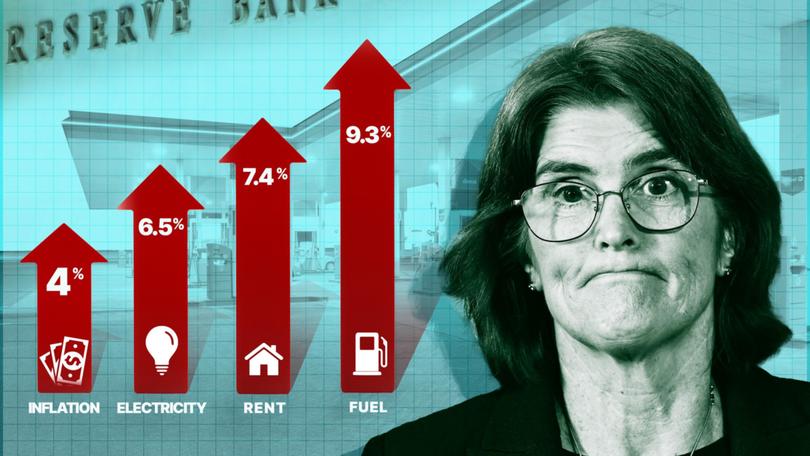

Inflation ran at 4 per cent in the year to May as fuel and power bite

Top economists reckon pressure for an August rate hike is rising after a “shocker” inflation reading which showed consumer prices up 4 per cent in the 12 months to May.

A “shocker” inflation reading has led some economists to shred their cash rate forecasts and sparked warnings of an August rate hike.

Prices rose 4 per cent in the year to May, up from April’s 3.6 per cent — a movement in the wrong direction for the Reserve Bank’s inflation war.

Investment bank UBS forecast an August rise with the risk of more, while Betashares chief economist David Bassanese said the result was a “shocker” which would put pressure on the RBA to lift rates.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Fuel was up 9.3 per cent for the year, the Australian Bureau of Statistics data showed.

Rents rose 7.4 per cent — a slightly slower pace than the prior month — and electricity 6.5 per cent.

Mr Bassanese said inflation remained “stuck” at an uncomfortably high level.

“To an extent, many of Australia’s lingering inflation pressures come despite weak consumer spending – and reflect the consequence of longstanding Federal and State government policy failures in the areas of housing, energy and social services,” he said.

Moody’s Analytics said a rise at the August meeting could not be ruled out.

Economist Harry Murphy Cruise said Australia was “on the cusp of a host of new cost-of-living relief and tax cuts coming into force next month”.

“The scale and breadth of those policies risk injecting a bunch of new spending into the economy as the Reserve Bank of Australia desperately tries to tighten households’ purse strings.”

He said the cash would likely leave bank accounts “just as quickly” as it hits. EY said an August lift was “not out of the question” but the KPMG said the central bank would “remain steady”.

Yet ABS head of price statistics Michelle Marquardt said volatile price changes in fuel, fruit and veggies and travel had affected the data.

“It can be helpful to exclude these items from the headline CPI to provide a view of underlying inflation, which was 4 per cent in May, down from 4.1 per cent in April,” she said.

While the May figure was higher than expected, the RBA prefers to focus on that underlying inflation data.

Treasurer Jim Chalmers said that data — which strips out volatile numbers — had moderated.

“We know people are under substantial pressure, but the ABS clearly confirmed again today that inflation would be even higher if it wasn’t for our cost-of-living policies,” Mr Chalmers said.

He said power bills would have been up 14.5 per cent without relief. Rents would have been 9.3 per cent higher without changes to rent assistance, Mr Chalmers said.

But the Federal Government has faced criticism for stepping on the pedal with new spending measures before the inflation fight was over.

Shadow treasurer Angus Taylor added to the heat on Wednesday morning, saying core inflation was higher than other big economies and rising.

“This is what happens when you have a big spending Labor government that’s completely out of touch with the economic reality,” Mr Taylor said.

Earlier, assistant governor Chris Kent said the RBA must remain vigilant about fighting inflation, which he said hits lower income households especially hard.

The monthly ABS numbers are a prelude to quarterly inflation data at the end of July, which will be key when the Reserve Bank of Australia next meets in August.

Markets were on Tuesday projecting a 10 per cent chance of a cash rate hike from the RBA board at that meeting.