Raiz investing report: Bega Cheese tops trades along with property investment company GPT Group

In a relatively flat final week of August, trading in an Aussie cheese-making company surged on the back of a stark turnaround in the company’s profit margins.

Reporting Season is almost done and dusted for Australian investors, and many have spent the time searching for new stocks.

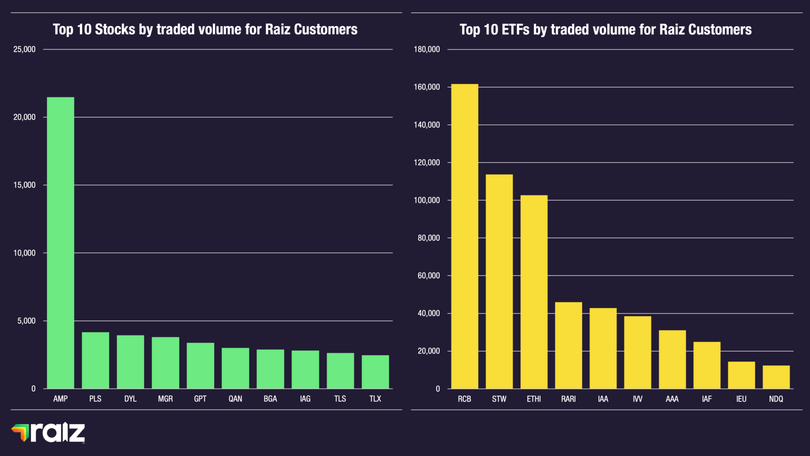

Investing on Raiz was relatively flat in the final week of August, with just a 3 per cent drop in overall trading among the top 10 stocks for the week.

Trading in Bega Cheese ($BGA), however, surged, with a 262 per cent boost in shares traded following last week’s financial results. The company managed to turn around its profit, reporting a net income of $30.5 million, compared to last year’s loss of $229.9m. This was primarily driven by its branded segment, which contributed 86 per cent of total revenue.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.For traders, the biggest news was perhaps the final dividend of 4 cents per share, up 33 per cent from last year’s 3 cents. This brings the full-year dividend to 8 cents per share, an increase from 7.5 cents.

GPT Group ($GPT) also experienced a significant rise in trading, up 206 per cent over the week. The property investment company experienced an uptick in its share price following a strong interim result a couple of weeks ago. It hit 52-week highs, thanks to its portfolio, valued at $32.4 billion, which led to upgrades from broker houses.

Morgan Stanley rated it as “outperform,” giving it a price target of $5.60, with its current price hovering around $5.

Raiz favourite Pilbara Minerals ($PLS) maintained its position in the top three, with a 164 per cent increase in shares traded over the last seven days. The lithium miner has had a tough year, with its share price down 34 per cent year-to-date. However, there is still a bull case for the company given its lithium exposure.

The company increased its production, secured a new debt facility, and could pursue new growth opportunities. All of this, though, hinges on a rebound in lithium prices, and it’s anyone’s guess as to when that might happen.

The only negative among Raiz’s top ten was Telix Pharmaceuticals ($TLX), which saw trading in its shares drop by 73 per cent. However, the company saw a massive boost on the Raiz platform following a 65 per cent half-year revenue surge and a net profit of $US30m. It’s a huge financial turnaround for the company, which had previously reported a loss. So, a drop this week comes after some major highs, still keeping it above other weeks on the platform.

The ETF market on Raiz this week was more stable, with few movements across the board. The biggest increase was 23 per cent in the Betashares Global Sustainability Leaders ETF ($ETHI). Right behind it was the Russell Investments Australian Responsible Investment ETF ($RARI), which saw a 21 per cent rise in traded units. There has been a flurry of climate news this week, including the Australian government detailing its plan to reach net zero by 2050. By investing in these ETFs, investors may be looking to hedge their bets by supporting companies aiming to help Australia reach net zero.

The biggest fall in the ETF market was the Betashares Nasdaq 100 ETF ($NDQ), which saw a 16 per cent decline in traded units. There has been a recent tech sell-off in the US, with tech giant NVIDIA seeing its shares drop by 12 per cent over the last seven days, wiping off approximately $250b in market cap. The index is currently at a two-week low, which could signal an exit point for some investors.

The information contained in this report is general information only and does not take into account your financial situation, objectives or needs.

Raiz Invest Australia Limited – Authorised Representative of AFSL 434776. The Raiz Invest Australia Fund is issued in Australia by Instreet Investment Limited (ACN 128 813 016 AFSL 434776) a subsidiary of Raiz Invest Limited and promoted by Raiz Invest Australia Limited (ACN 604 402 815). PDS and TMD are available on the Raiz Invest website and App. You should read and consider those documents before deciding whether, or not, to acquire and continue to hold interests in the product.