RAIZ INVEST: The Australian companies seeing the biggest increase in shares traded at the end of FY24

The end of FY24 has seen some big movers and shakers in share trading. Here’s our pick of the best.

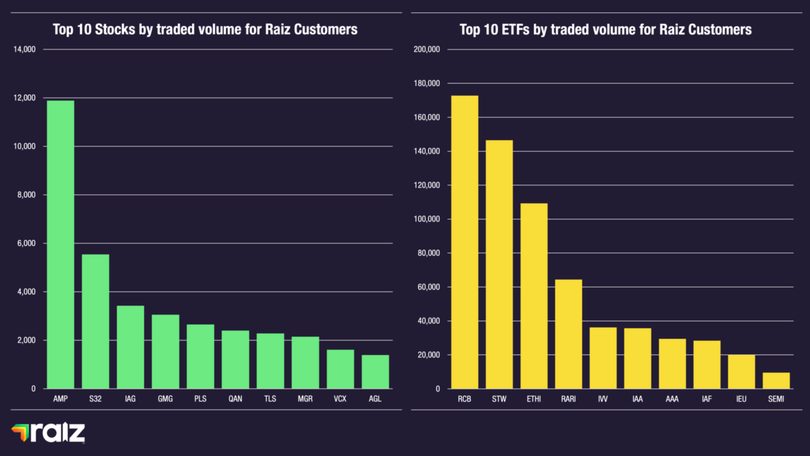

The end of FY24 has led to some big movements in the top ten stocks at Raiz with some seeing a more than 200 per cent increase in shares traded.

Trading overall for the week was 36,363 which was a 10 per cent increase on the top 10 of the week prior.

Leading the charge was Insurance Australia Group ($IAG) which stormed into third position with a 223 per cent increase in shares traded. The company hasn’t been seen in the top 10 for a few weeks now. The boost follows an announcement by the insurer of a significant deal with US-listed Berkshire Hathaway, of Warren Buffett fame.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The agreement is said to provide IAG with reinsurance protection against natural perils. It’s been a solid investment this year, with shares up over 20 per cent on the year.

Goodmap Group ($GMG) is another corporation storming into the top 10 with a 209 per cent increase in shares traded. The real estate investment trust (REIT) was the best performing ASX20 stock of 2024, with shares up over 73.8 per cent as of market close on June 28. The company is set to benefit from the AI boom due to its data centres which now represent over a third of its work-in-progress pipeline.

REITs in general outperformed the broader market over the last financial year with the sector posting a total return of 24.7 per cent against 13.5 per cent. Most of this is being driven by those data centres as office tower valuations have been the downfall for some of the other REITs on the exchange.

In fact, two other REITs on the ASX, also boosted their position amongst Raiz Investors, with Mirvac Group ($MGR) and Vicinity Centres ($VCX) both appearing in the top 10 this week. Mirvac was up 144 per cent shares traded and Vicinity was up 145 per cent. Interestingly, Mirvac was one of the REITs that dragged down the sector due to its overexposure in office towers which still haven’t come back since COVID-19 sent everyone to work from home.

Pilbara Minerals ($PLS) maintained its position in the top 10 with a 105 per cent increase in shares trading, bringing it into the top 5. On the flip-side, the real laggard of the top 10 this week was AGL Energy ($AGL) that managed to cling to the 10th stop, even after a 70 per cent drop.

Still that was better than Origin Energy ($ORG), Treasury Wine Estates ($TWE), Medibank Private ($MPL) and Fortescue Metals ($FMG) which all crashed out of the top 10 list.

The ETF market also saw a 6 per cent increase in units traded amongst its top 10 despite not a huge amount of movement. Only one ETF dropped off the board from last week, the BetaShares NASDAQ 100 list which last week was number 8. Sneaking in instead into the tenth position was the Global X Semiconductor ($SEMI) which has featured in the list before.

The top four ETFs all maintained their positions this week, but instead of dropping saw an increase in their units traded. That was driven by BetaShares Global Sustainability Leaders ($ETHI) and the Russell Investments Australian Responsible Investment ($RARI) which were up 33 per cent and 28 per cent respectively.

The big drop this week was the BetaShares Australian High Interest Cash ($AAA) which dropped from 5th to 7th with a 34 per cent decrease in shares traded.

The information contained in this email is general information only and does not take into account your financial situation, objectives or needs.

Raiz Invest Australia Limited – Authorised Representative of AFSL 434776. The Raiz Invest Australia Fund is issued in Australia by Instreet Investment Limited (ACN 128 813 016 AFSL 434776) a subsidiary of Raiz Invest Limited and promoted by Raiz Invest Australia Limited (ACN 604 402 815). PDS and TMD are available on the Raiz Invest website and App. You should read and consider those documents before deciding whether, or not, to acquire and continue to hold interests in the product.