Electricity price a barrier to making Fortescue’s green hydrogen dream a reality

Fortescue’s energy boss Mark Hutchinson is resolute on green hydrogen despite an admission electricity cost targets for projects in Australia are ‘not possible’ right now.

Fortescue’s energy boss Mark Hutchinson is resolute on green hydrogen despite an admission electricity cost targets for projects in Australia are “not possible” right now, as iron ore shipments miss guidance for the year.

The Andrew Forrest-chaired miner reported results for the final quarter of 2024 on Thursday, a week after 700 corporate staff were laid off as it struggles to bring established iron ore operations in the Pilbara and a raft of global green hydrogen and renewables projects under one banner.

At the same time Fortescue had walked back a goal of producing 15 million tonnes of green hydrogen by 2030, a target Mr Forrest said the division would achieve “eventually”.

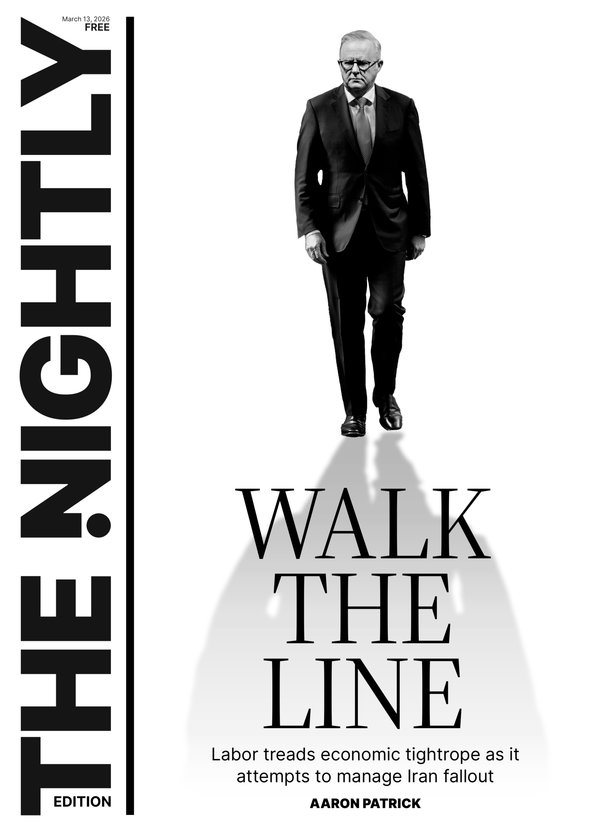

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr Hutchinson, who was brought in to spearhead the energy business in 2022, affirmed to analysts that Fortescue was “steadfast” in its commitment to green hydrogen, but that projects were “not viable” while electricity costs remained outside the $US30 ($45.70) range.

“We’ll never do projects that are not economically viable,” he said.

“As the green hydrogen market develops around the world, it is really clear that the cost of green power … has to be in the $US30 range to make projects viable.”

He conceded this price target was “not possible” in Australia “at the moment”.

“In Australia it’s difficult … on the west coast we think we can do that over the shorter term, and on the east coast obviously a bit longer. But those prices are not possible at the moment.”

Fortescue is expected to plough $US500 million of new capital expenditure into hydrogen and renewables in 2025, while operating costs of running the division are expected to be $US700m.

Meanwhile in its revenue-driving iron ore division, the miner shipped a record 53.7 million tonnes in the three months to the end of June — 10 per cent higher that the same quarter a year earlier — which pulled up full-year exports to 191.6mt, just short of the previous year’s 192mt.

This marked a rare full-year export guidance miss for the Pilbara major. It was also outside of Fortescue’s target of between 192mt and 197mt.

Shipments were curtailed by a train derailment on December 30 last year when at least 40 empty wagons left the tracks 150km south of Port Hedland. The miner blamed soaring temperatures which had buckled the tracks.

The derailment cut Fortescue’s transport link to the Herb Elliott Port in Port Hedland, the export gateway for its three iron ore mining hubs.

And in a sign it expects further problems ahead, Fortescue has lowered the bottom end of full-year guidance for this financial year to 190mt, with a top target of 200mt.

Fortescue received an average of $US103/t for its Pilbara iron ore over the full year while higher-grade magnetite from its underperforming Iron Bridge joint venture with Formosa Steel achieved an average of $US137/t.

The cost to produce a wet metric tonne of hematite iron ore in FY25 is expected to rise to between $US18.50 and $US19.75/t, compared with an average $US18.24/t in FY24.

Iron ore prices dipped below the $US100 a tonne mark this week, in what was attributed to a lack of new major infrastructure stimulus from China.

Reporting back on sentiment during a visit to customers in China, Fortescue’s iron ore boss Dino Otranto said its Pilbara product was in “great demand” and that property had been “overrepresented” as a consumer for the steelmaking commodity.

Fortescue shares were down 3.6 per cent on the update to $20.56 at 9.50am.

Originally published as Electricity price a barrier to making Fortescue’s green hydrogen dream a reality