which now numbers 64 company-owned stores and 130 franchise outlets.

Some 103 of those restaurants achieved weekly sales records across lunch and dinner trading during the 12 months to June 30.

Same-store sales growth was up 8.1 per cent for the year, boosted by an 18 per cent jump in breakfast sales on the back of demand from tradies and younger workers on the way to work.

Founder and co-chief executive Steven Marks said attracting more breakfast customers - helped by a stronger coffee offer - would be a major focus for Guzman.

“It’s the best thing that GYG sells,” he told analysts.

“It will be a major focus in the coming months to make sure we drive breakfast sales in our restaurants, which currently sits at about 6 or 7 per cent of our sale.”

He also called out stronger customer growth in the 18 to 35-year-old market. “The younger generation is definitely coming in,” Mr Marks said.

Guzman shares were more than 3 per cent lower at $34.60 at midday, still well above their IPO issue price of $22.