Rio Tinto steadfast on Aboriginal ties as Argyle diamond mine closure costs balloon nearly 50 per cent

The clean-up bill for the famed Argyle diamond mine will be about $270 million more than Rio Tinto originally planned, but the mining behemoth’s financial commitment to traditional owners is unshaken.

The clean-up bill for the famed Argyle diamond mine will be about $270 million more than Rio Tinto originally planned, it can be revealed, but the mining behemoth’s financial commitment to traditional owners is unshaken.

Rio Tinto closed the curtains on mining at Argyle in November 2020, after extracting more than 865 million carats of rough diamonds across 37 years of operation.

The mine in WA’s remote East Kimberley region was renowned for its unparalleled endowment of pink and red diamonds, which are ultra-rare colour varieties of the gem that can fetch millions of dollars per carat.

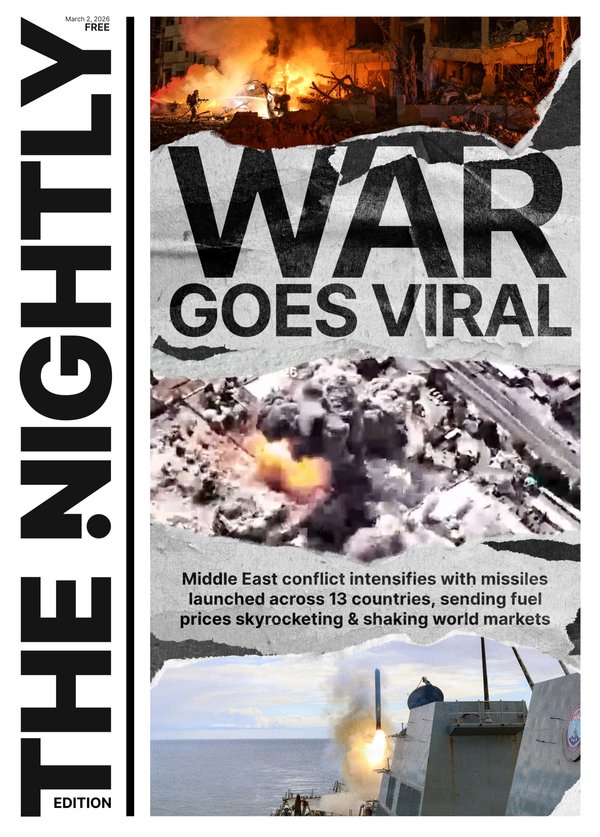

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.When Argyle was switched off Rio provisioned $578m in rehabilitation costs for a process it said at the time would take “at least five years”.

The West Australian understands this provision is now approximately $850m, with $300m spent by the end of last year.

Sources say the substantial spike in forecasted costs is largely a combination of general inflationary pressures, difficulties sourcing specialised labour and equipment, plus managing unforeseen issues related to the adjacent Lake Argyle.

A Rio spokesman said the Argyle closure project will begin to wind down in the latter half of next year.

“It is expected to be completed in 2026 and be followed by an extended period of monitoring,” he said.

Despite the cost crunch, Rio is seemingly not hitting the brakes on contracts with local Aboriginal groups.

The miner expanded its cash outlay to traditional owner businesses at the project from $21m in 2022 to $33m last year.

The Rio spokesman said feasibility studies for Argyle’s rehabilitation had estimated the total spend with traditional owner enterprises at circa $69m.

“We have been able to meet this target as at the first quarter of 2024,” he said.

“Through close collaboration with traditional owner businesses, contract partners, traditional owners and their representative organisation – Gelganyem, we have so far awarded contracts worth over $120m.”

This equates to 40 per cent of the total siteworks and services expenditure for the project by the end of 2023.

The Argyle operation supplied 95 per cent of the world’s pink diamonds in its heyday, leading to a highly constrained supply of the prized gems globally once the mine was exhausted.

Rio has been steadily auctioning off the remaining stockpile to capitalise on the market deficit.

Argyle is not the only rehabilitation challenge the Anglo-Australian miner is facing in the top end of our country.

Earlier this month, Rio was handed the reins by Energy Resources of Australia to manage the Ranger uranium mine rehabilitation project in the Northern Territory’s Kakadu National Park.

ERA, which Rio effectively controls with its 86.3 per cent stake, has already warned investors the clean-up cost would “materially exceed” the $2.2 billion initially calculated.

Ranger was closed in 2021.

Mining rival BHP could also be on the hook for a massive rehabilitation bill as the company mulls walking away from its Nickel West operations in WA.

Shutting down Nickel West would trigger a closure cost of about $US900m ($1.4b), the Big Australian said in February this year.