Coalition doubles down on production tax credit attack as China’s Tianqi pleads for a taxpayer handout

A Chinese lithium refiner that owns a big stake in a WA mine that delivered a $6.3 billion profit last year is begging the Federal Government to give it a tax break.

A Chinese lithium refiner that owns a big stake in a WA mine that delivered a $6.3 billion profit last year is begging the Federal Government to give it a tax break.

Tianqi Lithium on Tuesday hosted China’s Premier Li Qiang, WA Premier Roger Cook, and Federal Resources Minister Madeleine King at its majority-owned Kwinana lithium hydroxide plant. Perth-based IGO controls the remaining 49 per cent stake in the plant.

The visit, which Prime Minister Anthony Albanese was also meant to attend, came a day after Tianqi chief executive Frank Ha told another media outlet that his company “deserves” to qualify for a production tax credit.

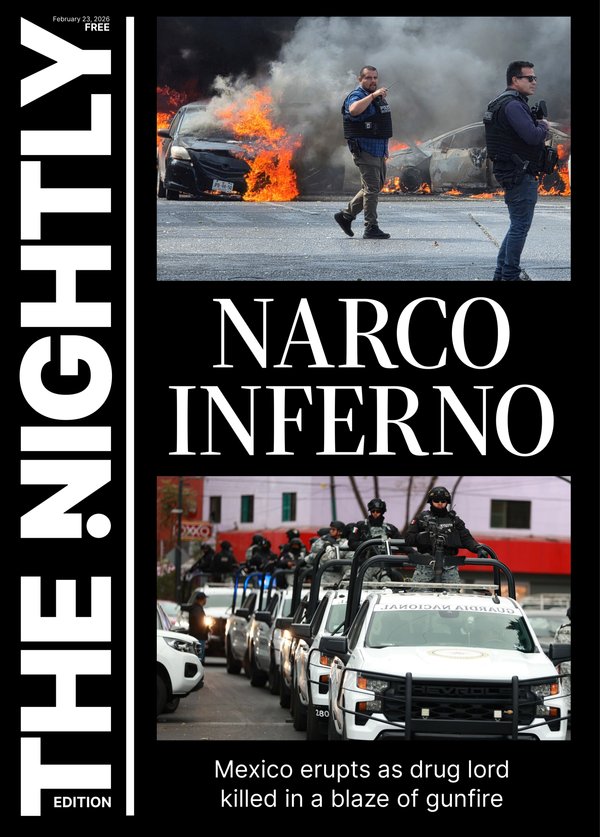

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The 10 per cent tax break for processors of critical minerals, which includes lithium, was announced in the May Budget and is set to cost $7.1b over the next decade, and then another $10.6b until 2041.

The coalition has said the tax relief is simply “billions in handouts for billionaires” and on Tuesday shadow minister for resources Susan McDonald renewed calls for the policy to be scrapped.

“The coalition has made it clear that we do not support Labor’s production tax credit because it does not stack up,” she told The West Australian.

“The biggest risk facing the mining sector at the moment is the layers of poor policy from this Government, including their damaging industrial relations laws, the safeguards mechanism, EPBC changes and slow approvals timelines, and the biggest risk, skyrocketing energy prices.

“Labor’s production tax credits do nothing to fix these issues.”

Meanwhile, the boss of the Association of Mining and Exploration Companies — the industry group that spearheaded the policy — supports Tianqi being included among the tax credit recipients.

“The massive investment in Australia from companies like Tianqi far outweighs the incentives being offered by the Federal Government,” AMEC chief executive Warren Pearce said.

“The fact that China has sent Premier Li Qiang to Western Australia, shows how important we are to their country. That relationship should not be taken for granted.”

Tianqi owns 26 per cent of the huge Greenbushes lithium mine, 250km south of Perth, which raked in $6.3b of profit for its owners in 2023. The Chinese giant therefore effectively received a $1.64b dividend windfall.

While Greenbushes has been a raging success for Tianqi, the $1b Kwinana plant it uses to refine the spodumene concentrate from the mine into lithium hydroxide has been plagued by technical issues.