Fortescue exports derailed in first quarter as wait goes on for long overdue green projects

Bad weather and a train derailment on Fortescue’s Pilbara rail network just a day before the end of 2023 battered iron ore exports from the Andrew Forrest-led miner in the first three months of the new year.

Water issues and a train derailment on Fortescue’s Pilbara rail network just a day before the end of 2023 battered iron ore exports from the Andrew Forrest-led miner in the first three months of the new year.

Wednesday’s release of March quarter figures confirmed the ore car incident on December 30 had left a dent in shipments, which fell 6 per cent from a year earlier to 43.3 million tonnes.

It is understood up to 40 cars left the track south of the Herb Elliott Port in Port Hedland and blocked the flow of iron ore to the miner’s only export hub for four days.

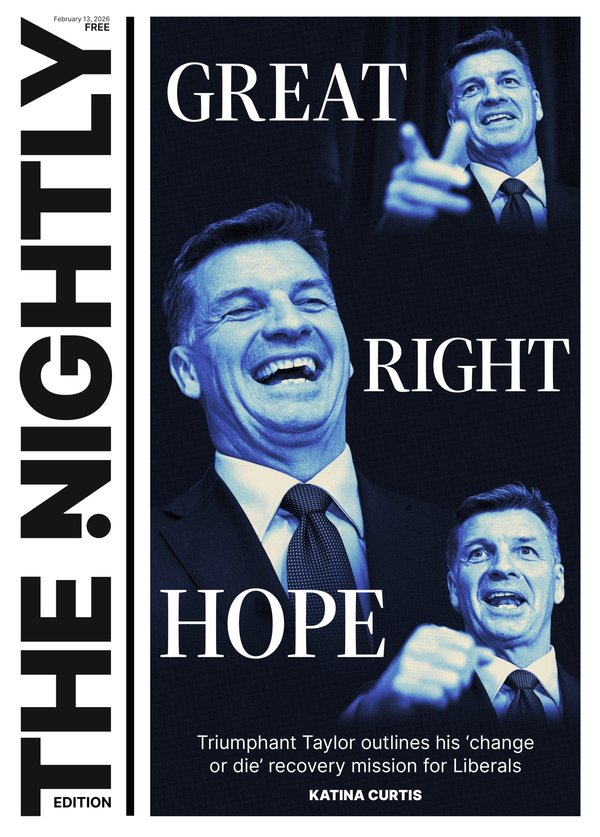

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The miner also blamed “weather disruptions” in the Pilbara for curtailing output.

Fortescue noted shipments later recovered, with a record month for exports of 18.7mt last month.

But the lower volumes over the three months saw costs increase 7 per cent on the previous quarter to $US18.93/t. It achieved average revenue of $US104/t — 85 per cent of the average Platts 62 per cent CFR Index.

Higher quality magnetite iron ore from Fortescue’s troubled Iron Bridge magnetite project achieved revenue of $US145/t.

In January, Fortescue was forced to cut expected output from Iron Bridge and cough up an extra $US100 million ($152.2m) to deal with a water pipeline issue, the latest in a string of setbacks and cost blowouts plaguing the project.

On Wednesday, Fortescue chief executive Dino Otranto pinned the pipeline issue on a “manufacturer quality” problem but declined to elaborate further.

Fortescue has maintained full-year shipment guidance of between 192mt and 197mt, with the total expected to be at the lower end of the forecast due to the derailment and weather disruptions.

But after the derailment setback, to achieve even the lowest end of the range Fortescue will need to break its export record each month for the three months to the end of June.

Questions also remain over the ability of the miner’s cash-guzzling green energy arm to deliver on long-overdue clean power promises.

Deadlines for a string of clean hydrogen projects have lapsed and energy division chief executive Mark Hutchinson gave little hint that any projects would be announced in the near-term, saying only that “the pipeline of green energy projects continues to develop”.

Mr Hutchinson was quizzed further on an analyst call about the ability of the company to hit its key clean energy targets — such as 15mt of green hydrogen production by 2030 — given the delays and lack of tangible detail over its future developments.

“We totally believe we’re gonna get there … we’re very confident that’s going to happen,” he said.

Fortescue held $US4.1 billion in cash at the end of the March quarter, down from $US4.7b at December 31, while net debt doubled to $US1.2b.

The weakening cash balance and growing debt left some analysts questioning whether Fortescue’s FY2025 dividends will shrink significantly, given the company has indicated it will ramp up its spending spree on green energy projects in the coming years.

Mr Otranto did not divulge the miner’s future pay-out plans.

“We’ll give guidance in due course,” he said.

Shares in Fortescue were down 1.7 per cent to $24.18 in early trade.

Originally published as Fortescue exports derailed in first quarter as wait goes on for long overdue green projects