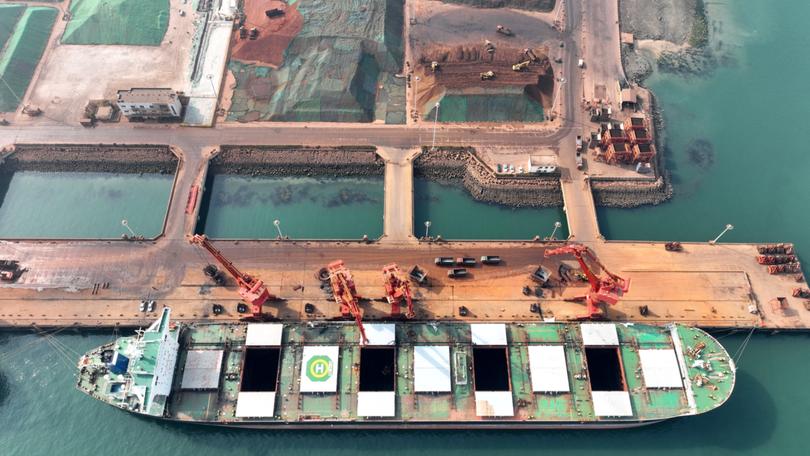

Iron ore slumps for fifth time as China property crisis spurs demand concerns

Iron ore’s poor start to 2024 continued as benchmark futures in Singapore dropped for the fifth time in six sessions yesterday.

Iron ore hit a three-month low as the upcoming Lunar New Year and ongoing property market crisis cast a shadow over Chinese demand.

Benchmark futures in Singapore dropped for the fifth time in six sessions yesterday, sinking below $US124 a tonne overnight Tuesday to hit the lowest intraday level since early November. Hot-metal production in China is muted, with pre-holiday steel demand generally weak, according to Huatai Futures Co.

The nation’s property market — the largest driver of steel demand — continues to face liquidity woes. More than 1000 projects in 25 cities are seeking 373 billion yuan ($80 billion) in funding, according to a tally by Bloomberg Intelligence, which said it showed “the grave need for finance”.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Iron ore has suffered from a poor start to the new year, retreating by about 11 per cent in one of the weakest performances among major commodities. The steel-making staple has been dragged lower by China’s as-yet-unfixed property woes, as well as signs of abundant supplies from Brazil.

Construction-led steel demand is expected to drop to lower levels given that the Central Committee of the Chinese Communist Party aims to reduce leverage in the property sector, according to DBX Commodities.

Iron ore traded will open on Thursday morning at $US125/t. In steel markets, rebar futures and hot-rolled coil in Shanghai both touched the lowest intraday levels since November on Wednesday.

On the London Metal Exchange, prices were mixed. Nickel headed for its first close below $US16,000/t in almost three years, while tin, copper, lead and zinc edged higher.

Bloomberg