How AI is transforming Australian companies from the largest corporates to the smallest business

Australia’s productivity has been poor for almost a decade, so could AI be the answer to fixing our stubborn problem?

In the International Monetary Fund’s most recent review of the Australian economy, released this week, a standout concern was the continued issue of low productivity.

It matters greatly, because productivity is a key factor in how the Reserve Bank thinks about interest rates.

If productivity is high, businesses are getting more output per worker. That means prices rise more slowly than wages, which keeps inflation in check, or even allows businesses to reduce prices.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The RBA’s most recent minutes revealed how concerned the Board is about productivity in not only the public service, but in the corporate sector as well.

“There was a broad-based pattern of productivity growth in Australian industries having been below rates recorded by comparable industries in the United States,” the Bank said.

“Members discussed the implications for inflation of persistently weak productivity growth. They noted that these would depend on whether aggregate demand and wages growth also slowed commensurately, thereby limiting inflationary pressures, or not.”

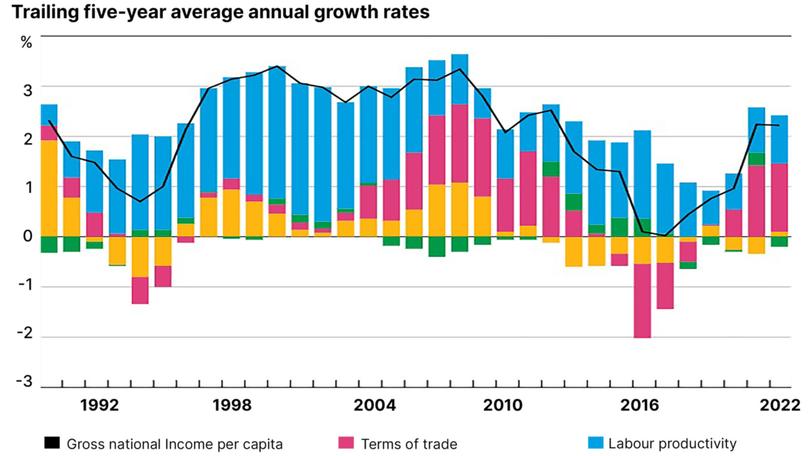

Australia’s productivity peak came in the wake of the Hawke-Keating reforms of the early 1990s which saw productivity grow by 2 per cent annually, fuelling disposable income growth of 3 per cent per year. Those days are long gone. In the September quarter, productivity fell 0.5 per cent and is now down 0.8 per cent over the year.

Part of the reasons for the fall is the fact that Australia kept businesses alive over the pandemic, meaning unproductive companies continued to operate. The other factor is high migration amid low unemployment, which has meant businesses have been hiring less skilled workers.

According to the OECD, Australia sits at the bottom of the pile in terms of labour productivity compared to the rest of the OECD, below Japan, below Germany and well below Greece.

But Australia’s productivity has been poor for almost a decade, with McKinsey finding business investment in new tools and equipment at 1990s recession era levels.

And the problem is going to get worse. While the OECD figures point out the poor productivity figures in Australia, their recent global outlook shows that it will be an issue across the world as an ageing population sees skilled workers enter retirement.

“Over the past decade, job vacancy rates have nearly doubled, with particularly sharp increases in sectors like healthcare and ICT,” the OECD said about the global economy. “Population ageing is exacerbating these shortages and is expected to accelerate in the coming decades . . . (and) can impede economic growth.”

Warren Hogan, economic adviser to Judo Bank, says the demographic distribution due to an ageing population means we are now in a world of labour scarcity.

“The world has fundamentally changed in the last five years and COVID supercharged it,” Hogan says.

“Demographic change takes about 10 to 15 years to manifest itself in the economy, and the baby boomers who started retiring about 10 years ago has been supercharged. We’ve gone from 60 years where every year we got more and more labour supply and so labour was abundant, to labour shortages as the structural, persistent issue.”

Hogan believes “AI is going to save the day” by freeing up workers from rote, repetitive tasks and allowing for the creation of income generating ideas.

“This is the great promise that we can really supercharge our living standards once again, and it will happen. It’s already happening in the US,” he said.

Banking on AI

Commonwealth Bank says that an AI supercharged world is coming faster than most people think.

The bank is deploying AI agents across a suite of products to assist retail and business customers.

