Australian home and car insurance premiums set to rise by at least 10 per cent in 2025 on average

Despite moderating inflation and diminishing claims, experts see home and motor premiums rising by double digits next year, sending insurer profitability skyward.

Cash-strapped householders can expect more pain in 2025 with home and motor insurance premiums to rise by another 10 per cent on average next year, as insurers top up their profits to above the long-term average.

The price rises come as 1.61 million Australian households, or 15 per cent of the total, are believed to be facing extreme insurance stress, which is defined as paying more than four weeks’ gross household income for a policy.

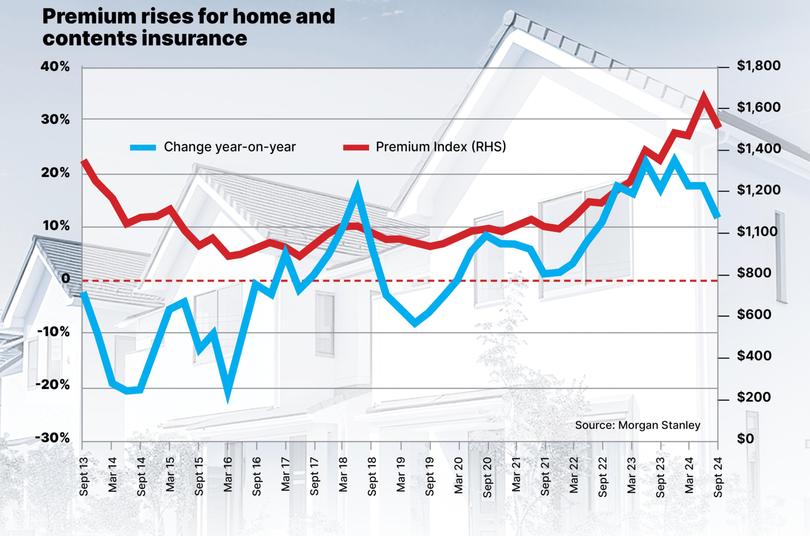

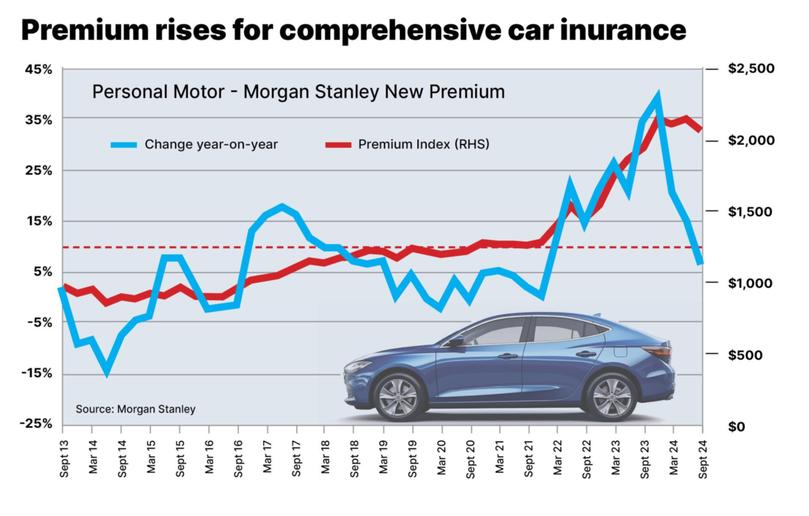

Analysis by actuarial consultants Finity showed that revenue growth — measured by the industry as Gross Earned Premium — is forecast to increase by 12 per cent across both the motor and household insurance sectors in fiscal 2025. It follows a 17 per cent rise in revenue from motor insurance and a 15 per cent rise in revenue from household insurance last financial year.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Private motor insurance revenue grew by a record level in the 2024 financial year, according to Finity, driven by “strong premium rate growth”. In fact, Gross Written Premiums for private motor vehicles have been growing at a rate of approximately 10 per cent per year for the last five years.

For household insurance, Finity estimates “profitability greatly improved in FY24, supported by strong premium rate growth”, following five years of revenue growth of around 11 per cent.

The increase in premium revenue is not driven by an increase in volume, with the number cars of the road and houses built just growing by approximately 1 to 2 per cent annually. That suggests that the forecast rate for premium rises next year will be 10 per cent across the sector. The research doesn’t account for individual pricing.

