Morgan Stanley takes negative stance against Australian banks amid less competitive retail environment

A less competitive retail banking environment could weigh on the profitability of Australia’s major banks, with Morgan Stanley analysts taking a negative stance against the Big Four.

In a note to investors on Friday, analyst Richard Wiles said the nation’s banks continued to face a weak revenue growth outlook.

Morgan Stanley forecast revenues would likely fall about one per cent in the second half of the 2024 financial year, before increasing about 2.5 per cent in 2025.

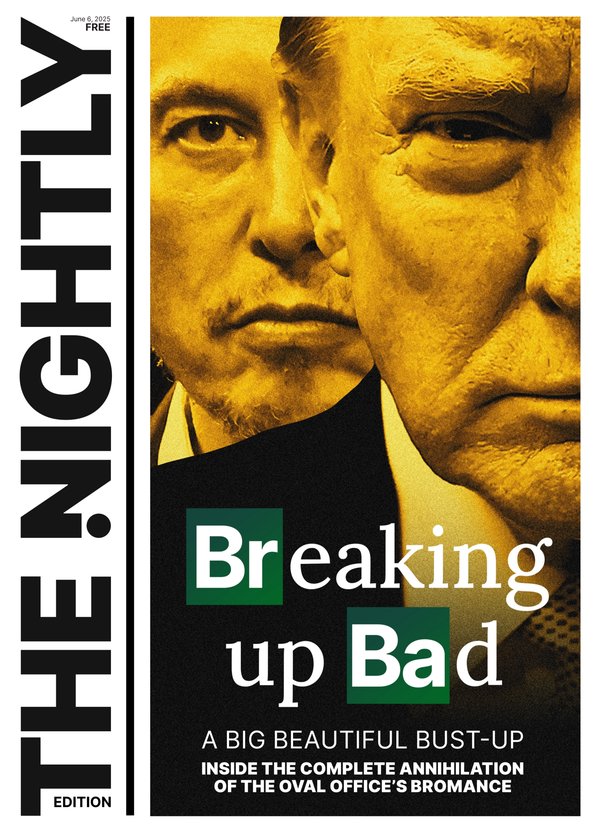

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr Wiles said margin pressure had eased slightly but there was considerable debate about the outlook for retail bank profitability, and whether the recent decline was structural or cyclical.

He said the major banks have skewed their business mix towards retail banking at a time when the segment’s profitability had been under pressure, weighing on group returns.

“In our view, it will be difficult for retail bank margins to expand and profitability to improve in an environment where the major banks have large businesses, want to grow at or close to system in mortgages, aim to win share in transaction banking, and appear to adopt different approaches to transfer pricing and cost allocation in determining their cost of capital,” Mr Wiles said.

“We think this limits the potential for a strong recovery in (earnings per share) and dividend growth and an increase in sustainable returns.”

“We believe there is too much optimism about the timing and size of (the Reserve Bank of Australia) rate cuts and the implications for banks.”

Twelve of the major analysts rate Commonwealth Bank as sell, compared to just three of the 12 who rate ANZ a sell. Meanwhile, five of 12 analysts also rate National Australia Bank as sell. Of 12 analysts, four rate Westpac as sell and three a buy.

It comes just weeks after three of the big four reported a slump in first-half cash earnings and profits. ANZ flagged plunging loan margins and increased consumer anxiety, while Westpac said it was facing tougher competition in the mortgage market.

For NAB, its personal banking division posted the biggest drop in cash earnings, noting earlier this month that “competitive pressures more than offset disciplined volume growth and benefits from the higher interest rate environment.”

As profits decline in the consumer segment, the major banks are looking to their business divisions for growth.

Meanwhile, shares in mid-tier Bendigo and Adelaide Bank are up 8.5 per cent to $10.76 at 12.30pm on Friday, despite reporting unaudited after-tax cash earnings for the ten months to the end of April fell 2.3 per cent to $464 million.

Net interest margin — the closely watched difference between the interest rate depositors receive versus the average rate the bank charges on loans — hit 1.87 per cent, higher than its year-to-date average.

“At our half-year results in February we reiterated our commitment to managing the business for long term value,” Bendigo chief executive Marnie Baker said.

“We have continued our focus on disciplined growth and prudent management of our costs.”