Using AI, Commbank is now sending 20-30,000 proactive messages a day to warn customers of potentially fraudulent activity. AI agents can negotiate refunds for purchases made via a CBA credit card, or compare travel insurance coverage.

Ultimately, the bank thinks that 90 per cent of call centre could be handled by AI-powered chat bots.

“The technology that we have seen over the last six to nine months has the potential to be quite transformational,” Commbank CEO Mr Comyn told attendees at the recent unveiling of their expanded artificial intelligence-powered tools.

The business bank is also seeing plenty of use cases. Using AI, Commbank can ingest the Business Activity Statements of a small business, enabling it to approve loans in under 10 minutes. AI tools can help reduce the time taken to conduct a legislated annual review of borrowers from two days to less than an hour.

Commbank believes the power of AI is the ability to instantly scale operations. The 20-30,000 fraud alerts that it currently sends can be up-weighted to 50,000 with no extra effort.

The bank is feeding 157 billion data points into its AI model, with each interaction an opportunity to learn more about a customer and tailor services to them.

AI’s most practicable use so far is its ability to sort vast amounts of information at scale.

At US-based Dow Jones Factiva, AI is powering summaries from almost 4000 publishers across 160 countries and 29 languages, absorbing 600,000 articles daily and sorting three billion pieces of content from the archive.

Via a partnership with Google Gemini, its AI-generated news feed is powering chatbots and newsletters with verified copyright content allowing its finance-heavy subscriber base to conduct investigative due diligence on verified content in as little as five minutes.

In an increasingly regulated world, AI may be the solution to ensuring that compliance does not become stifling, said Traci Mabrey, General Manager, Factiva.

“An automated solution of risk management is critical to banks to maintain their ongoing due diligence needs. The data within Factiva is quite key for both reputational risk consideration as well as regulatory risk considerations, and we want to leverage generative AI for both of those areas,” Ms Mabrey told The Nightly.

Worker adoption critical

While hundreds of billions of dollars had been poured into AI, and the data centres that host it, the adoption in the workplace had still been relatively slow.

A survey by the Australian Industry Group found that while half of businesses had made some efforts to adopt the technology, there was a lack of necessary workforce skills to implement technology.

The biggest adopters were large corporates focused on services, while small and medium businesses were slower to adopt showing take-up of 31 per cent and 41 per cent respectively.

But the real-world applications that are happening behind the scenes are both frightening and awe inspiring.

Two separate firms I have spoken to this week explain how the technology will disrupt jobs and create new opportunities.

The first example comes from talking to an AI developer who was given the task of training a model to recognise images of invoices and expenses and match them to the claimed transaction amount.

The reconciliation process required 1200 image-checking workers. With two weeks of AI prompting and coding, the entire workforce was no longer needed.

Those workers had fairly low skilled jobs but a different example demonstrates how they can become higher-skilled using AI technology.

Another company operates an outsourcing business that takes on back office functions for a variety of other firms, from large to small.

The workers in the Philippines and other lower-wage countries, ordinarily would only be able to deal with highly documented tasks to ensure they don’t make mistakes. But the outsourcing company is rolling AI out to their clients and are finding they have “upskilled” these remote workers to conduct tasks that would previously be well beyond their remit.

“Administrative or support services” jobs have been the largest growing segment of employment for the past thirty years according to the Australian Bureau of Statistics.

If tasks can be increasingly outsourced to AI, or to outsourced workers using AI, then the nearly two million people who work in the sector, once public sector admin jobs are included, then a large part of the workforce may need to be redeployed.

It may be no bad thing, Warren Hogan said, if AI picks up administrative tasks to free people up to care for the sick and elderly, although it won’t make the productivity numbers any better as calculating income in the ‘care economy’ is very difficult.

Matt Comyn at Commbank is already looking at that future.

“If we can harness what AI has got to offer, this is going to be as big as any of the other previous industrial revolutions. And we need it because we’ve labour shortages now. We’ve got all these retirees coming through who continue to want services, but we have less and less people to service them,” he said.

“Generative AI should have a positive effect on productivity and not just in Australia. Things that we produce in any economy will be able to be done in a more automated and productive fashion.”

The big step change, Comyn thinks is when the technology moves beyond the automated and into the era of science fiction.

“If you look more broadly in medical research and life science, there may be 100 years worth of scientific discovery in the next 15 years. There’s some really hard problems to be solved outside of banking and I think there’s certainly cause for optimism.”