Insurance premiums are showing up in the national figures for inflation, with the sector reporting one of the highest inflation rates of 6.2 per cent, compared to a national inflation rate of 2.8 per cent.

The bump in profitability for insurers comes after a number of years of poor profitability thanks to extreme weather events, such as the Lismore floods, inundating insurers with claims.

“Household insurance was actually loss-making for four years straight, so this is the first time it has made money in five years. Private motor hasn’t been too bad. Prior to 2024 there were very small profit margins, and it’s this year that the profit margins increase,” said Finity’s Pravesh Ponna.

Insurers also argue that the premium rises are required to offset the cost of replacement, repairs and maintenance where there has been significant inflation in the cost of labour, building materials and motor vehicle spare parts.

But as supply chains open up, much of the cost inflation for parts and materials has eased.

Speaking at their investment day, Australia’s largest insurer IAG said that they expected moderation to continue to ease into next year, meaning that the price hikes should flow substantially through to the bottom line. IAG, which operates NRMA, RACV and will soon be operating RACQ insurance, is targeting a 15 per cent margin across the business. Macquarie Research calculates home and motor insurance are two of the “most profitable” products for IAG and arch rival Suncorp - together the pair control more than 50 per cent of the market.

For the year to date, total shareholder returns for IAG are up 55 per cent, Suncorop is up 50 per cent and QBE is up 40 per cent.

Watchdog taking note

The industry regulator is keeping a close eye on the sector as part of its mandate next year to assist consumers suffering from cost of living pressures.

“How insurers deal with their customers will be a priority area for us in 2025. Insurers are required by law to treat their customers fairly and in good faith. Where ASIC finds them not doing so, we have shown we are willing to take serious enforcement action,” said Australian Securities and Investment Commissioner Alan Kirkland.

“If insurers are using cost inflation as a reason to justify premium increases, then the opposite should apply. If inflation moderates, then consumers have a right to expect the rate of increase in premiums will reduce. Insurers can’t have it both ways,” he said.

Insurers have already been in ASIC’s crosshairs recently over their application of loyalty discounts.

In October, ASIC sued insurer QBE for misleading consumers about the value of discounts offered on home, contents and car insurance, while Insurance Australia Group and RACQ were fined $40 million and $10m respectively for similar behaviour. In the QBE case, ASIC alleges half a million customers were offered discounts that in some cases were completely eroded by the insurer’s pricing model.

Mr Kirkland said that the discounting process was one of the reasons insurance pricing was so opaque.

“Discounting makes it really hard for consumers to understand if they are getting a good deal and to shop around and compare prices. The range of discounts, and no claims bonuses make it really hard to put policies side by side and work out which is the best deal,” he said.

How to ensure a good deal

Avoiding the “loyalty tax” was an important way to ensure they got the best pricing, Mr Kirkland said.

“The general rule is the longer you’ve been with your current insurer, the more likely it is you are paying more than you need to,” he said. “You can often secure significant reductions in premiums by shifting to a new insurer or even just threatening to do so.”

Consumer advocates Choice said it was critical to shop around, but warned against relying on comparison websites which may have contracts with, or be actually owned, by insurers.

Choice’s insurance expert Uta Mihm said the differences in premiums between providers could be over $1000 and recommended first getting an online quote from your own insurer before approaching three or four other companies.

She also suggested either increasing the excess, or paying out of pocket for smaller claims.

“If it’s a $1,000 claim on your car for instance, it’s quite often not worth claiming it because you will pay more on premiums if you do that,” she said.

Ms Mihm suggested that consumers make use of discounts for switching, or signing up online, but IAG has found that often customers quickly come back.

Speaking at IAG’s investment day, NRMA Insurance head Julie Batch said the amount of discounting in the market was a concern but “once they go through that first cycle, those customers return to us.”

The big factor likely to affect premiums as inflation eases is expected to be what happens over the summer storm season, according to IAG. Catastrophic events like the Lismore floods are one of the key concerns of the industry.

“Climate change increases the number of events and the cost of those events but also increases the volatility,” Mr Ponna said.

“Insurers might expect a stronger return for that volatility, or it costs them more money to buy reinsurance,which means over the medium term, prices, particularly for households, will have to continue to increase.”